Startup

ConexioH: E-commerce Data to Ease Online SME Credit

Dong-A Ilbo |

Updated 2025.10.24

[SeoulTech x Dong-A.com Joint Planning] Seoul National University of Science and Technology (hereinafter referred to as SeoulTech) operates various support programs to aid the growth of startups, including preliminary and early startup packages, makerspaces, and global collaboration. Furthermore, in collaboration with Dong-A.com, it provides global news to assist startups in overseas promotion and expansion, introducing promising deep-tech startups domestically and internationally.

The number of online shopping mall startups is increasing, thanks to the advantage of being able to start without capital or a storefront. However, once they begin their business, they encounter obstacles. Small business owners find it difficult to prove their performance with financial statements, leading to blocked bank loans, and they fall into a vicious cycle of using household loans obtained through personal credit as business funds.

There is a company that has stepped forward to solve these limitations using data and artificial intelligence (AI) technology. ConnexioH visualizes the invisible credit of online business operators based on e-commerce data. Centered around 'CH Data Lake', which processes e-commerce data for use by the financial sector, it provides ▲ 'CAH Cre-pan (Oncell)' that visualizes the credit of online business operators ▲ 'Data Service' that provides market insights to card companies ▲ 'MaemoPan', an analytical dashboard for Naver Smart Store sellers. ConnexioH aims to provide practical growth opportunities by proving the performance and credit of online business operators through data.

Data Management Know-how…Focusing on Financial Issues of Small Business Owners

Lee Kyung-ho, CEO of ConnexioH, built his career as an IT security expert and served as a professor at Korea University, operating a risk management laboratory. He noted that identifying risks in corporate credit risk analysis involves understanding the context in data gaps and unstructured data. CEO Lee stated, “Unlike laboratories that use refined data, in the field, the process of collecting and refining data is so complex that it accounts for 90% of the entire work,” and added, “ConnexioH focused on the e-commerce sector based on this technology and know-how.”

He decided to start a business after witnessing the reality that small business owners who transitioned to online e-commerce were not receiving proper financial support while analyzing corporate data. CEO Lee explained, “The traditional credit evaluation method of the financial system was centered on annual financial evaluations or collateral. Banks considered providing loans to online business operators without offline stores or real estate collateral as high risk, making it difficult for potential small online business operators to receive appropriate financial support.”

He continued, “I thought that utilizing real-time activity data generated daily on online platforms would allow for accurate and fair evaluations,” and added, “We began collecting and refining e-commerce data, which evolved into ‘credit data proving the capability of business operators’.” Through faculty entrepreneurship, he established the company and decided to play the role of a link that provides objective indicators to the financial sector, which inherently avoids risks, and tools that can prove potential to small business owners in need of growth opportunities.

Core Services: MaemoPan, CH Data Lake, Oncell

Among ConnexioH's main services, ‘MaemoPan’ is an AI-based analytical dashboard for 570,000 Naver Smart Store operators. It primarily supports search engine optimization (SEO) functions. CEO Lee stated, “Entering keywords and attribute information that match the search intent is essential for product exposure, and MaemoPan supports optimization tasks that are easy to miss by analyzing product exposure, search keywords, review and wishlist trends.” MaemoPan attracted 10,000 business operators within a week of its launch and has surpassed 50,000 cumulative subscribers. It is planned to be provided to all users next year.

Additionally, it is developing B2B business targeting the financial sector. Notably, ‘CH Data Lake’ is a data specification platform that periodically provides e-commerce data processed for use in alternative credit evaluations in the financial industry. ConnexioH currently supplies over 110 data items monthly to NICE Information Service and has signed supply contracts with major card companies such as KB Kookmin Card and Shinhan Card.

Based on this platform, ‘CAH Cre-pan (Oncell)’ is a data visualization tool for bank branches. It is a service that shows the sales flow and growth potential of online business operators on a map. CEO Lee explained, “Online business operators who can start without a storefront find it difficult to receive credit evaluations due to the lack of collateral. Oncell visualizes various information such as the business operator’s location, status, and business level on a dashboard.” It has been selected as a task for the Financial Services Commission's entrusted test and is currently being tested with BNK Busan Bank. Meanwhile, ConnexioH also directly provides e-commerce data necessary for card companies to secure insights into brand market information, price information, and competitor information.

Ontology and AI, Turning Data into 'Meaning'

Since 2022, ConnexioH has been collecting and refining petabyte-scale e-commerce data accumulated over four years and analyzing it in real-time based on AI. Furthermore, to convert vast data into meaningful information, it is developing an ontology-based AI engine. Ontology refers to technology that flexibly structures data according to the purpose and perspective of the service.

For example, even if there is one sales data point of a specific business operator, the criteria for judging data gaps and the flow of connections before and after differ depending on whether it is viewed for loan evaluation or marketing trend analysis. ConnexioH explains that its value lies not in simply providing data but in assisting decision-making by providing data that meets the evaluation criteria of the financial sector. It also plans to support querying data at the sentence level by combining it with large language models (LLM).

“Data and Technology Should Be an Economic Ladder”

ConnexioH, which started as a faculty entrepreneurship in 2020, is growing based on data technology and strategic agreements. It has entered a full-fledged sales growth phase this year, with expected sales of approximately KRW 3 billion in contracts, and KRW 5 billion in sales anticipated next year. It has established cooperative relationships with comprehensive credit information companies such as NICE Information Service, KCB, major card companies, and banks, with KB Kookmin Bank and NICE Information Service also participating as investors. CEO Lee stated, “We plan to challenge an IPO based on sales by 2029,” and added, “We will advance and expand CAH services to the financial sector and enter the global market with AI-based ontology services.”

Overseas expansion is approached with a technology strategy. The ontology solution is provided as open source to increase influence within the ecosystem. As part of this strategy, ConnexioH is also conducting a research project on data lake-based LLM with Oracle through the Seoul National University of Science and Technology's global corporate collaboration program. CEO Lee stated, “Through this project, we are receiving practical support such as business direction consulting and IR opportunities.”

Ultimately, ConnexioH aims to play the role of an economic ladder that helps small business owners receive fair evaluations and achieve business growth through data and technology. CEO Lee emphasized, “To maintain the middle class, structural problems must be solved, and tools are needed to teach how to earn money rather than simply providing money.”

He added, “However, there are still challenges to be addressed. Under current laws, a company that wants to evaluate the credit of individual business operators must have more than 50% of its shares owned by a financial company to receive credit evaluation business approval. Therefore, startups find it difficult to obtain this approval. It is also challenging for independent data companies like us to provide data to banks. We are continuously negotiating with the Financial Services Commission to improve the system.”

CEO Lee stated, “ConnexioH ultimately aims to provide new financial opportunities to online business operators who were difficult to evaluate with existing financial data by giving value to e-commerce data,” and added, “We will grow into a company that creates social value by reducing financially excluded groups and realizing inclusive finance.”

IT Dong-A Reporter Kim Ye-ji (yj@itdonga.com)

The number of online shopping mall startups is increasing, thanks to the advantage of being able to start without capital or a storefront. However, once they begin their business, they encounter obstacles. Small business owners find it difficult to prove their performance with financial statements, leading to blocked bank loans, and they fall into a vicious cycle of using household loans obtained through personal credit as business funds.

Lee Kyung-ho, CEO of ConnexioH / Source=IT Dong-A

There is a company that has stepped forward to solve these limitations using data and artificial intelligence (AI) technology. ConnexioH visualizes the invisible credit of online business operators based on e-commerce data. Centered around 'CH Data Lake', which processes e-commerce data for use by the financial sector, it provides ▲ 'CAH Cre-pan (Oncell)' that visualizes the credit of online business operators ▲ 'Data Service' that provides market insights to card companies ▲ 'MaemoPan', an analytical dashboard for Naver Smart Store sellers. ConnexioH aims to provide practical growth opportunities by proving the performance and credit of online business operators through data.

Data Management Know-how…Focusing on Financial Issues of Small Business Owners

Lee Kyung-ho, CEO of ConnexioH, built his career as an IT security expert and served as a professor at Korea University, operating a risk management laboratory. He noted that identifying risks in corporate credit risk analysis involves understanding the context in data gaps and unstructured data. CEO Lee stated, “Unlike laboratories that use refined data, in the field, the process of collecting and refining data is so complex that it accounts for 90% of the entire work,” and added, “ConnexioH focused on the e-commerce sector based on this technology and know-how.”

Lee Kyung-ho, CEO of ConnexioH / Source=IT Dong-A

He decided to start a business after witnessing the reality that small business owners who transitioned to online e-commerce were not receiving proper financial support while analyzing corporate data. CEO Lee explained, “The traditional credit evaluation method of the financial system was centered on annual financial evaluations or collateral. Banks considered providing loans to online business operators without offline stores or real estate collateral as high risk, making it difficult for potential small online business operators to receive appropriate financial support.”

He continued, “I thought that utilizing real-time activity data generated daily on online platforms would allow for accurate and fair evaluations,” and added, “We began collecting and refining e-commerce data, which evolved into ‘credit data proving the capability of business operators’.” Through faculty entrepreneurship, he established the company and decided to play the role of a link that provides objective indicators to the financial sector, which inherently avoids risks, and tools that can prove potential to small business owners in need of growth opportunities.

Core Services: MaemoPan, CH Data Lake, Oncell

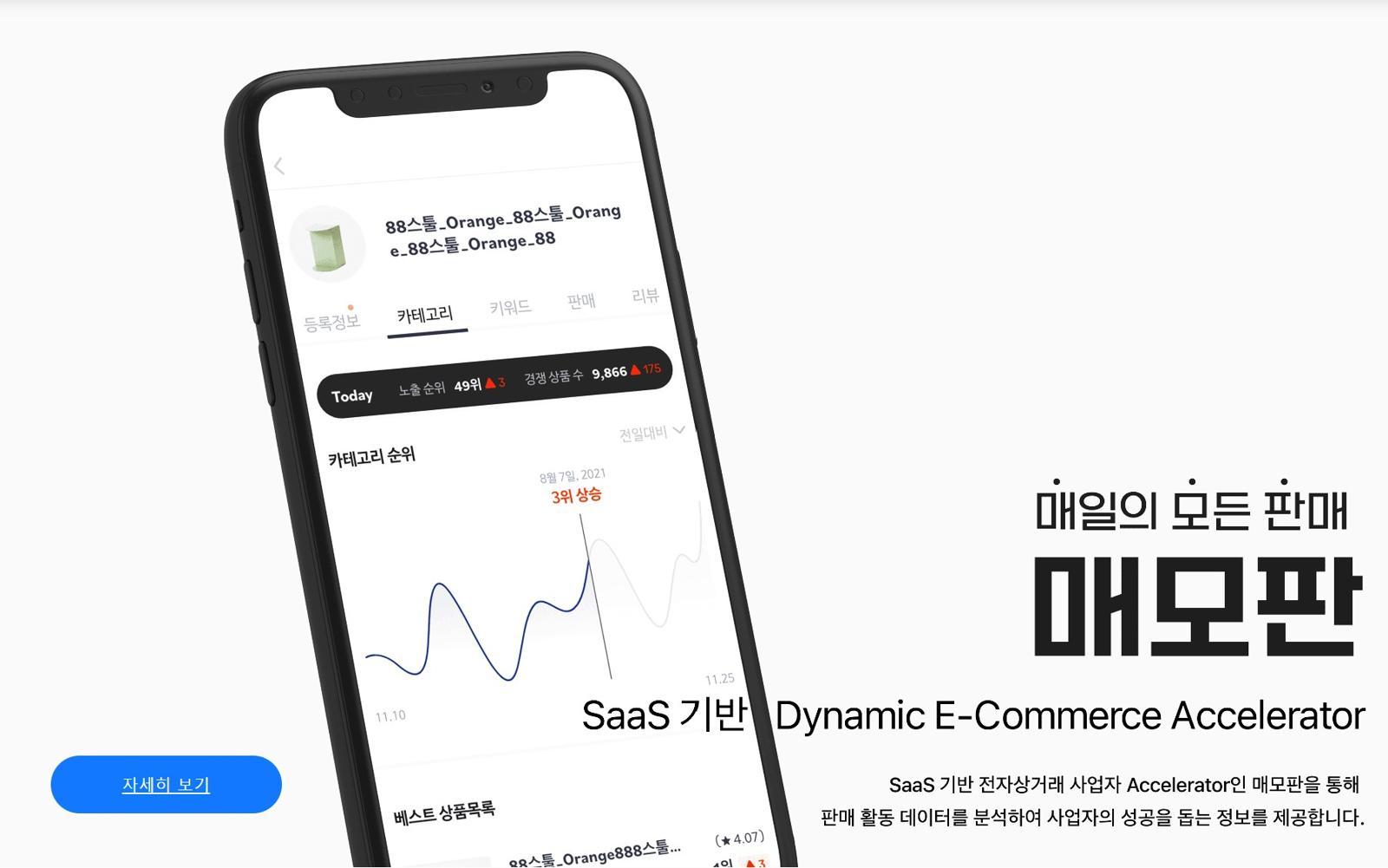

ConnexioH's MaemoPan Service / Source=ConnexioH

Among ConnexioH's main services, ‘MaemoPan’ is an AI-based analytical dashboard for 570,000 Naver Smart Store operators. It primarily supports search engine optimization (SEO) functions. CEO Lee stated, “Entering keywords and attribute information that match the search intent is essential for product exposure, and MaemoPan supports optimization tasks that are easy to miss by analyzing product exposure, search keywords, review and wishlist trends.” MaemoPan attracted 10,000 business operators within a week of its launch and has surpassed 50,000 cumulative subscribers. It is planned to be provided to all users next year.

Additionally, it is developing B2B business targeting the financial sector. Notably, ‘CH Data Lake’ is a data specification platform that periodically provides e-commerce data processed for use in alternative credit evaluations in the financial industry. ConnexioH currently supplies over 110 data items monthly to NICE Information Service and has signed supply contracts with major card companies such as KB Kookmin Card and Shinhan Card.

Based on this platform, ‘CAH Cre-pan (Oncell)’ is a data visualization tool for bank branches. It is a service that shows the sales flow and growth potential of online business operators on a map. CEO Lee explained, “Online business operators who can start without a storefront find it difficult to receive credit evaluations due to the lack of collateral. Oncell visualizes various information such as the business operator’s location, status, and business level on a dashboard.” It has been selected as a task for the Financial Services Commission's entrusted test and is currently being tested with BNK Busan Bank. Meanwhile, ConnexioH also directly provides e-commerce data necessary for card companies to secure insights into brand market information, price information, and competitor information.

Ontology and AI, Turning Data into 'Meaning'

ConnexioH's CAH Data Lake / Source=ConnexioH

Since 2022, ConnexioH has been collecting and refining petabyte-scale e-commerce data accumulated over four years and analyzing it in real-time based on AI. Furthermore, to convert vast data into meaningful information, it is developing an ontology-based AI engine. Ontology refers to technology that flexibly structures data according to the purpose and perspective of the service.

For example, even if there is one sales data point of a specific business operator, the criteria for judging data gaps and the flow of connections before and after differ depending on whether it is viewed for loan evaluation or marketing trend analysis. ConnexioH explains that its value lies not in simply providing data but in assisting decision-making by providing data that meets the evaluation criteria of the financial sector. It also plans to support querying data at the sentence level by combining it with large language models (LLM).

“Data and Technology Should Be an Economic Ladder”

Lee Kyung-ho, CEO of ConnexioH (left) and Yoon Hyun-sik, COO of ConnexioH / Source=IT Dong-A

ConnexioH, which started as a faculty entrepreneurship in 2020, is growing based on data technology and strategic agreements. It has entered a full-fledged sales growth phase this year, with expected sales of approximately KRW 3 billion in contracts, and KRW 5 billion in sales anticipated next year. It has established cooperative relationships with comprehensive credit information companies such as NICE Information Service, KCB, major card companies, and banks, with KB Kookmin Bank and NICE Information Service also participating as investors. CEO Lee stated, “We plan to challenge an IPO based on sales by 2029,” and added, “We will advance and expand CAH services to the financial sector and enter the global market with AI-based ontology services.”

Overseas expansion is approached with a technology strategy. The ontology solution is provided as open source to increase influence within the ecosystem. As part of this strategy, ConnexioH is also conducting a research project on data lake-based LLM with Oracle through the Seoul National University of Science and Technology's global corporate collaboration program. CEO Lee stated, “Through this project, we are receiving practical support such as business direction consulting and IR opportunities.”

Ultimately, ConnexioH aims to play the role of an economic ladder that helps small business owners receive fair evaluations and achieve business growth through data and technology. CEO Lee emphasized, “To maintain the middle class, structural problems must be solved, and tools are needed to teach how to earn money rather than simply providing money.”

He added, “However, there are still challenges to be addressed. Under current laws, a company that wants to evaluate the credit of individual business operators must have more than 50% of its shares owned by a financial company to receive credit evaluation business approval. Therefore, startups find it difficult to obtain this approval. It is also challenging for independent data companies like us to provide data to banks. We are continuously negotiating with the Financial Services Commission to improve the system.”

CEO Lee stated, “ConnexioH ultimately aims to provide new financial opportunities to online business operators who were difficult to evaluate with existing financial data by giving value to e-commerce data,” and added, “We will grow into a company that creates social value by reducing financially excluded groups and realizing inclusive finance.”

IT Dong-A Reporter Kim Ye-ji (yj@itdonga.com)

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News