Global Expansion

K-fashion Brands Enter Shanghai on Eased China Ban Hopes

Dong-A Ilbo |

Updated 2026.02.03

Seeking momentum in the world’s No. 2 fashion consumer market

Hazzys opens its second standalone store after Seoul

Musinsa also launches overseas select shops in succession

Race to secure popular MZ-generation brands

Hazzys opens its second standalone store after Seoul

Musinsa also launches overseas select shops in succession

Race to secure popular MZ-generation brands

Exterior view of LF Hazzys’ flagship store “Space H Shanghai,” which officially opened in Xintiandi, Shanghai, China, on the 2nd. Provided by LF

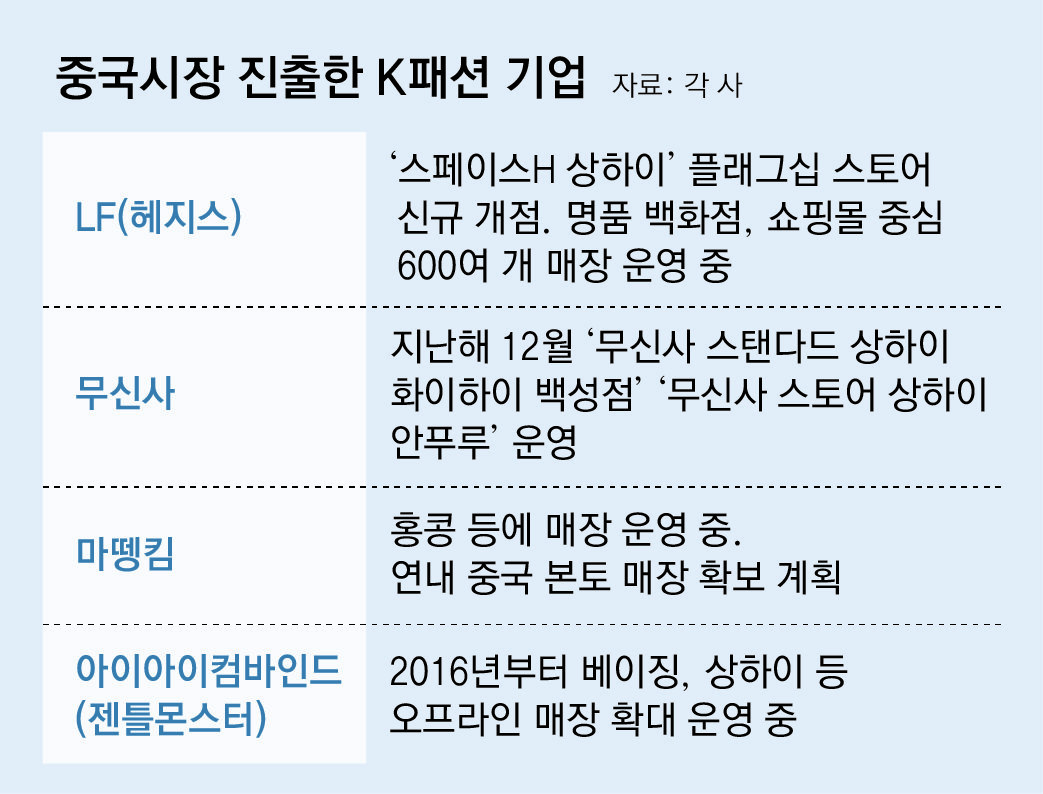

The pace is accelerating for K-brands seeking new growth drivers in China, the world’s second-largest fashion consumer market. As expectations grow for an easing of China’s “Korean Wave restriction order” (限韓令) and K-brands gain popularity among younger Chinese consumers, companies are aiming to strengthen competitiveness through premium positioning and localization.K-fashion platform Musinsa also opened its first overseas store, “Musinsa Standard Shanghai Huaihai Baisheng,” in Shanghai in December last year. It subsequently launched its first overseas multi-brand store, “Musinsa Store Shanghai Anfu Road,” demonstrating its intent to expand its China business centered on Shanghai. Musinsa is providing comprehensive support—from sales channel development to marketing and logistics—to help small and mid-sized K-fashion brands enter overseas markets more stably in their early stages.

Eye Eye Combine, operator of Gentle Monster, also accelerated its entry into the Chinese market in 2016 and currently operates more than 20 stores in Beijing and Shanghai. Matin Kim, which opened a standalone store in Hong Kong in 2024, is pushing to open a store in mainland China within the year. In addition, brands already widely recognized among China’s MZ generation, such as EIMIS and MLB, are increasing their store presence in the Chinese market, focusing on Shanghai and other major cities. School-uniform brand Hyungji Elite, which enjoys strong popularity in the Chinese school uniform market, signed a memorandum of understanding (MOU) last month with Shanghai Zhongshuai Robot Co., Ltd. (Zhongshuai Robot), a Chinese company specializing in intelligent exoskeleton robots, and is working to develop “wearable robots” as part of efforts to expand its influence in China.

Domestic fashion companies are focusing on China, judging that sustained growth in the Korean apparel market will be difficult. According to the Ministry of Trade, Industry and Energy’s provisional report “Export and Import Trends for the Full Year and December 2025,” textile exports to China from 1 January to 25 December last year totaled USD 1.37 billion, surpassing exports to the United States (USD 1.27 billion). While the Korean fashion market is expected to post annual growth of only around 1% due to weak consumption, China is forecast to grow by more than 3%.

Professor Chu Ho-jung of the Department of Clothing and Textiles at Seoul National University analyzed, “With the domestic fashion market bumping up against its growth limits, expanding into China—which is geographically close and has a large fashion market—is a natural strategy,” adding, “Given Shanghai’s significant status as a trend-leading fashion city, it will be an attractive option for fashion brands.”

Lee So-jeong

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News