MedTech

Alteogen Sees Record 2025 Margin Despite 2% Royalty

Dong-A Ilbo |

Updated 2026.02.02

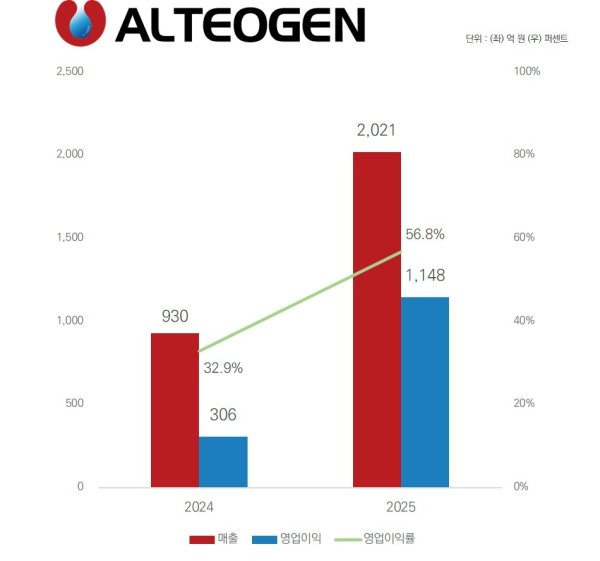

Sales of KRW 202.1 billion and operating profit of KRW 114.8 billion

Royalties from products like Keytruda SC become visible in earnings

Growth expected this year on expanded sales of related products

More than nine products to be secured by 2030… stabilizing revenue

Royalties from products like Keytruda SC become visible in earnings

Growth expected this year on expanded sales of related products

More than nine products to be secured by 2030… stabilizing revenue

Alteogen headquarters

Alteogen announced through a disclosure on the 2nd that it posted provisional 2024 results of KRW 202.1 billion in revenue and KRW 114.8 billion in operating profit last year. Compared with the previous year, revenue increased by 117% and operating profit grew by 275%, marking the highest performance in the company’s history. The operating margin rose sharply from 33% in 2024 to 57% last year.The company stated that these results can be attributed to revenue recognized from export contracts for its Hybrozyme platform technology, whose core is formulation modification. This includes the upfront payment from the license agreement with AstraZeneca and milestone payments related to U.S. and European approvals for the subcutaneous (SC) formulation Keytruda Qlex (ingredient name pembrolizumab). It also reflects royalty income from sales of Anguta, a Herceptin biosimilar marketed by its Chinese partner Qilu Pharmaceutical, as well as performance related to the supply of ALT-B4. In particular, although Alteogen’s share price fluctuated sharply after it became known that the royalty rate for Keytruda Qlex, for which technology was transferred to Merck (MSD), the marketer of Keytruda, was around 2%, falling short of market expectations, the company maintained a solid trajectory, recording an operating margin approaching 60%.

Alteogen also holds a positive outlook for this year’s performance. With the assignment of a J-code (a code that simplifies insurance claims and payments in the United States) for Keytruda Qlex scheduled to take effect in April, the company expects insurance claim procedures to become more streamlined and the market share of the subcutaneous formulation to expand as the number of countries where it is marketed increases. The company forecasts that performance will grow even more significantly as sales-linked milestone inflows expand. It also expects that sales of its own product Tergase injection, which is still in the early stages of market entry, will grow as prescribing experience accumulates.

Alteogen performance

The company emphasized that the Hybrozyme platform has proven its technological capabilities and safety in the global market through the first commercialized product to which the technology has been applied. Based on these achievements, it is expanding discussions with potential partners, with some now progressing to actual contract stages. It explained that additional partnerships are expected to follow, starting with this year’s first agreement signed with GSK subsidiary Tesaro.Jeon Tae-yeon, CEO of Alteogen, said, “2025 was a meaningful year in which Alteogen’s Hybrozyme platform technology entered commercialization through our partner MSD,” adding, “This year, we will be able to confirm the results more visibly through the recognition of sales-linked milestones.” He continued, “From a long-term perspective, we plan to continue making strategic decisions that can enhance corporate value, including investment in production facilities to stabilize the global supply chain and securing new pipelines through open innovation.”

MSD Keytruda Qlex (Keytruda SC)

Currently, there are three Alteogen-related products being sold in the global market: Tergase injection (a standalone hyaluronidase product), MSD’s Keytruda Qlex, and Qilu Pharmaceutical’s Anguta. In addition, its independently developed Eylea biosimilar Eyluxvi obtained marketing authorization from the European Commission (EC) in the second half of last year, and the company expects commercialization within this year. Alteogen has set a medium- to long-term goal of increasing the number of commercialized products, including its own products and out-licensed products, to at least nine by 2030. Its policy is to gradually establish a stable revenue structure based on its platform technology.

Kim Min-beom

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News