SK Hynix

SK Hynix Overcomes AI Bubble, "Sells Out Next Year"

Dong-A Ilbo |

Updated 2025.10.30

Third-quarter operating profit hits record KRW 11.4 trillion

AI model expands from ‘training’ to ‘inference’… Surging demand for memory semiconductors like HBM

DRAM demand expected to grow over 20% next year… “A fundamentally different type of supercycle”

AI model expands from ‘training’ to ‘inference’… Surging demand for memory semiconductors like HBM

DRAM demand expected to grow over 20% next year… “A fundamentally different type of supercycle”

On the 22nd of this month, a visitor at the 27th Semiconductor Exhibition (SEDEX 2025) held at COEX in Gangnam-gu, Seoul, examines the next-generation high-bandwidth memory (HBM) HBM4 unveiled by SK Hynix. News1

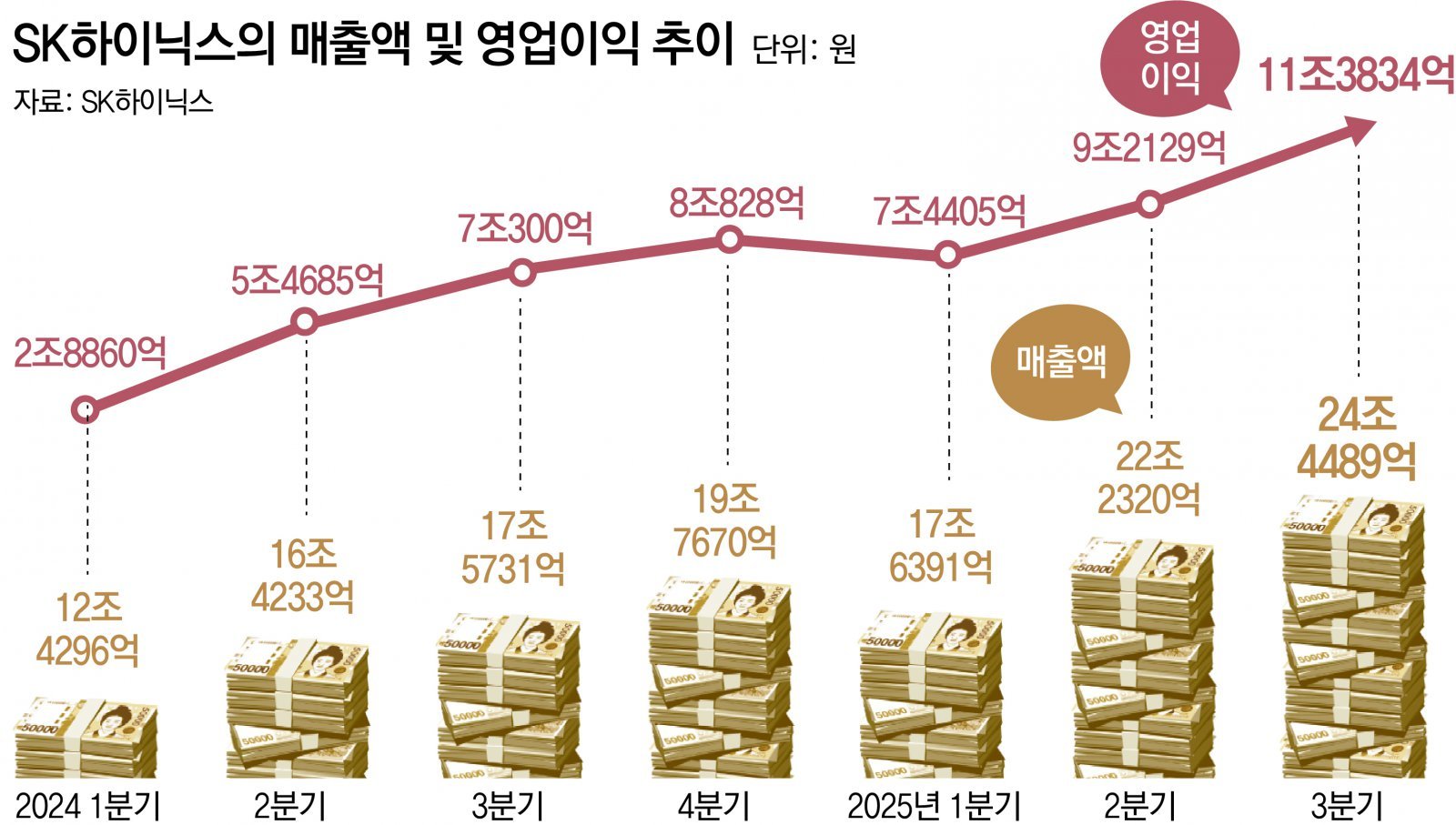

《SK Hynix Soars... Surpasses KRW 10 Trillion in Operating Profit for the First Time in Q3SK Hynix surpassed KRW 10 trillion in quarterly operating profit for the first time since its founding in 1983, during the third quarter (July-September) of this year. SK Hynix announced on the 29th that its third-quarter sales and operating profit were KRW 24.4489 trillion and KRW 11.3834 trillion, respectively, up 39.1% and 61.9% from the same period last year. Both sales and operating profit are the highest on a quarterly basis. The strong performance of SK Hynix is attributed to the surge in demand for memory semiconductors in the global market. Analysts suggest that the increase in AI investments by global big tech companies signals the start of a 'semiconductor supercycle' (long-term boom).》

SK Hynix has achieved its highest-ever quarterly sales and operating profit in the third quarter (July-September) of this year, signaling the start of a 'supercycle' (long-term boom) in the global semiconductor industry. SK Hynix disclosed on the 29th that its third-quarter sales and operating profit increased by 39.1% and 61.9%, reaching KRW 24.4489 trillion and KRW 11.3834 trillion, respectively. The market views this performance as a rebuttal to the so-called 'AI bubble theory,' which suggests that the AI boom is merely a short-term overheating.

● “Memory Semiconductors Sold Out Until Next Year”

The outlook for the future is also positive. According to SK Hynix, the production volume of memory semiconductor products, including high-bandwidth memory (HBM) used in AI semiconductors, as well as DRAM and NAND flash, has been pre-sold for next year. The company expects that the supply of HBM products will remain 'tight' compared to demand until 2027.

SK Hynix plans to start shipping the next-generation HBM4 in the fourth quarter (October-December) and begin full-scale sales next year. During a conference call, SK Hynix stated, "The next-generation HBM4 developed in September this year meets customer performance requirements and achieves the industry's highest speed." It is known that SK Hynix's major customer, NVIDIA, will equip its next-generation AI semiconductor 'Rubin,' scheduled for release next year, with HBM4.

The strong performance of SK Hynix is analyzed to result from changes in the AI market leading to increased demand for memory semiconductors. As the AI market expands from the 'learning' stage of large-scale models to the 'inference' stage where actual users utilize AI services, memory usage is increasing explosively. SK Hynix forecasts that DRAM demand will grow by more than 10% annually this year and over 20% next year. According to market research firm Counterpoint Research, SK Hynix recorded DRAM sales of USD 13.7 billion in the third quarter, maintaining the number one market share for three consecutive quarters. In the HBM sector, it continued to hold the top position with a 56% market share based on shipment volume.

● “The Semiconductor Supercycle Has Arrived”

SK Hynix stated, "The memory market has entered a super boom period as demand recovered faster than expected this year," diagnosing it as a fundamentally different new form of supercycle compared to the cloud-centric boom period of 2017-2018. The company predicts that memory semiconductor demand will continue to increase as new demands based on AI, such as autonomous driving and robotics AI, emerge in the medium to long term. Samsung Electronics and Micron, which announced their earnings earlier, also reported 'earnings surprises.' Samsung Electronics' third-quarter operating profit increased by 31.81% compared to the same period last year, and the U.S. memory semiconductor company Micron saw its operating profit increase by 127% in the fourth quarter of fiscal year 2025 (June-August).

In 2017-2018, SK Hynix's operating profit margin soared to around 50%, and it recovered to a similar level of 47% in the third quarter of this year. The company stated, "Although equipment input is increasing due to the expansion of HBM production, the nature of the process does not allow for unlimited production increases," predicting that these structural constraints will support a long-term boom.

SK Hynix plans to increase facility investment and advance production schedules next year. The Cheongju M15X fab (factory) has opened its first cleanroom and started equipment installation. In the semiconductor industry, equipment installation typically signifies preparation for full-scale mass production. Additionally, the company plans to advance the schedule of the Yongin Phase 1 fab, which began construction this year.

Lee Min-a

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News