K-Beauty

K-Beauty Leader APR Hits KRW 1.5 Trillion; Amore, LG HHC Seen Rebounding

Dong-A Ilbo |

Updated 2026.02.05

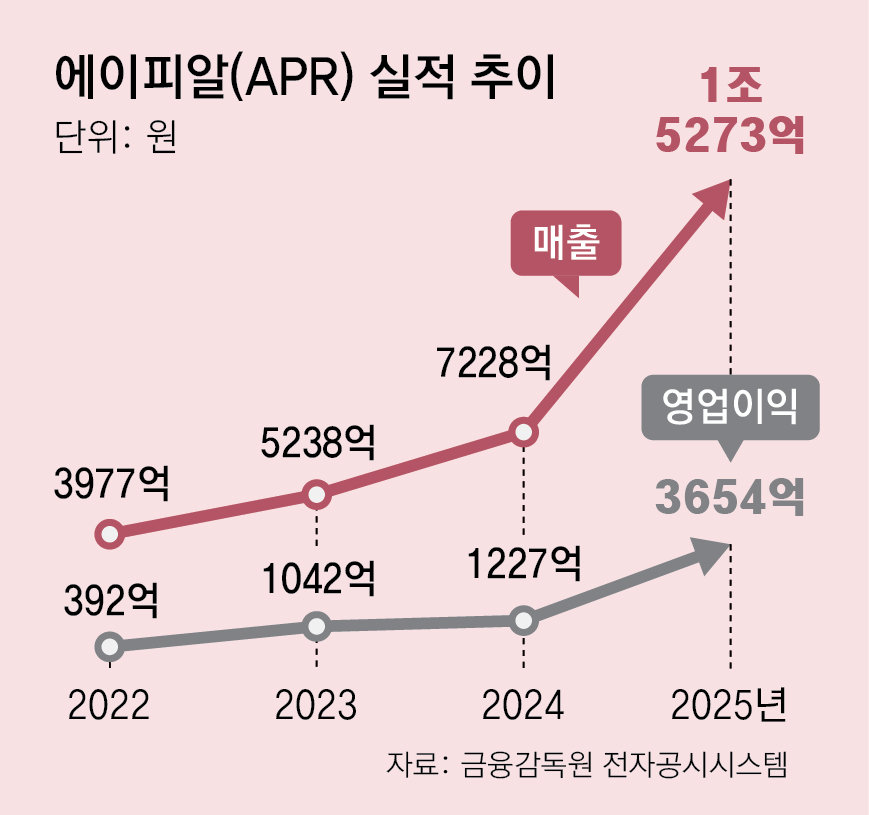

APR sales up 111% and operating profit up 198% last year

Third domestic beauty brand to reach KRW 1 trillion in sales

Medical device launch in H2 could push sales toward KRW 2 trillion

Amorepacific and LG H&H move to improve profitability

Third domestic beauty brand to reach KRW 1 trillion in sales

Medical device launch in H2 could push sales toward KRW 2 trillion

Amorepacific and LG H&H move to improve profitability

APR announced in a disclosure on the 4th that its consolidated revenue last year was tentatively tallied at KRW 1,527.3 billion, up 111% from about KRW 722.8 billion a year earlier. This is the first time since its founding in 2014 that APR has achieved revenue in the KRW trillion range. Over the same period, operating profit increased 198% from KRW 122.7 billion to KRW 365.4 billion.

Quarterly results also hit record highs. APR’s consolidated revenue for the fourth quarter (October–December) of last year came to KRW 547.6 billion, up 124% from KRW 244.2 billion in the same period a year earlier, marking the highest quarterly performance ever. Operating profit rose 228% from KRW 39.7 billion to KRW 130.1 billion.

Home beauty device product “Medicube Age-R Booster Pro Mini Plus” launched under APR’s brand Medicube. Provided by APR

APR’s strong performance was driven by the global popularity of K-beauty. The share of overseas markets in its total revenue increased from 55% in 2024 to 80% last year. In particular, the United States became the first single country to surpass KRW 50 billion in quarterly revenue. APR’s skincare brand “Medicube” recorded revenue of KRW 1,416.7 billion last year. Medicube is the third Korean brand to achieve annual revenue of more than KRW 1 trillion, following Amorepacific’s “Sulwhasoo” and LG H&H’s “The History of Whoo.”There are projections that APR could reach annual revenue of KRW 2 trillion once it adds products such as energy-based aesthetic medical devices (EBD, Energy-Based Device) in the second half of this year (July–December).

A rebound in earnings is also anticipated for Amorepacific, a traditional K-beauty leader. According to the financial investment industry, domestic securities firms’ forecasts for Amorepacific’s performance last year stand at approximately KRW 4,277.0 billion in revenue and KRW 344.0 billion in operating profit. Amorepacific is expected to return to the KRW 4 trillion revenue range for the first time in three years. Profitability is improving as the company closes about 30 Sulwhasoo stores in China and focuses on the stronger-performing North American and European markets. Bae Song-yi, an analyst at Mirae Asset Securities, said, “Earnings improvement is expected through line-up expansion, such as commercializing the device brand ‘Makeon.’”

LG H&H, which posted an operating loss of KRW 72.7 billion in the fourth quarter last year, is also seeking a turnaround. Under CEO Lee Sun-joo, who previously worked at L’Oréal, the company has embarked on a comprehensive restructuring of its business. Rather than indiscriminate expansion of scale, it is reorganizing its profit structure by concentrating on “cash-cow” brands that have proven themselves overseas, such as Dr. Groot and e’Zimaal (Yusimol).

The cosmetics industry expects the popularity of K-beauty to continue for the time being, sustaining the upward trend in companies’ earnings. According to the Ministry of Trade, Industry and Energy, cosmetics exports reached USD 11.4 billion last year, the highest level ever. The Korea Health Industry Development Institute stated that market research firms Fitch Solutions and Euromonitor project that Korea’s cosmetics exports will continue to grow to USD 12.5 billion this year.

Nam Hye-jeong

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News