Business / BESS

Battery Big Three Await KRW 1 Trillion ESS Bid Outcome

Dong-A Ilbo |

Updated 2026.02.06

KPX to announce no later than right after Lunar New Year

Beyond securing funds to bridge the EV chasm

A key battleground for future global ESS supremacy

Some foreign capital in the consortium… “Advantage for those who contribute more to the domestic ecosystem”

Beyond securing funds to bridge the EV chasm

A key battleground for future global ESS supremacy

Some foreign capital in the consortium… “Advantage for those who contribute more to the domestic ecosystem”

Domestic battery makers, currently enduring a harsh “barley hump” due to the electric vehicle (EV) chasm (a temporary stagnation in demand) and low-price competition, are closely watching the result of a KRW 1 trillion energy storage system (ESS) tender to be announced next week. This bid is regarded not only as a means to secure immediate “cash” to get through the current downturn, but also as a decisive “turning point” to seize dominance in the global ESS market, which is expected to expand rapidly to the KRW 200 trillion range.

According to the battery industry on the 5th, the Korea Power Exchange plans to announce the results of the 2nd ESS central contract market tender, which closed last month, as early as next week or, at the latest, immediately after the Lunar New Year holiday. This project aims to build ESS facilities with a total capacity of 540 MW (megawatts) and about 3.24 GWh (gigawatt-hours) in battery capacity, with the project cost alone reaching around KRW 1 trillion.

The primary reason the three domestic battery makers are staking everything on this bid is the urgent need for a “portfolio shift” from EV batteries to ESS batteries. Last year, the combined global market share of the three Korean companies in EV batteries was 15.3%, a decline of 3.4 percentage points from 18.7% in the previous year.

As global automakers scale back or exit EV-related businesses amid the EV chasm, ESS is emerging as the only viable alternative that can utilize idle production lines while defending profitability. Since the manufacturing processes for EV batteries and ESS batteries are similar, the additional burden of new facility investment is relatively limited.

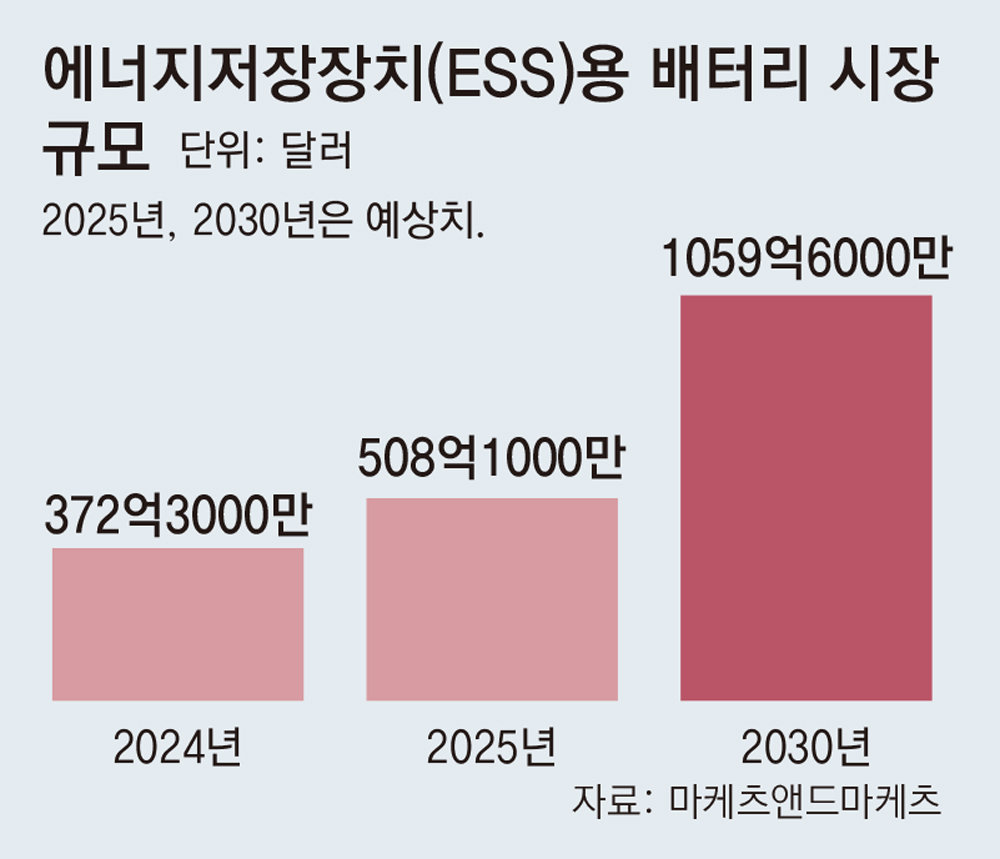

In addition, as power demand surges due to the rapid increase in artificial intelligence (AI) data centers, the ESS market for ensuring stable power supply is expanding, and the related market size is expected to grow accordingly. According to market research firm MarketsandMarkets, the size of the global ESS market is forecast to more than double, from about USD 50.8 billion (approximately KRW 74 trillion) last year to USD 105.9 billion (approximately KRW 155 trillion) in 2030.

From the perspective of battery companies, the outcome of this tender can serve as a “resume” for entry into the global ESS market, giving it high strategic value. Because ESS facilities must operate for more than 10 years once installed, project owners place great importance on “project track records” that prove product reliability and safety. Going forward, large power utilities in regions such as North America are expected in many cases to require substantial domestic installation and operation experience as a prerequisite when selecting partners for local projects.

Accordingly, a company that wins this KRW 1 trillion-level public tender will not merely increase its domestic sales; it will effectively obtain a “government-backed certificate” that can be leveraged to advance into overseas markets such as North America.

Within the battery industry, there is an assessment that, as the government has emphasized the aim of “fostering domestic industry,” companies with a high level of contribution to the domestic industrial ecosystem are more likely to emerge as winners. However, it is known that more than one-third of the consortia that participated in the second tender partnered with foreign capital such as US private equity funds, and that more than half adopted lithium iron phosphate (LFP) batteries, which have a high dependence on Chinese materials.

An industry official said, “This tender will of course have short-term earnings improvement effects, but the track record of having actually executed ESS battery projects will be an even greater asset,” adding, “The results this time will serve as an important springboard in future competition for overseas ESS orders.”

According to the battery industry on the 5th, the Korea Power Exchange plans to announce the results of the 2nd ESS central contract market tender, which closed last month, as early as next week or, at the latest, immediately after the Lunar New Year holiday. This project aims to build ESS facilities with a total capacity of 540 MW (megawatts) and about 3.24 GWh (gigawatt-hours) in battery capacity, with the project cost alone reaching around KRW 1 trillion.

The primary reason the three domestic battery makers are staking everything on this bid is the urgent need for a “portfolio shift” from EV batteries to ESS batteries. Last year, the combined global market share of the three Korean companies in EV batteries was 15.3%, a decline of 3.4 percentage points from 18.7% in the previous year.

As global automakers scale back or exit EV-related businesses amid the EV chasm, ESS is emerging as the only viable alternative that can utilize idle production lines while defending profitability. Since the manufacturing processes for EV batteries and ESS batteries are similar, the additional burden of new facility investment is relatively limited.

From the perspective of battery companies, the outcome of this tender can serve as a “resume” for entry into the global ESS market, giving it high strategic value. Because ESS facilities must operate for more than 10 years once installed, project owners place great importance on “project track records” that prove product reliability and safety. Going forward, large power utilities in regions such as North America are expected in many cases to require substantial domestic installation and operation experience as a prerequisite when selecting partners for local projects.

Accordingly, a company that wins this KRW 1 trillion-level public tender will not merely increase its domestic sales; it will effectively obtain a “government-backed certificate” that can be leveraged to advance into overseas markets such as North America.

Within the battery industry, there is an assessment that, as the government has emphasized the aim of “fostering domestic industry,” companies with a high level of contribution to the domestic industrial ecosystem are more likely to emerge as winners. However, it is known that more than one-third of the consortia that participated in the second tender partnered with foreign capital such as US private equity funds, and that more than half adopted lithium iron phosphate (LFP) batteries, which have a high dependence on Chinese materials.

An industry official said, “This tender will of course have short-term earnings improvement effects, but the track record of having actually executed ESS battery projects will be an even greater asset,” adding, “The results this time will serve as an important springboard in future competition for overseas ESS orders.”

Lee Dong-hoon

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News