Investment Trend

Japan Approves First $36 Billion US Investment, Pressuring Korea

Dong-A Ilbo |

Updated 2026.02.19

Trump: “Three Sectors – Power, Oil, and Minerals”

Takaichi: Closer Alignment to “Strengthen U.S.-Japan Ties”

Takaichi: Closer Alignment to “Strengthen U.S.-Japan Ties”

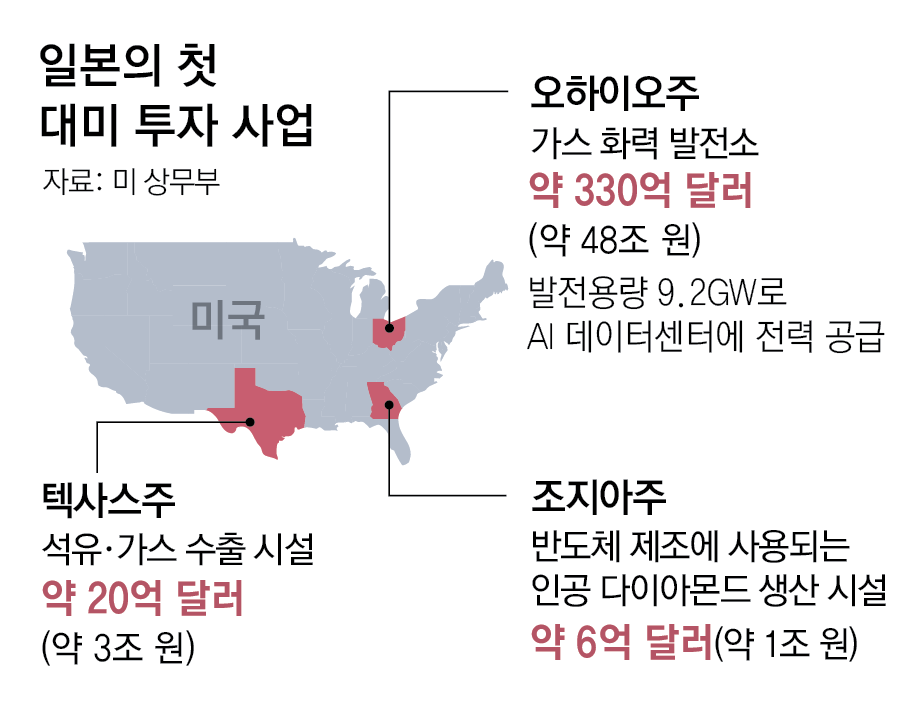

Donald Trump, President of the United States, on the 17th (local time) disclosed the first target of Japanese investment in the United States under the U.S.-Japan trade agreement. The investment project, totaling USD 36 billion (approximately KRW 52 trillion), consists of the construction of a gas-fired power plant in Ohio, a crude oil export facility in Texas, and a synthetic diamond manufacturing plant in Georgia. With Japan, which concluded a trade agreement with the United States ahead of Korea, announcing its first investment target in the U.S., concerns are emerging that Korea, which is under pressure to promptly implement its own investment commitments in the United States, could face a heavier burden. In July last year, Japan agreed with the United States to promote a total of USD 550 billion in investment in the U.S. in exchange for lowering tariffs from 25% to 15%.

Through Truth Social on the same day, President Trump stated, “The large-scale trade agreement with Japan has finally begun,” adding, “This is a very exciting and historic time for both the United States and Japan.” Regarding the three Japanese investment projects in the U.S., he said, “They would not have been possible without tariffs, which are a very important element,” and added, “Through this, we will put an end to the foolish dependence on foreign countries for minerals.”

Japanese Prime Minister Sanae Takaichi (高市早苗) also wrote on social media platform X that “these projects strengthen the ties between the two countries in strategically important economic security fields such as critical minerals, energy, artificial intelligence (AI), and data centers.”

The New York Times (NYT) reported, “Japan’s investment plan is the first step in a pledge to invest in order to reduce tariffs and maintain its relationship with the United States.” Citing sources, it also reported that “the Japanese government is reviewing additional investment announcements around Prime Minister Takaichi’s visit to the United States (scheduled for the 19th of next month).”

Japan’s first investment in the U.S. is focused on energy-related sectors that President Trump has repeatedly emphasized as critical. According to the Yomiuri Shimbun, investment items are selected through discussions within a “consultative committee” composed of high-level U.S. and Japanese government officials, with President Trump making the final decision. Regarding this U.S.-bound investment, Prime Minister Takaichi stated on X that it is “the first project under the ‘strategic investment initiative’ agreed on the basis of U.S.-Japan tariff consultations.”

● Japan offers a gift to the U.S. ahead of Takaichi’s March visit

Immediately after President Trump unveiled Japan’s first investment projects in the U.S., U.S. Secretary of Commerce Howard Lutnick, who has led the trade negotiations, provided details on X. According to him, the United States and Japan plan to build the largest-ever natural gas-fired power plant complex in Ohio, which will generate 9.2 GW (gigawatts) of electricity. Bloomberg reported, “This is the largest of the three projects, with approximately USD 33 billion to be invested,” adding that “at full operation it will generate power equivalent to nine nuclear power plants.” These plants are expected to supply electricity needed for AI data centers and other facilities.

The two countries will also build a deepwater crude oil export facility in the Gulf of Mexico with an investment of USD 2.1 billion. President Trump initially described it as a liquefied natural gas (LNG) facility, but foreign media reported that the target of investment is the GulfLink export terminal, a crude oil facility in Texas. The U.S. Department of Commerce explained that through this facility, the United States will export USD 20–30 billion worth of U.S.-produced crude oil annually, thereby boosting U.S. dominance in the energy sector.

The U.S.-bound investments also include an industrial synthetic diamond manufacturing facility valued at USD 600 million. Secretary Lutnick said, “Synthetic diamonds are essential raw materials for advanced industries and technology production,” adding, “We will no longer depend on foreign countries for these critical materials and will produce 100% of U.S. demand domestically.” He further emphasized, “Japan will earn investment returns, and the United States will gain strategic assets, expanded industrial capacity, and strengthened energy hegemony.”

● Major Japanese companies reviewing participation in the projects

Regarding the selection of investment destinations in the U.S., the Yomiuri Shimbun reported, “Japanese companies have strengths in areas such as manufacturing gas turbines needed for construction and plan to contribute to stabilizing the power base,” adding that “Toshiba, Hitachi, Mitsubishi Electric, and SoftBank Group have expressed interest in supplying related equipment.” In relation to investment in crude oil export infrastructure, Mitsui O.S.K. Lines, Nippon Steel, JFE Steel, and MODEC are reportedly exploring participation, while Asahi Diamond Industrial and Noritake are considering involvement in the synthetic diamond project.

The Nihon Keizai Shimbun reported, “The U.S. and Japanese governments plan to establish special purpose vehicles (SPVs) to invest in the three projects,” adding, “In Japan, the Japan Bank for International Cooperation (JBIC) will provide capital, Japan Trade Insurance (NEXI) will offer loan guarantees, and Japanese banks will extend financing.” It also noted that the two governments prioritized industrial demand and project feasibility during the selection process.

● Concerns that Korea’s burden related to U.S.-bound investment could increase

With the United States and Japan having selected their first investment projects, concerns are being raised that Korea’s burden could grow. The Trump administration has signaled that it will raise tariffs on Korean products from 15% to 25%, while stressing the urgent implementation of Korea’s investment commitments in the United States. The process of publishing the related measure in the Federal Register is reportedly underway.

Recently, Korea dispatched Minister of Trade, Industry and Energy Kim Jung-kwan and Trade Minister Yeo Han-koo to the United States for related consultations, but they have not achieved any notable progress.

Through Truth Social on the same day, President Trump stated, “The large-scale trade agreement with Japan has finally begun,” adding, “This is a very exciting and historic time for both the United States and Japan.” Regarding the three Japanese investment projects in the U.S., he said, “They would not have been possible without tariffs, which are a very important element,” and added, “Through this, we will put an end to the foolish dependence on foreign countries for minerals.”

Japanese Prime Minister Sanae Takaichi (高市早苗) also wrote on social media platform X that “these projects strengthen the ties between the two countries in strategically important economic security fields such as critical minerals, energy, artificial intelligence (AI), and data centers.”

The New York Times (NYT) reported, “Japan’s investment plan is the first step in a pledge to invest in order to reduce tariffs and maintain its relationship with the United States.” Citing sources, it also reported that “the Japanese government is reviewing additional investment announcements around Prime Minister Takaichi’s visit to the United States (scheduled for the 19th of next month).”

On Takaichi’s reappointment day, a ‘Trump-tailored’ power–oil–minerals investment gift to the U.S.

Power supply to AI data centers, etc.… Focus on energy sector emphasized by Trump

Takaichi calls it a “strategic investment initiative”… Working to secure outcomes ahead of next month’s U.S. visit

U.S. likely to increase pressure on Korea to “implement investment”

Takaichi calls it a “strategic investment initiative”… Working to secure outcomes ahead of next month’s U.S. visit

U.S. likely to increase pressure on Korea to “implement investment”

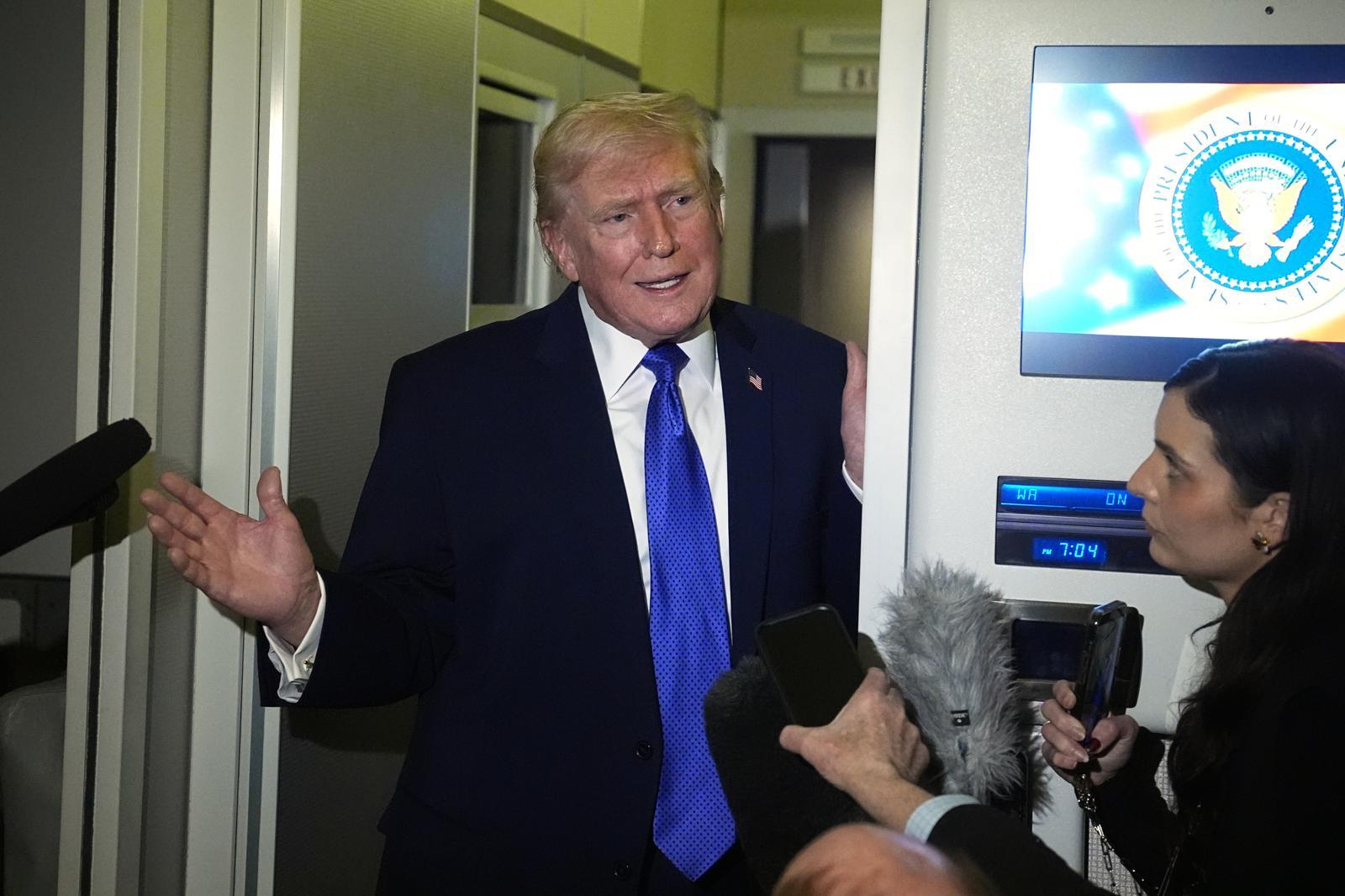

Air Force One media session On the 16th (local time), U.S. President Donald Trump speaks with reporters aboard Air Force One while traveling from West Palm Beach, Florida, to Washington. Air Force One=AP Newsis

President Donald Trump’s announcement of Japan’s first U.S.-bound investment project under the U.S.-Japan trade agreement came on February 17 (Eastern U.S. time, February 18 Japan time), the very day Japanese Prime Minister Sanae Takaichi (高市早苗) was reappointed and about one month before her planned visit to the United States (scheduled for the 19th of next month).Japan’s first investment in the U.S. is focused on energy-related sectors that President Trump has repeatedly emphasized as critical. According to the Yomiuri Shimbun, investment items are selected through discussions within a “consultative committee” composed of high-level U.S. and Japanese government officials, with President Trump making the final decision. Regarding this U.S.-bound investment, Prime Minister Takaichi stated on X that it is “the first project under the ‘strategic investment initiative’ agreed on the basis of U.S.-Japan tariff consultations.”

● Japan offers a gift to the U.S. ahead of Takaichi’s March visit

The two countries will also build a deepwater crude oil export facility in the Gulf of Mexico with an investment of USD 2.1 billion. President Trump initially described it as a liquefied natural gas (LNG) facility, but foreign media reported that the target of investment is the GulfLink export terminal, a crude oil facility in Texas. The U.S. Department of Commerce explained that through this facility, the United States will export USD 20–30 billion worth of U.S.-produced crude oil annually, thereby boosting U.S. dominance in the energy sector.

The U.S.-bound investments also include an industrial synthetic diamond manufacturing facility valued at USD 600 million. Secretary Lutnick said, “Synthetic diamonds are essential raw materials for advanced industries and technology production,” adding, “We will no longer depend on foreign countries for these critical materials and will produce 100% of U.S. demand domestically.” He further emphasized, “Japan will earn investment returns, and the United States will gain strategic assets, expanded industrial capacity, and strengthened energy hegemony.”

● Major Japanese companies reviewing participation in the projects

Regarding the selection of investment destinations in the U.S., the Yomiuri Shimbun reported, “Japanese companies have strengths in areas such as manufacturing gas turbines needed for construction and plan to contribute to stabilizing the power base,” adding that “Toshiba, Hitachi, Mitsubishi Electric, and SoftBank Group have expressed interest in supplying related equipment.” In relation to investment in crude oil export infrastructure, Mitsui O.S.K. Lines, Nippon Steel, JFE Steel, and MODEC are reportedly exploring participation, while Asahi Diamond Industrial and Noritake are considering involvement in the synthetic diamond project.

The Nihon Keizai Shimbun reported, “The U.S. and Japanese governments plan to establish special purpose vehicles (SPVs) to invest in the three projects,” adding, “In Japan, the Japan Bank for International Cooperation (JBIC) will provide capital, Japan Trade Insurance (NEXI) will offer loan guarantees, and Japanese banks will extend financing.” It also noted that the two governments prioritized industrial demand and project feasibility during the selection process.

● Concerns that Korea’s burden related to U.S.-bound investment could increase

With the United States and Japan having selected their first investment projects, concerns are being raised that Korea’s burden could grow. The Trump administration has signaled that it will raise tariffs on Korean products from 15% to 25%, while stressing the urgent implementation of Korea’s investment commitments in the United States. The process of publishing the related measure in the Federal Register is reportedly underway.

Recently, Korea dispatched Minister of Trade, Industry and Energy Kim Jung-kwan and Trade Minister Yeo Han-koo to the United States for related consultations, but they have not achieved any notable progress.

Im Woo-seon; Hwang In-chan; Kim Yun-jin

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News