SK Hynix

SK Hynix Posts Record Earnings, Cements HBM Lead

Dong-A Ilbo |

Updated 2026.01.29

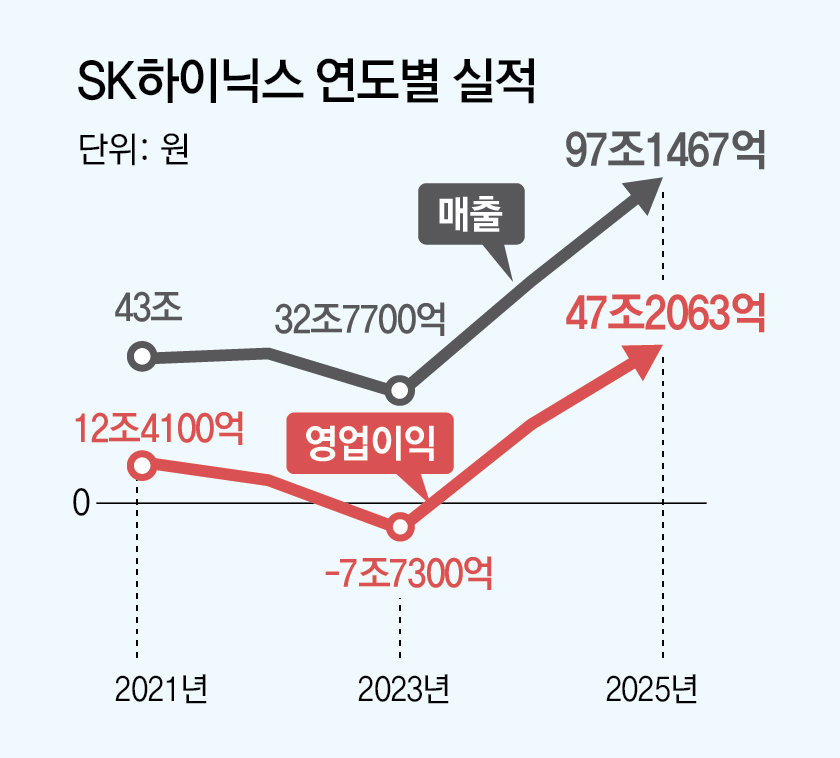

Operating profit surged 101% to KRW 47 trillion last year

Revenue jumped 47% to a record KRW 97 trillion since founding

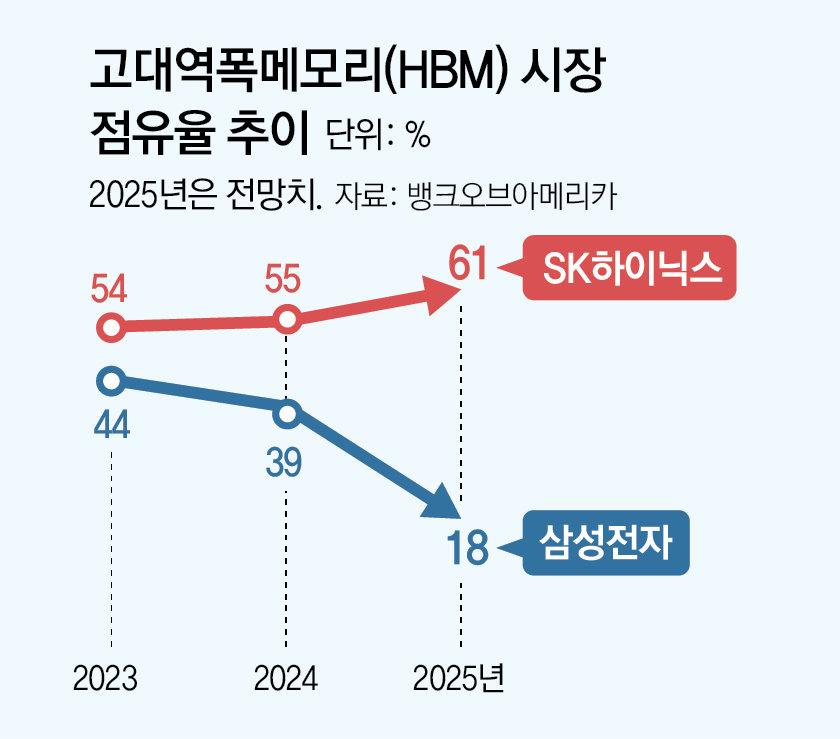

Secures over 60% of Nvidia’s HBM4 supply… growing forecasts of “operating profit to top KRW 100 trillion this year”

Dividend of KRW 1,875 per share… totaling over KRW 1 trillion

Revenue jumped 47% to a record KRW 97 trillion since founding

Secures over 60% of Nvidia’s HBM4 supply… growing forecasts of “operating profit to top KRW 100 trillion this year”

Dividend of KRW 1,875 per share… totaling over KRW 1 trillion

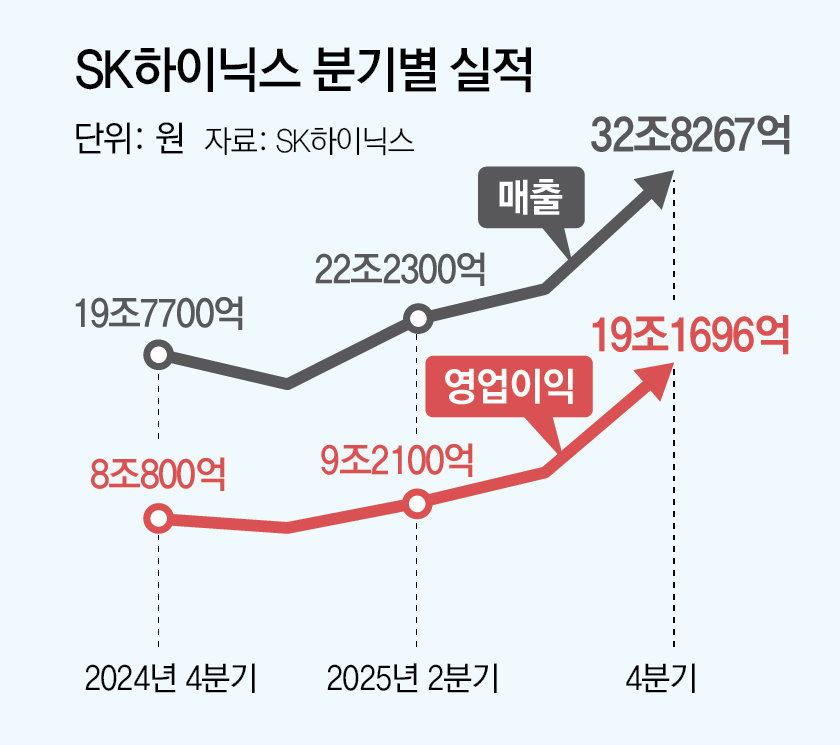

● Quarterly operating profit nears KRW 20 trillion… highest results on record

It also posted record-high results on a quarterly basis. In the fourth quarter of last year (October–December), SK hynix’s revenue and operating profit stood at KRW 32,826.7 billion and KRW 19,169.6 billion, respectively, up 66% and 137% year-on-year. SK hynix’s fourth-quarter 2025 operating profit ranked second in Korean corporate quarterly earnings, following Samsung Electronics’ 2025 fourth-quarter figure (KRW 20 trillion). In particular, its operating margin reached 58.4%, surpassing Taiwan’s TSMC (54.0%), which had maintained the highest operating margin in the global semiconductor industry, for the first time in seven years since the fourth quarter of 2018.

Moreover, as the AI market evolves from a phase focused on training large-scale models to a “inference” phase in which users actually utilize AI services, usage of memory semiconductors is soaring. Han Dong-hee, an analyst at SK Securities, said, “All memory products, including HBM3E, HBM4, and commodity DRAM, are in short supply.” SK hynix stated on the day, “We will rapidly maximize the production capacity of the Cheongju M15X fab and proceed with the construction of the first fab in Yongin to expand our production base.”

● Forecasts: “Operating profit to exceed KRW 100 trillion this year”

SK hynix also decided to implement an additional dividend of KRW 1 trillion, or KRW 1,500 per share. It will cancel 15.3 million treasury shares (a 2.1% stake) valued at KRW 12,200 billion based on the closing price on the 27th. On the 28th, SK hynix’s share price closed at KRW 841,000.

Meanwhile, SK hynix plans to pay an “excess profit distribution (PS)” next month on the 5th, funded by 10% of last year’s operating profit (about KRW 4,700 billion. Although the amount will vary depending on years of service and performance, a simple calculation by headcount suggests a per-capita payout of around KRW 140 million.

Lee Min-a 기자 omg@donga.com;Lee Dong-hoon 기자 dhlee@donga.com

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News