Tech / AI

Insurers Boost Efficiency with AI in Costly Reviews

Dong-A Ilbo |

Updated 2025.10.24

“Numerous insurance benefit applications require dedicated staff to be fully engaged in their work daily. Reviewers must be familiar with thousands of benefit criteria and keep up with frequent amendments. However, humans cannot perfectly master complex regulations, and even when operating under familiar review standards, mistakes occur. Moreover, the situation is not smooth due to a lack of personnel,” lamented the head of the insurance review team at a general hospital in Incheon. According to statistics from the Health Insurance Review & Assessment Service, domestic medical institutions apply for 1.617 billion insurance benefits annually, amounting to a staggering KRW 116.7 trillion in economic terms. Mistakes occur in the process of handling hundreds or thousands of insurance reviews daily, leading to reduced hospital revenue and decreased trust. The complexity of work increases with the annually strengthening insurance benefit review standards. The number of specialists handling insurance reviews steadily declines due to population decrease. This is why there is a call to utilize AI in the time-consuming and costly insurance review work.

Enhancing Efficiency of Complex Insurance Review Work with AI

As the reduction amount increases due to the strengthening of insurance benefit review standards, small and regional hospitals suffering from manpower shortages are critically hit. Above all, problems such as claim omissions, code errors, and disapprovals continue to occur in the process of handling insurance benefit reviews relying on manpower.

AI is gaining attention as a technology that can significantly enhance the efficiency of such manpower-based insurance review work. It analyzes complex documents such as thousands of medical records, prescriptions, and test data within hospitals to detect claim omissions or rejection possibilities in real-time. By automatically checking medical expense claims and related documents and presenting potentially problematic items, it supplements areas that existing review personnel might easily overlook.

As a result, hospitals can shift from a manpower-dependent insurance review process to an AI-centered system where humans perform the final inspection. This can lead to a virtuous cycle of reduced hospital operating costs, improved work speed, and decreased review error rates. It is also expected to create an environment where medical staff can focus more on treatment and research. This is why each medical institution is showing great interest in the introduction and utilization of AI.

In fact, at the 'KHF 2025 Digital Health Tech Exhibition' held at COEX in Seoul from September 17 to 19, the technology that received the most attention was AI. For example, at the exhibition site, the CGinside booth, which showcased the insurance review support AI agent 'MedClaim' in collaboration with DK Medical Systems, was frequented by team leaders of large hospital review teams and insurance review claim specialists. They showed great interest by continuously demonstrating the technology.

CGinside is an AI specialized company that introduced the legal, regulatory, and policy-focused AI service 'iHopper-xAI' before showcasing MedClaim. iHopper-xAI is an AI agent that organizes and interprets various policies and regulations, as well as bills and minutes of the National Assembly of Korea. It also handles laws, precedents, and millions of academic paper data.

CGinside applied the technology and know-how accumulated from developing iHopper-xAI, which processes over 1 billion pieces of data annually in real-time, to the medical field and introduced MedClaim.

MedClaim generates answers only from the original benefit criteria when performing insurance benefit review tasks and always provides clear sources. It comprehensively considers various variables of insurance review, such as patient types, medical actions, and drugs, to derive accurate conclusions even in complex claims. It operates based on an advanced language model that automatically recognizes and classifies medical documents in various formats such as PDF and HWP and understands the context of medical documents.

Jeon Byung-hoon, AI team leader at CGinside, stated, “At the KHF 2025 Digital Health Tech Exhibition, we confirmed the intense interest of each medical institution in AI agents that assist with insurance review work. In fact, insurance benefit review team leaders and insurance review claim specialists have requested demonstration services, and from this month, we will begin demonstrating MedClaim targeting general hospitals, university hospitals, and national medical centers,” adding, “MedClaim is designed to comply with HIPAA (Health Insurance Portability and Accountability Act) and ISO27001 standards to minimize the risk of patient information leakage or system hacking. In the future, we plan to develop MedClaim into an electronic medical record (EMR) linkage solution by adding not only review support functions but also automated appeal functions for disapprovals. Through API development, we plan to directly link with hospital EMR systems to predict and prevent reduction possibilities from the treatment record stage as a 'built-in' solution. We will help each medical institution transition the entire insurance review process to be AI-centered.”

IT Donga Reporter Kim Dong-jin (kdj@itdonga.com)

Source=Shutterstock

Enhancing Efficiency of Complex Insurance Review Work with AI

As the reduction amount increases due to the strengthening of insurance benefit review standards, small and regional hospitals suffering from manpower shortages are critically hit. Above all, problems such as claim omissions, code errors, and disapprovals continue to occur in the process of handling insurance benefit reviews relying on manpower.

AI is gaining attention as a technology that can significantly enhance the efficiency of such manpower-based insurance review work. It analyzes complex documents such as thousands of medical records, prescriptions, and test data within hospitals to detect claim omissions or rejection possibilities in real-time. By automatically checking medical expense claims and related documents and presenting potentially problematic items, it supplements areas that existing review personnel might easily overlook.

As a result, hospitals can shift from a manpower-dependent insurance review process to an AI-centered system where humans perform the final inspection. This can lead to a virtuous cycle of reduced hospital operating costs, improved work speed, and decreased review error rates. It is also expected to create an environment where medical staff can focus more on treatment and research. This is why each medical institution is showing great interest in the introduction and utilization of AI.

In fact, at the 'KHF 2025 Digital Health Tech Exhibition' held at COEX in Seoul from September 17 to 19, the technology that received the most attention was AI. For example, at the exhibition site, the CGinside booth, which showcased the insurance review support AI agent 'MedClaim' in collaboration with DK Medical Systems, was frequented by team leaders of large hospital review teams and insurance review claim specialists. They showed great interest by continuously demonstrating the technology.

Medical professionals demonstrating technology at the CGinside booth at the KHF 2025 Digital Health Tech Exhibition / Source=CGinside

CGinside is an AI specialized company that introduced the legal, regulatory, and policy-focused AI service 'iHopper-xAI' before showcasing MedClaim. iHopper-xAI is an AI agent that organizes and interprets various policies and regulations, as well as bills and minutes of the National Assembly of Korea. It also handles laws, precedents, and millions of academic paper data.

CGinside applied the technology and know-how accumulated from developing iHopper-xAI, which processes over 1 billion pieces of data annually in real-time, to the medical field and introduced MedClaim.

MedClaim generates answers only from the original benefit criteria when performing insurance benefit review tasks and always provides clear sources. It comprehensively considers various variables of insurance review, such as patient types, medical actions, and drugs, to derive accurate conclusions even in complex claims. It operates based on an advanced language model that automatically recognizes and classifies medical documents in various formats such as PDF and HWP and understands the context of medical documents.

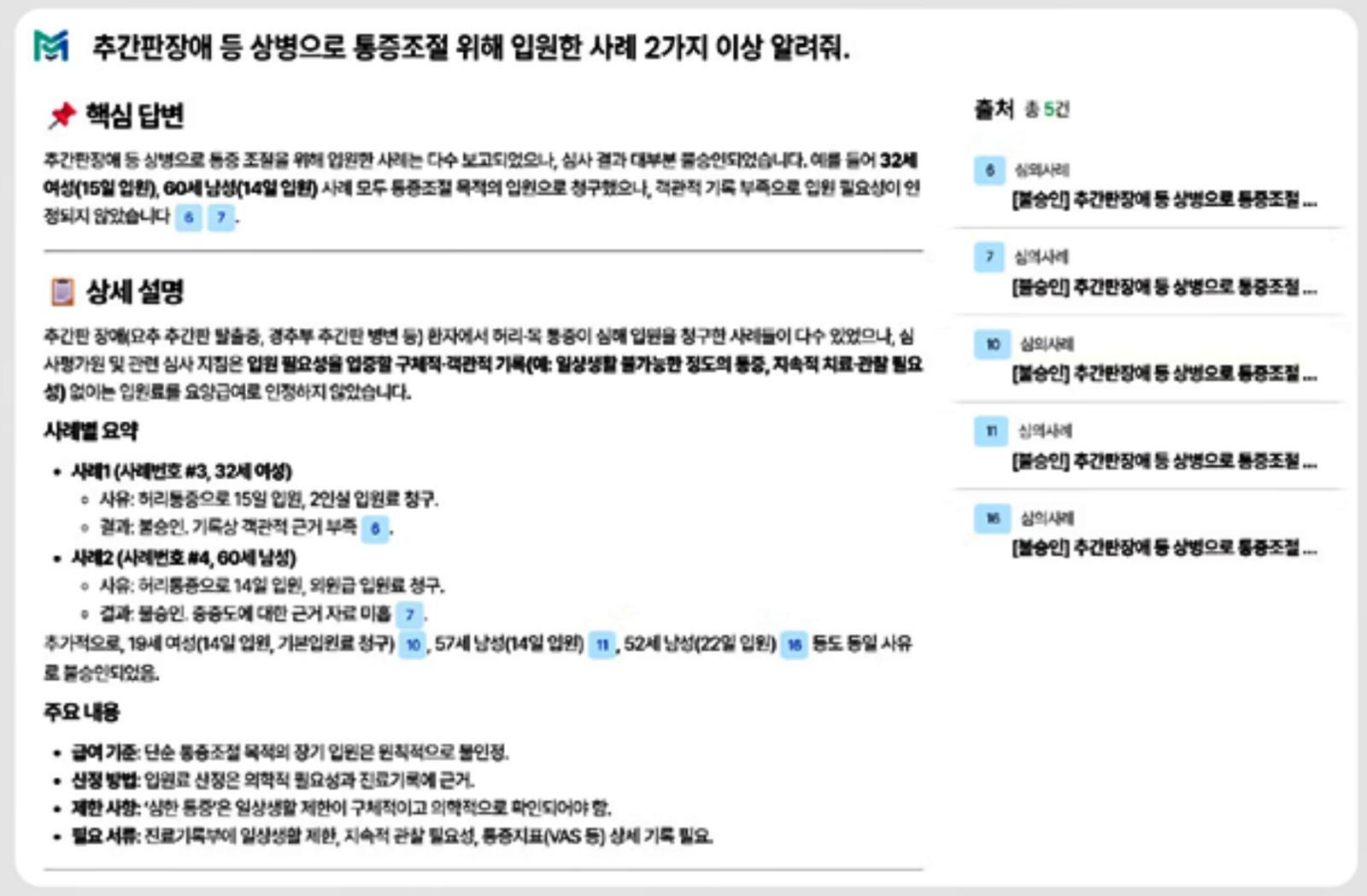

MedClaim service image / Source=CGinside

Jeon Byung-hoon, AI team leader at CGinside, stated, “At the KHF 2025 Digital Health Tech Exhibition, we confirmed the intense interest of each medical institution in AI agents that assist with insurance review work. In fact, insurance benefit review team leaders and insurance review claim specialists have requested demonstration services, and from this month, we will begin demonstrating MedClaim targeting general hospitals, university hospitals, and national medical centers,” adding, “MedClaim is designed to comply with HIPAA (Health Insurance Portability and Accountability Act) and ISO27001 standards to minimize the risk of patient information leakage or system hacking. In the future, we plan to develop MedClaim into an electronic medical record (EMR) linkage solution by adding not only review support functions but also automated appeal functions for disapprovals. Through API development, we plan to directly link with hospital EMR systems to predict and prevent reduction possibilities from the treatment record stage as a 'built-in' solution. We will help each medical institution transition the entire insurance review process to be AI-centered.”

IT Donga Reporter Kim Dong-jin (kdj@itdonga.com)

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News