Business / Capital Market

SK Hynix Weighs US ADR Listing; Shares Up 3.7%

Dong-A Ilbo |

Updated 2025.12.11

Trading ADRs backed by treasury shares like stocks

“One option to enhance corporate value… not finalized”

Hopes to improve undervalued share price versus rivals

Foreign investors buy most since September

“One option to enhance corporate value… not finalized”

Hopes to improve undervalued share price versus rivals

Foreign investors buy most since September

SK hynix’s share price strengthened on expectations that the company could enter the US stock market. As the possibility of issuing American Depositary Receipts (ADR) using treasury shares has been raised, attention is focusing on whether the company’s undervalued stock price relative to competitors could be re-rated.

● Foreign investors’ net buying of SK hynix hits three-month high

On 10 December, SK hynix announced regarding the ADR issuance speculation that “Various measures to enhance corporate value, including listing on the US stock market using treasury shares, are under review, but nothing has been finalized so far.” Nevertheless, the market viewed positively the fact that SK hynix had considered issuing ADR. While the KOSPI closed down 0.21% that day, SK hynix shares rose 3.71%. Foreign investors recorded a net purchase of SK hynix shares worth KRW 729.9 billion. This was the largest net buying since 10 September (KRW 730 billion net purchase), which marked the early stage of the semiconductor stock uptrend.

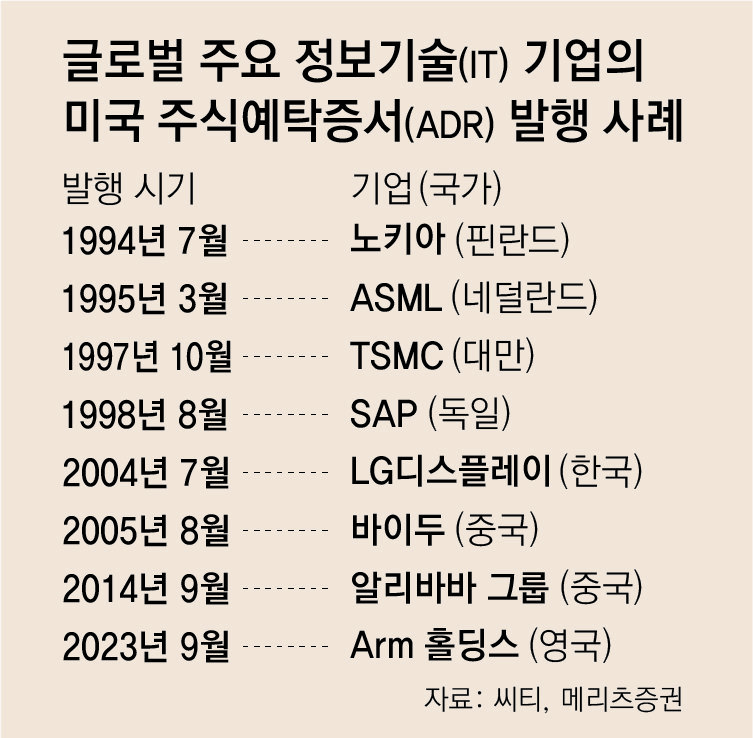

Recently, the securities industry has been projecting that SK hynix could issue ADR as a measure to enhance corporate value. A company can deposit its shares with a US depositary institution (bank) and issue ADR backed by those shares to enter the US stock market. ADR can be traded like shares on US exchanges or over-the-counter markets. Compared with a direct US listing, as in the cases of Coupang and WEBTOON Entertainment, the procedure is simpler while still expanding contact points with overseas investors. Among Korean companies, POSCO Holdings, SK Telecom, and LG Display have issued ADR. Taiwan’s TSMC and the Netherlands’ ASML also issue ADR in the US market and are traded there.

● Potential use of treasury shares to enhance shareholder value

There is an outlook that if SK hynix issues ADR, it could provide additional momentum for share price appreciation. As long-term semiconductor supply contracts increase, many forecasts project that earnings next year and the year after will be exceptionally strong. Securities firms expect SK hynix’s operating profit next year to reach KRW 80–90 trillion.

Its undervalued share price compared with competitors such as Micron could also improve. SK hynix posted operating profit of KRW 11.3834 trillion in the third quarter (July–September). Although this is nearly double Micron’s operating profit of about KRW 5.8 trillion in the fourth quarter of fiscal 2025 (June–August), the two companies’ market capitalizations on 9 December were not significantly different, at KRW 426 trillion (SK hynix) and about KRW 418 trillion (Micron). Kim Sun-woo, an analyst at Meritz Securities, explained, “If SK hynix issues ADR, it is estimated that the valuation gap with Micron will narrow rapidly.”

With ADR issuance, SK hynix could be included in the Philadelphia Semiconductor Index in the US, which comprises only companies traded in the US stock market. In that case, the company could benefit from the inflow of passive funds from exchange-traded funds (ETF) that track the index. Among the constituents of the Philadelphia Semiconductor Index, the only companies with a larger market capitalization than SK hynix are NVIDIA, Broadcom, TSMC, ASML, and AMD. Of these, TSMC and ASML are ADR issuers.

There is also a view that SK hynix could move to issue ADR using its 2.4% treasury shareholding, even taking into account the potential cancellation of treasury shares following amendments to the Commercial Act. The government and the Democratic Party of Korea are pushing for an amendment to the Commercial Act that would mandate the disposal of existing treasury shares within 18 months. As demands to enhance shareholder value may grow at next year’s shareholders’ meeting and other venues, some analysts believe that management could present ADR as an alternative.

● Foreign investors’ net buying of SK hynix hits three-month high

Recently, the securities industry has been projecting that SK hynix could issue ADR as a measure to enhance corporate value. A company can deposit its shares with a US depositary institution (bank) and issue ADR backed by those shares to enter the US stock market. ADR can be traded like shares on US exchanges or over-the-counter markets. Compared with a direct US listing, as in the cases of Coupang and WEBTOON Entertainment, the procedure is simpler while still expanding contact points with overseas investors. Among Korean companies, POSCO Holdings, SK Telecom, and LG Display have issued ADR. Taiwan’s TSMC and the Netherlands’ ASML also issue ADR in the US market and are traded there.

● Potential use of treasury shares to enhance shareholder value

Its undervalued share price compared with competitors such as Micron could also improve. SK hynix posted operating profit of KRW 11.3834 trillion in the third quarter (July–September). Although this is nearly double Micron’s operating profit of about KRW 5.8 trillion in the fourth quarter of fiscal 2025 (June–August), the two companies’ market capitalizations on 9 December were not significantly different, at KRW 426 trillion (SK hynix) and about KRW 418 trillion (Micron). Kim Sun-woo, an analyst at Meritz Securities, explained, “If SK hynix issues ADR, it is estimated that the valuation gap with Micron will narrow rapidly.”

With ADR issuance, SK hynix could be included in the Philadelphia Semiconductor Index in the US, which comprises only companies traded in the US stock market. In that case, the company could benefit from the inflow of passive funds from exchange-traded funds (ETF) that track the index. Among the constituents of the Philadelphia Semiconductor Index, the only companies with a larger market capitalization than SK hynix are NVIDIA, Broadcom, TSMC, ASML, and AMD. Of these, TSMC and ASML are ADR issuers.

There is also a view that SK hynix could move to issue ADR using its 2.4% treasury shareholding, even taking into account the potential cancellation of treasury shares following amendments to the Commercial Act. The government and the Democratic Party of Korea are pushing for an amendment to the Commercial Act that would mandate the disposal of existing treasury shares within 18 months. As demands to enhance shareholder value may grow at next year’s shareholders’ meeting and other venues, some analysts believe that management could present ADR as an alternative.

Hong Seok-ho

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News