K-TECH / Samsung Electronics

Samsung Electronics’ Four Big Deals Clarify Smart AI Ecosystem

Dong-A Ilbo |

Updated 2026.02.06

Acquisitions in audio, HVAC, automotive electronics, and healthcare totaling about KRW 6 trillion

“Targeting 400 million AI-enabled new products this year”

Semiconductors also entering a ‘super cycle’… expectations for KRW 100 trillion in operating profit this year

“Targeting 400 million AI-enabled new products this year”

Semiconductors also entering a ‘super cycle’… expectations for KRW 100 trillion in operating profit this year

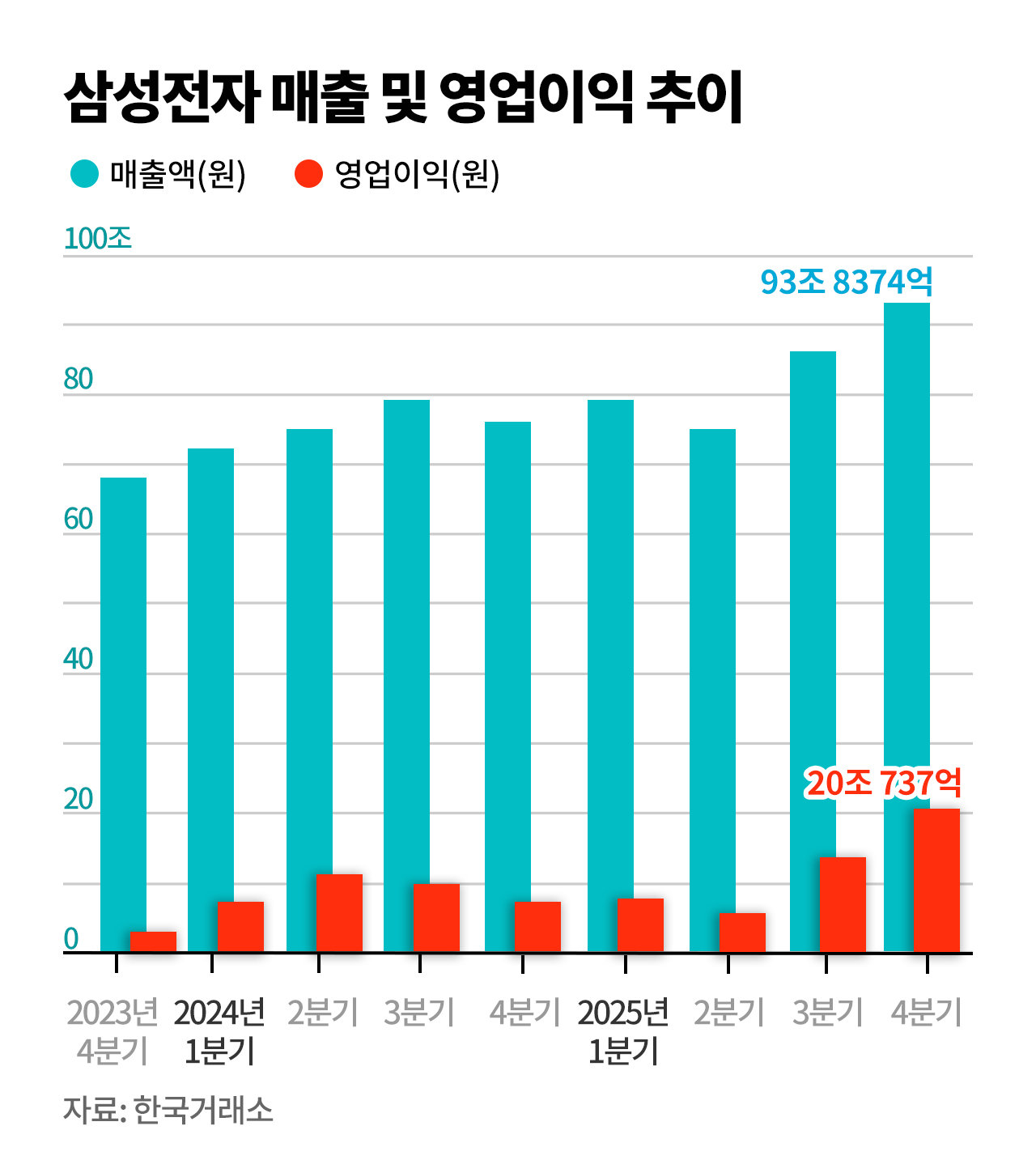

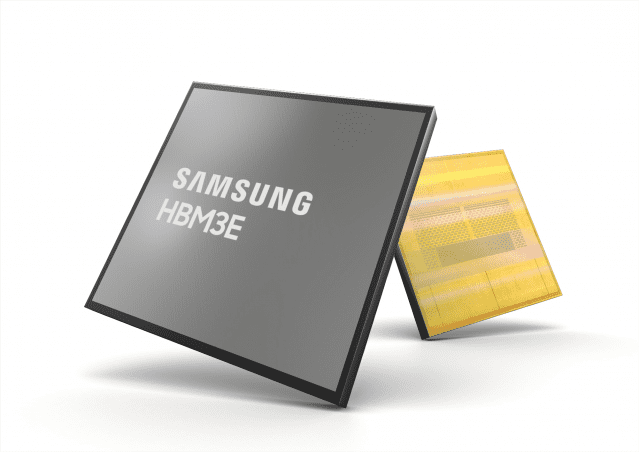

In the fourth quarter of 2025, Samsung Electronics recorded operating profit of KRW 16.4 trillion in its semiconductor business. It became the first Korean company to open the era of KRW 20 trillion in annual operating profit in this segment. In particular, high bandwidth memory (HBM), a core semiconductor for artificial intelligence (AI), has become the central axis of the earnings rebound, driving revenue (KRW 333.6 trillion) to an all-time high. This is being evaluated as a symbolic milestone for gauging the technological competitiveness and strategic direction of K-tech in the midst of the AI transition. The next steps for K-tech are examined in a multidimensional way around four pillars: Samsung Electronics’ semiconductors, AI, global technology hegemony, and industrial ecosystem.

Samsung Electronics Music Studio product image

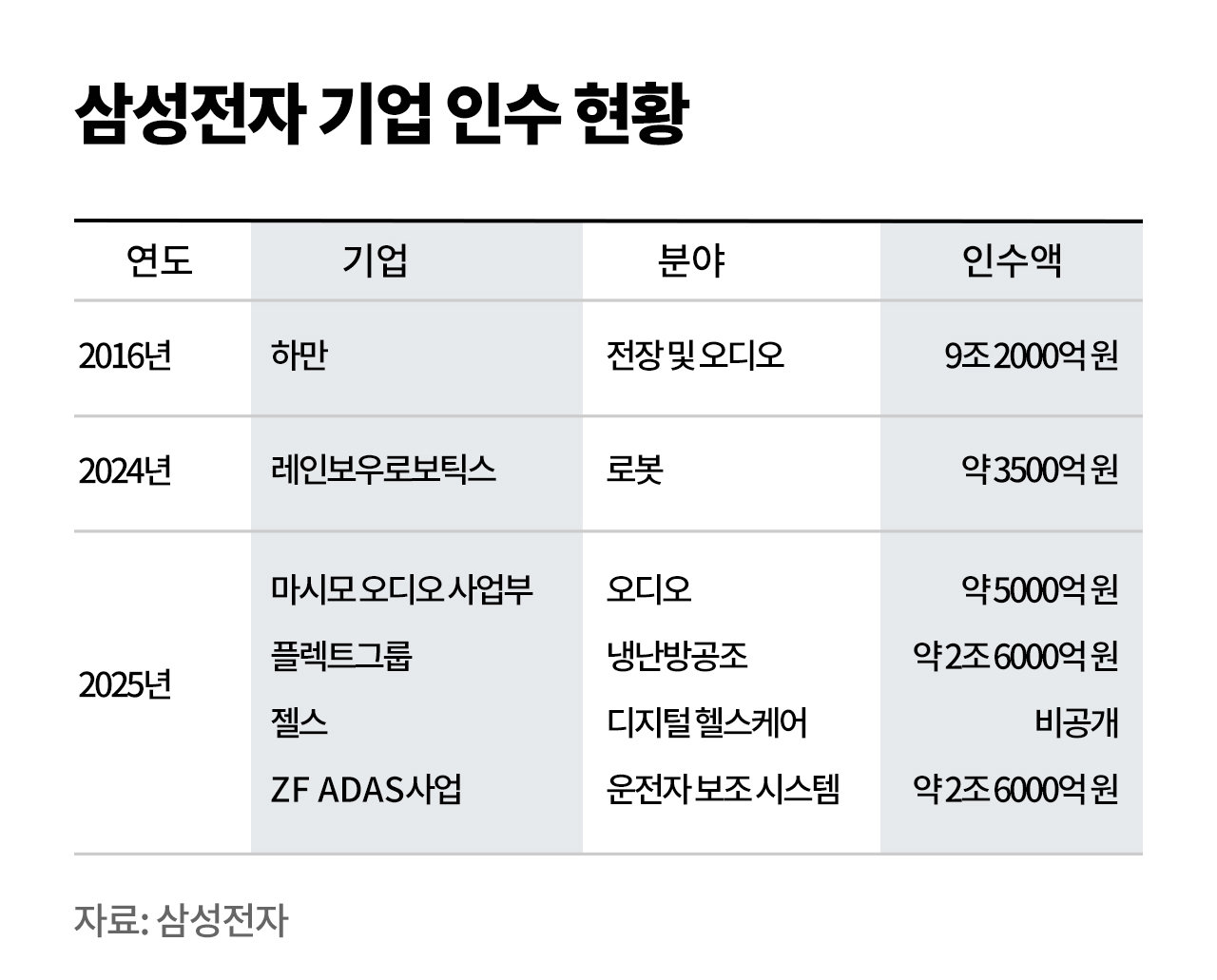

Samsung Electronics is accelerating efforts to secure future growth engines, having executed four large-scale mergers and acquisitions (M&A) just last year. Based on this, expectations are rising for the establishment of a hyper-scale AI ecosystem connecting smartphones, smart homes, and smart cars.KRW 6 trillion-scale acquisitions for ‘four new growth engines’

In May last year, Harman International, Samsung Electronics’ automotive and audio subsidiary, acquired the audio division of U.S. medical device company Masimo for USD 350 million (about KRW 500 billion). This was a major M&A deal concluded eight years after Samsung Electronics acquired Harman in 2016.

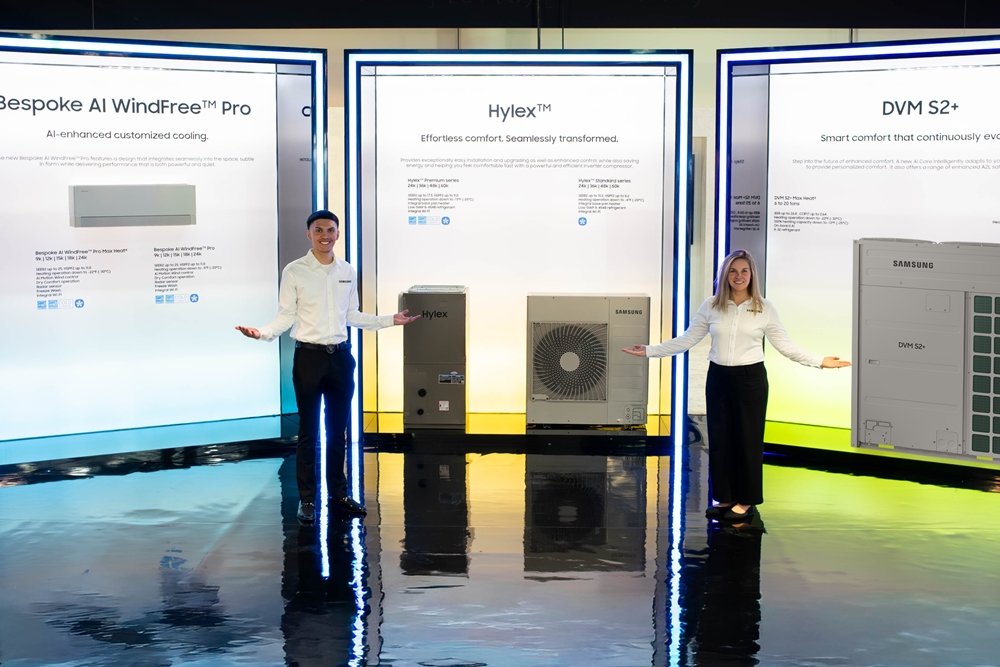

Samsung Electronics participated in AHR Expo, North America’s largest HVAC exhibition held in Las Vegas, and showcased HVAC products specialized for the North American market and AI-based integrated device management functions.

Through this acquisition, Harman secured a number of well-known audio brands, including Bowers & Wilkins (B&W), the high-end brand of Masimo’s audio division. Together with its existing brands such as JBL, Harman Kardon, and AKG, Harman has effectively completed a global audio portfolio. This is expected to generate significant synergies for Samsung Electronics’ overall business, as high-quality audio solutions can now be applied across all product categories, including TVs, smartphones, and soundbars.ZF CEO Matthias Miedreich (from left), Harman Board Chair Young Sohn, and Harman CEO and President of Automotive Christian Sobottka pose for a commemorative photo after signing the agreement to acquire ZF’s ADAS business.

Samsung Electronics also acquired Germany’s FlaktGroup, the largest HVAC (heating, ventilation and air conditioning) company in Europe, for EUR 1.5 billion (about KRW 2.5 trillion). As the AI data center market grows, this move is aimed at swiftly expanding its presence in the global HVAC market. This was followed by the acquisition of digital healthcare company Xealth in July and the ADAS (Advanced Driver Assistance Systems) business of Germany’s ZF Friedrichshafen in December last year.

Overview of Samsung Electronics’ corporate acquisitions

In particular, through the acquisition of ZF’s ADAS business, Samsung has secured technologies and products that play a key role in automotive driving assistance, such as forward-facing cameras and ADAS controllers, and is expected to make a full-scale entry into the fast-growing ADAS market. The plan is to expand its role from an in-vehicle electronics manufacturer that implements in-cabin information to areas that recognize and assess driving conditions. Until now, Harman has grown its automotive electronics business around digital cockpits, infotainment, and car audio.

Samsung Electronics is estimated to have spent about KRW 6 trillion solely on M&A deals last year. Based on the disclosed transaction amounts, it invested about KRW 5 trillion in total for the acquisitions of FlaktGroup and ZF’s ADAS business, each valued at EUR 1.5 billion, and spent USD 350 million (about KRW 500 billion) on the acquisition of Masimo’s audio division. The acquisition price for Xealth has not been disclosed.

This acquisition strategy is also aligned with the future growth engines highlighted by Samsung Electronics. Roh Tae-moon, President and CEO of Samsung Electronics and head of the Device eXperience (DX) Division, named four “new growth engines”—HVAC, automotive electronics, medical technology, and robotics—at a press conference held in Las Vegas on the eve of CES 2026, the world’s largest home appliance and information technology (IT) exhibition. Most of last year’s M&A deals fall into these categories. In robotics, Samsung had already begun acquiring shares in Rainbow Robotics in 2023.

The ‘AI empire’ envisioned by Samsung… Further M&A expected

Roh Tae-moon, President and CEO of Samsung Electronics (Head of DX Division), delivers a speech at the CES 2026 ‘The First Look’ press conference.

Samsung Electronics’ M&A drive can be seen not as simple expansion of scale, but as a structural strategy to seize leadership in the future infrastructure market centered on AI and data. If each business progresses smoothly, the company is expected to move closer to its goal of becoming a “comprehensive AI IT company.” As automotive electronics technologies are added to Samsung’s core businesses such as semiconductors, displays, cameras, smartphones, and home appliances, expectations are building that a single ecosystem spanning smartphones, smart homes, and smart cars will be established.

Roh also stated, “We will equip all Galaxy smartphones, premium TVs of 4K and above, and home appliances with Wi-Fi connectivity with AI,” adding, “This year we are targeting total shipments of 400 million AI-applied new products.” At the “Samsung Galaxy Unpacked” event in July 2024, Samsung had declared that it would apply “Galaxy AI” to 200 million units and subsequently delivered on that pledge; the new target announced about a year later is double that figure.

Samsung Electronics’ quarterly revenue and operating profit trends

Industry observers expect Samsung Electronics to continue pursuing large-scale M&A this year as well to secure future growth engines. This is because the company established an M&A team within its Business Support Task Force in November last year. In addition, based on its third-quarter business report, Samsung holds approximately KRW 53 trillion in cash and cash equivalents, and its current assets total KRW 230 trillion, leading to the assessment that it has ample financial firepower.

There is particular continued interest in M&A in the semiconductor sector. To date, Samsung Electronics’ M&A activity has been centered on non-semiconductor businesses. This appears to be due to a combination of factors such as global antitrust regulations and the scarcity of acquisition targets. However, competitors such as Intel are expanding through M&A. Although ultimately shelved, Samsung Electronics had sought to acquire Dutch semiconductor company NXP to strengthen its automotive semiconductor business.

Additional M&A in the robotics field is also anticipated. Roh stated at CES 2026 that the company is “reviewing investments in multiple companies to strengthen competitiveness in the robotics business.” Samsung has also begun moves to secure talent in robotics. According to industry sources, Samsung is recruiting research personnel in robotics and embedded intelligence at Samsung Research America, its R&D base in the United States. The annual salary for a principal researcher can reach up to about KRW 530 million, roughly KRW 200 million higher than that of principal researchers in the memory area, underscoring the company’s strong commitment to the robotics business.

‘Semiconductor supercycle’… Driving Korea’s first KRW 100 trillion in operating profit

In parallel, the Device Solutions (DS) Division, which is responsible for Samsung Electronics’ core semiconductor business, is entering a supercycle.

Samsung Electronics announced that, on a preliminary basis, it recorded revenue of KRW 333.6059 trillion and operating profit of KRW 43.6011 trillion last year. On an annual basis, revenue reached the highest level on record. Operating profit was the fourth highest ever, following 2018 (KRW 58.89 trillion), 2017 (KRW 53.65 trillion), and 2021 (KRW 51.63 trillion).

Samsung Electronics HBM3E

Both fourth-quarter revenue and operating profit reached record highs. Revenue came to KRW 93.8374 trillion and operating profit to KRW 20.0737 trillion, surging 23.8% and 209.2% year-on-year, respectively. The DS Division’s performance was particularly notable. Fourth-quarter DS revenue increased 46% to KRW 44 trillion, while operating profit soared 465% to KRW 16.4 trillion. Given that total fourth-quarter operating profit was about KRW 20 trillion, the DS Division accounted for roughly 80%.

This appears to have been heavily influenced by the surge in AI demand, which led to shortages even in general-purpose DRAM such as Double Data Rate (DDR)5. According to market research firm Counterpoint Research, Samsung’s fourth-quarter 2025 memory revenue reached USD 19.2 billion (about KRW 28 trillion) for DRAM and USD 6.7 billion (about KRW 9.8 trillion) for NAND flash, ranking first in the global market in both categories.

The high bandwidth memory (HBM) business is also starting to bear fruit. As HBM3E revenue expanded belatedly, the market estimates that Samsung’s fourth-quarter HBM-related revenue likely reached KRW 6 trillion–7 trillion. With DRAM prices continuing to rise and sales of HBM4 entering full swing, some forecasts suggest that Samsung Electronics’ annual operating profit could exceed KRW 100 trillion this year, a first for a Korean company. Counterpoint Research noted, “Samsung’s new smartphone line-up, the Galaxy S26 series, is about to be launched, and it is also expected to smoothly pass NVIDIA’s HBM4 quality tests, so record results are anticipated next quarter as well.”

Samsung Electronics expects the growth trend in the semiconductor business to continue in the first quarter of this year, driven by demand for AI and servers. Accordingly, the DS Division plans to lead the market through mass production and shipment of HBM4 products, including those with speeds of 11.7Gbps.

A look at Samsung Electronics’ M&A through Q&A

Q. What brands are included in Masimo’s audio division?

A. Masimo, an AI medical device company, includes B&W along with Denon, Marantz, Polk, and Definitive Technology in its audio division. Masimo has grown its audio business while attempting to integrate medical devices, home appliances, and audio.

Founded in 1966 in the United Kingdom, B&W is a luxury audio brand highly favored among professionals and enthusiasts for its high-quality sound. Its flagship loudspeaker “Nautilus” costs more than KRW 150 million per unit. Denon, with a 115-year history, is known as the company that invented the CD player, while Marantz is well known for high-quality sound in its premium amplifier and receiver product lines.

Q. What kind of company is Flakt?

A. Flakt is an HVAC equipment company with technological expertise accumulated over more than 100 years and is a premium HVAC company dedicated to creating clean and comfortable air quality with minimal energy consumption even under harsh climate conditions. It supplies high-quality, high-efficiency HVAC systems to various facilities, including: large data centers where stable cooling is essential; museums and libraries that manage sensitive rare books and artifacts; airports and terminals with high traffic; and large hospitals where antibacterial, constant temperature, and humidity control are critical.

The HVAC business is a core industry related to human life that controls temperature and humidity to supply optimal air to homes and a wide range of commercial and industrial facilities. The central HVAC market, which targets large facilities such as airports, shopping malls, and factories within the HVAC sector, is projected to grow at an average annual rate of 8%, from USD 61 billion in 2024 to USD 99 billion in 2030. Within this, the data center segment is expected to reach USD 44.1 billion by 2030, driving the HVAC market with a high average annual growth rate of 18%.

Flakt’s differentiated technological capabilities have been recognized with the “Data Center Cooling Innovation of the Year Award,” an innovation prize at the DCS Awards 2024, often dubbed the “Oscars of the data center industry.” Now under Samsung Electronics, Flakt plans to establish its first domestic production line in Gwangju this year.

Q. What is Xealth’s technological strength?

A. Xealth is a company that provides multiple digital healthcare solutions on a single platform. It has more than 500 hospitals as partners, including major large hospital groups in the United States, and partners with about 70 digital healthcare solution companies related to diabetes, pregnancy, surgery, and other areas.

Xealth’s platform enables healthcare professionals to comprehensively understand a patient’s condition, prescribe or recommend digital healthcare solutions to patients, and check patients’ health status in real time. For example, a physician at a hospital partnered with Xealth can recommend, through the Xealth platform, an app from a solution partner company that helps manage blood sugar and lifestyle habits for a diabetes patient, and can then monitor at a glance changes in blood sugar, dietary control, and exercise records.

Q. What is the significance of the acquisition of the ADAS business from Germany’s ZF Friedrichshafen?

A. ZF is a comprehensive automotive electronics company that originated in Germany in 1915 and has more than 100 years of history and technological capability. Its wide-ranging business portfolio includes ADAS, transmissions, chassis components, and electric vehicle drive parts. Built on over 25 years of experience, its ADAS business collaborates with various system-on-chip (SoC) companies and supplies major automakers, securing the No. 1 position in the global ADAS smart camera market.

ADAS is a core autonomous driving technology that protects driving and safety by using cameras, radar, and sensors. For example, it automatically applies the brakes when the vehicle gets too close to the car ahead or adjusts steering to prevent lane departure.

Recently, automobiles have evolved into “software-defined vehicles (SDVs)” that combine IT and software technologies, and are shifting to a centralized controller architecture that integrates digital cockpits and ADAS. A digital cockpit is a next-generation driver’s seat system that combines the instrument cluster, infotainment, and head-up display to present in-vehicle information via digital screens and software. Harman plans to strengthen its capabilities by integrating ADAS into its

Q. What brands are included in Masimo’s audio division?

A. Masimo, an AI medical device company, includes B&W along with Denon, Marantz, Polk, and Definitive Technology in its audio division. Masimo has grown its audio business while attempting to integrate medical devices, home appliances, and audio.

Founded in 1966 in the United Kingdom, B&W is a luxury audio brand highly favored among professionals and enthusiasts for its high-quality sound. Its flagship loudspeaker “Nautilus” costs more than KRW 150 million per unit. Denon, with a 115-year history, is known as the company that invented the CD player, while Marantz is well known for high-quality sound in its premium amplifier and receiver product lines.

Q. What kind of company is Flakt?

A. Flakt is an HVAC equipment company with technological expertise accumulated over more than 100 years and is a premium HVAC company dedicated to creating clean and comfortable air quality with minimal energy consumption even under harsh climate conditions. It supplies high-quality, high-efficiency HVAC systems to various facilities, including: large data centers where stable cooling is essential; museums and libraries that manage sensitive rare books and artifacts; airports and terminals with high traffic; and large hospitals where antibacterial, constant temperature, and humidity control are critical.

The HVAC business is a core industry related to human life that controls temperature and humidity to supply optimal air to homes and a wide range of commercial and industrial facilities. The central HVAC market, which targets large facilities such as airports, shopping malls, and factories within the HVAC sector, is projected to grow at an average annual rate of 8%, from USD 61 billion in 2024 to USD 99 billion in 2030. Within this, the data center segment is expected to reach USD 44.1 billion by 2030, driving the HVAC market with a high average annual growth rate of 18%.

Flakt’s differentiated technological capabilities have been recognized with the “Data Center Cooling Innovation of the Year Award,” an innovation prize at the DCS Awards 2024, often dubbed the “Oscars of the data center industry.” Now under Samsung Electronics, Flakt plans to establish its first domestic production line in Gwangju this year.

Q. What is Xealth’s technological strength?

A. Xealth is a company that provides multiple digital healthcare solutions on a single platform. It has more than 500 hospitals as partners, including major large hospital groups in the United States, and partners with about 70 digital healthcare solution companies related to diabetes, pregnancy, surgery, and other areas.

Xealth’s platform enables healthcare professionals to comprehensively understand a patient’s condition, prescribe or recommend digital healthcare solutions to patients, and check patients’ health status in real time. For example, a physician at a hospital partnered with Xealth can recommend, through the Xealth platform, an app from a solution partner company that helps manage blood sugar and lifestyle habits for a diabetes patient, and can then monitor at a glance changes in blood sugar, dietary control, and exercise records.

Q. What is the significance of the acquisition of the ADAS business from Germany’s ZF Friedrichshafen?

A. ZF is a comprehensive automotive electronics company that originated in Germany in 1915 and has more than 100 years of history and technological capability. Its wide-ranging business portfolio includes ADAS, transmissions, chassis components, and electric vehicle drive parts. Built on over 25 years of experience, its ADAS business collaborates with various system-on-chip (SoC) companies and supplies major automakers, securing the No. 1 position in the global ADAS smart camera market.

ADAS is a core autonomous driving technology that protects driving and safety by using cameras, radar, and sensors. For example, it automatically applies the brakes when the vehicle gets too close to the car ahead or adjusts steering to prevent lane departure.

Recently, automobiles have evolved into “software-defined vehicles (SDVs)” that combine IT and software technologies, and are shifting to a centralized controller architecture that integrates digital cockpits and ADAS. A digital cockpit is a next-generation driver’s seat system that combines the instrument cluster, infotainment, and head-up display to present in-vehicle information via digital screens and software. Harman plans to strengthen its capabilities by integrating ADAS into its

Yoon Woo-yeol

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News