AI SaaS

Flow Proves Growth With AI Tool, Speeds Global Push

Dong-A Ilbo |

Updated 2026.01.30

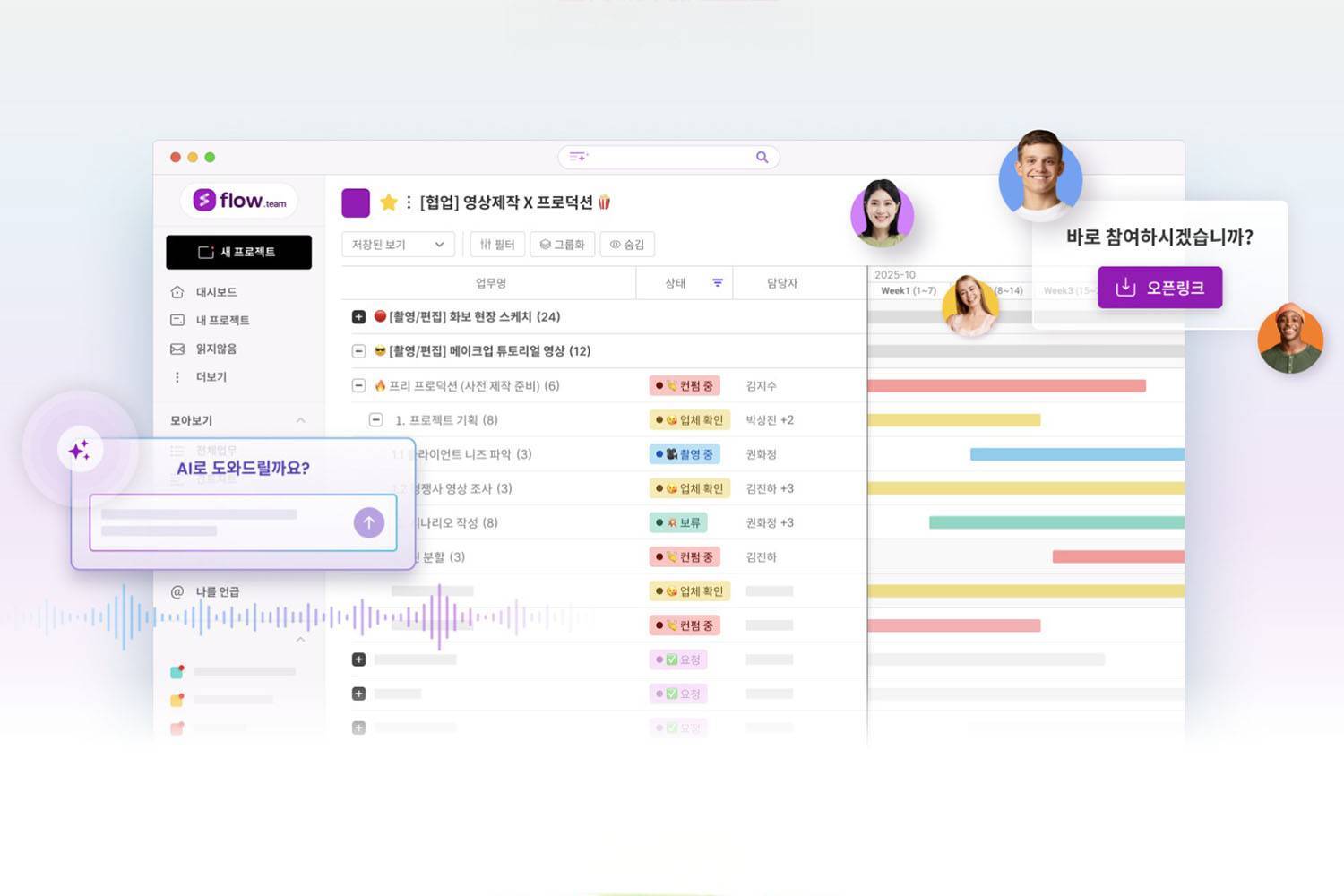

Madras Check, provider of the AI collaboration tool Flow, achieved KRW 21.0 billion in 2025 revenue (based on orders and contracts), successfully turning to profit / Source = Madras Check

As remote work environments have expanded, the global collaboration tool market has grown rapidly. According to data from market research firm Global Market Insights, the collaboration tool market is estimated at USD 18.0 billion (approximately KRW 2.56734 trillion) in 2024 and is projected to grow to USD 37.5 billion (approximately KRW 5.34862 trillion) by 2034.

However, the growth of the collaboration tool market does not translate into opportunities for all companies. With global giants such as Microsoft Teams, Slack, and Google Workspace dominating most of the market, it is not easy for domestic companies to secure competitiveness and survive. Various collaboration tools are attempting differentiation, but many assessments have been that this is insufficient to break through the ecosystem dominance of global players.

By contrast, there is a company showing notable progress among these global giants: Flow, developed by the domestic collaboration tool startup Madras Check. Flow achieved revenue of KRW 21.0 billion in 2025 based on orders and contracts, growing more than 50% compared with the KRW 14.0 billion recorded in 2024. It also succeeded in turning to profit, demonstrating both growth potential and profitability.

Flow expands customer base with hybrid strategy

The reason Flow succeeded in turning to profit lies in the diversification of its revenue structure. Many software-as-a-service (SaaS) startups rely solely on cloud subscription models and consequently hit growth ceilings. In addition to SaaS, Flow has built a variety of service formats, including private cloud and on-premises internal network deployments.

This service diversification strategy has attracted the attention of large corporations, financial institutions, and public agencies. It has accumulated more than 70 on-premises deployment cases, ranging from large manufacturing and distribution companies such as Samsung Electro-Mechanics, Hyundai Mobis, and BGF Retail, to financial institutions such as Samsung Life Insurance, Samsung Fire & Marine Insurance, Korea Investment & Securities, and DB Financial Investment, and public institutions such as Korea Gas Corporation, the Financial Supervisory Service, the National Assembly Budget Office, and the Korea Tourism Organization.

The on-premises market is advantageous for securing long-term revenue because it requires continuous maintenance and upgrades. It is a structure that can enjoy both the stable cash flow provided by subscription-based SaaS and the short-term revenue expansion effect of large-scale deployment projects. Madras Check emphasized that, through its hybrid strategy, it has secured both the stability and scalability of its revenue.

Flow’s strength is that it provides the same collaboration experience in any environment. The user interface (UI) and functions are identical across SaaS and on-premises deployments. The fact that companies can choose Flow regardless of their size or security level constitutes a key competitive advantage that broadens the market base.

Revenue and profit structure validated, 2026 targets are global expansion and IPO

Over the past five years, Flow has posted a compound annual growth rate (CAGR) of more than 40% based on accounting revenue. On an orders and contracts basis, it jumped from KRW 14.0 billion in 2024 to KRW 21.0 billion in 2025. This has validated a structure in which Flow’s growing influence is linked directly to actual revenue and profit. Above all, the aspect to which Madras Check attaches the most significance is the turn to profit. This is not about one-off cost cuts or seasonal sales, but about sustainable earnings generated by AI-centered product competitiveness and a hybrid revenue structure.

Image summarizing Flow’s growth trend / Source = Madras Check

There was a strategic choice behind this. Rather than pursuing reckless market expansion, the company built up revenue around a verified customer base and focused research and development (R&D) investment on internalizing AI technology. Lee Hak-joon, CEO of Madras Check, stated, “We plan to reinvest Flow’s revenue into customer-centered AI technology internalization and R&D for product advancement. We will elevate the competitiveness of the AI collaboration operating system to the next level.”

Flow has designated 2026 as a year of leap forward. It aims to achieve KRW 30.0 billion in revenue based on orders and contracts in 2026 and plans to accelerate expansion into global markets. Focusing on overseas markets such as Japan, the United States, and the United Kingdom, the company will pursue simultaneous validation and expansion in the AI collaboration platform market. Flow intends to differentiate itself by highlighting its diverse AI collaboration tool deployment cases. Its multi-AI transformation (AX) strategy, which emphasizes enterprise security, is expected to serve as a differentiation point even in highly regulated markets such as Europe and the United States.

Madras Check will also begin preparations for an initial public offering (IPO) in parallel with global expansion. The plan is to secure growth momentum based on the turn to profit and revenue growth. CEO Lee said, “In an environment where most startups find it difficult to achieve both external growth and profitability at the same time, Flow has solved these challenges through an AI-centered product strategy and a hybrid SaaS and on-premises revenue structure. The full-year turn to profit in 2025 is the starting point of structural growth, and we will move forward toward achieving KRW 30.0 billion in 2026 revenue and becoming a global AI collaboration platform.”

IT Donga, reporter Kang Hyeong-seok (redbk@itdonga.com)

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News