Global Expansion

Hyosung Heavy wins up to KRW 787 billion order

Dong-A Ilbo |

Updated 2026.02.10

Not only semiconductor makers but also Korean power equipment companies have recently been enjoying a clear “AI boom.” As securing power grids has become essential for the construction and expansion of artificial intelligence (AI) data centers, demand for power equipment has surged, coinciding with the replacement cycle for aging equipment and effectively ushering in a supercycle (boom). Leveraging high quality and on-time delivery, domestic power equipment manufacturers are targeting the U.S. market and benefiting from this trend.

● HD Hyundai ranks No. 1 in U.S. transformer market… a heyday for Korea

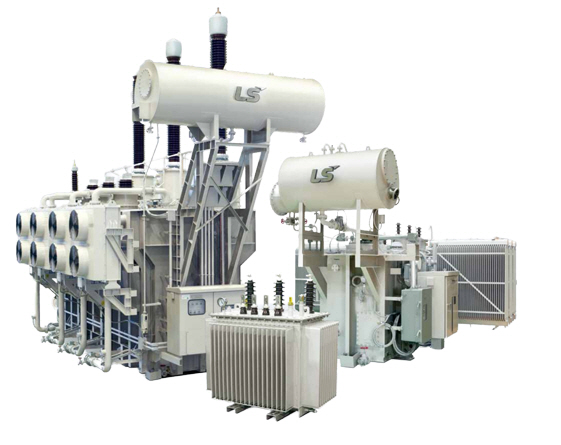

This is the result of surging demand for ultra-high-voltage transformers needed for data centers amid the recent “AI boom.” AI data centers consume 3–10 times more power than general data centers, making “high-spec” power equipment essential for controlling this usage. Due to the U.S.-driven supercycle, orders for power equipment have been pouring in, and Korea’s top three power equipment companies—HD Hyundai Electric, Hyosung Heavy Industries, and LS Electric—have already secured 3–4 years’ worth of work (with combined outstanding orders totaling KRW 27 trillion). The cable industry, which serves as the “blood vessels” of power equipment, is also booming. LS Cable & System announced on the 10th that it will supply underground ultra-high-voltage cables and submarine ultra-high-voltage cables worth KRW 686.5 billion to a U.S. company.

When they first entered the market more than a decade ago, Korean power equipment drew attention mainly for delivery times that were about one year faster than those of overseas competitors. However, after full-scale market entry, they gained trust with high quality and defect rates below 1%. An industry source added, “When client companies request design changes, overseas suppliers tend to demand additional costs or delay delivery, but Korean companies accommodate such requests and achieve close to 100% on-time delivery, so the perception of ‘Korean products you can trust’ has spread.” Domestic companies are in fact aiming for consecutive orders. HD Hyundai Electric, which recently agreed on a large-scale supply of distribution equipment with a U.S. big tech company, is seeking to expand orders for ultra-high-voltage transformers and other products through around 2029–2030.

● Supercycle expected to continue for several years

To respond to the expansion of the U.S. market, Korean companies are also increasing local production bases. LS Electric has decided to make an additional investment of KRW 200.0 billion in the first half of this year (January–June) to expand its high-voltage switchgear plant in Utah. HD Hyundai Electric is preparing to complete its second plant in Alabama in April next year. Hyosung Heavy Industries is expanding its ultra-high-voltage transformer plant in Tennessee, with completion targeted for 2028. Once the expansion is complete, it will become the largest transformer plant in the United States, with an annual production capacity in the KRW 1 trillion range.

This growth has been influenced by the direct involvement of group top management. Cho Hyun-joon, chairman of Hyosung Group, has personally engaged with top executives at U.S. energy and power companies, including U.S. Energy Secretary Chris Wright, to win orders for Hyosung Heavy Industries. Chairman Cho stated, “With the spread of AI and data centers, power infrastructure has now become a core industry directly linked to national security,” adding, “Based on the Memphis plant and our ultra-high-voltage technology capabilities, we will establish ourselves as an irreplaceable key partner in stabilizing the U.S. power grid.”

Choi Won-young;Lee Dong-hoon

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News