Business / Commodity Market

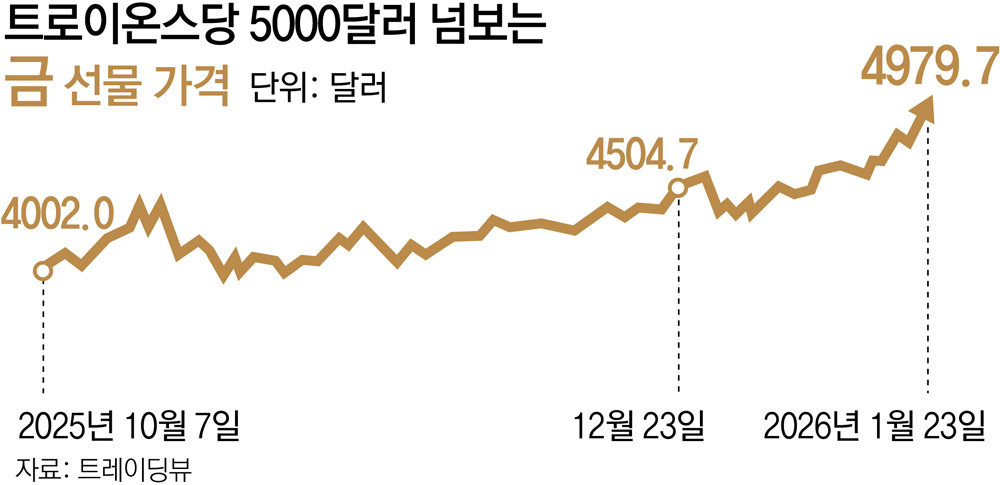

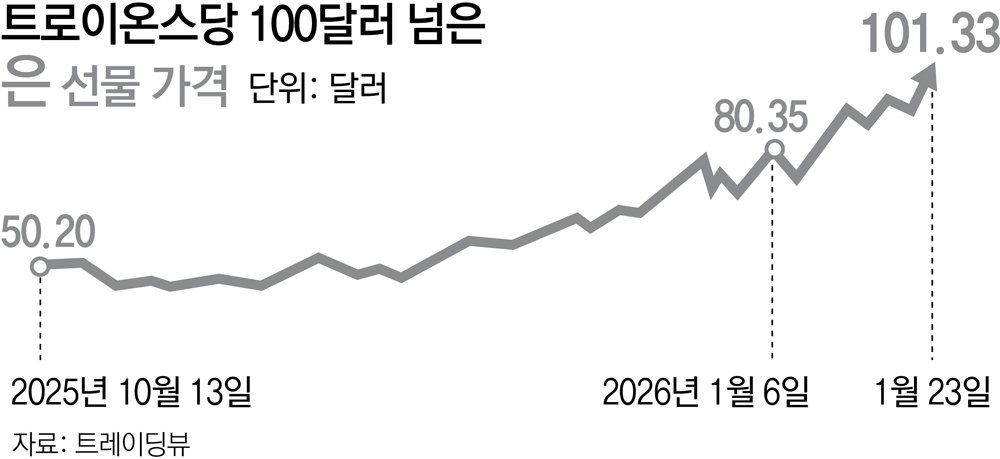

Gold Near $5,000, Silver Tops $100 in Record Run

Dong-A Ilbo |

Updated 2026.01.26

‘Sell America’ spreads amid global geopolitical uncertainty

Safe-haven demand rises, fueling expectations of a ‘rally’

Lump-sum funds pour into domestic spot gold ETFs

KRW 71.6 billion worth of gold bars sold in just three weeks

Safe-haven demand rises, fueling expectations of a ‘rally’

Lump-sum funds pour into domestic spot gold ETFs

KRW 71.6 billion worth of gold bars sold in just three weeks

Silver bars are displayed at a jewelry shop in Jongno, Seoul, on the 25th. On the New York Mercantile Exchange on the 23rd (local price), the March futures price of international silver closed at USD 101.33 (about KRW 147,500) per troy ounce, hitting a record high. Newsis

International gold prices are on the verge of breaking through USD 5,000 (about KRW 7,276,500) per troy ounce (approximately 31.1 g). Silver prices have surpassed USD 100 (about KRW 145,500) per troy ounce for the first time, setting an all-time high. The move is attributed to growing preference for safe-haven assets amid unstable global conditions such as tensions between the United States and the European Union (EU) over Greenland and the situation in Venezuela at the beginning of the year, as well as threats to the independence of the US Federal Reserve (Fed). The market expects the upward trend in safe-haven asset prices, including gold and silver, to continue in the first half of this year (January–June).

● Silver up more than 40% so far this year

In the domestic market, the consumer buyback price of one don (3.75 g) of pure gold has also exceeded KRW 1 million. According to Korea Gold Exchange, as of the 24th the buyback price for one don of pure gold was KRW 1,015,000. The price for one don of pure gold was KRW 530,000 in January last year and has doubled in one year, surpassing KRW 1 million for the first time.

As prices of precious metals including gold continue to rise, investment demand is also increasing. According to Koscom, over the past week (16–22), the net asset value of “ACE KRX Gold Spot,” an exchange-traded fund (ETF) that invests in domestic spot gold, exceeded KRW 4 trillion. This marks a return to the trillion-won level just two months after surpassing KRW 3 trillion in November last year.

Gold bars available for purchase through banks are also popular. According to the financial sector, gold bars sold between the 1st and 22nd of this month at KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup Bank totaled KRW 71,673.11 million. This is more than double the sales in December last year (KRW 35,005.87 million).

● “Safe-haven demand growing on ‘sell America’ sentiment”

The sustained rise in gold and silver prices is due to unresolved political uncertainties in the global foreign exchange market. After US President Donald Trump announced a plan to annex Greenland and threatened to impose tariffs on European countries, he further intensified pressure to dismiss Federal Reserve Chair Jerome Powell, fueling “sell America” sentiment (selling US assets).

Expectations of further Fed benchmark rate cuts are also among the factors driving gold and silver prices higher. At this year’s first Federal Open Market Committee (FOMC) meeting, to be held on the 27th–28th of this month, the benchmark rate is widely expected to be kept unchanged at the current 3.50–3.75% range. However, there are still strong expectations that additional cuts will be made around the time when the Fed chair is replaced in May. When interest rates fall, expected returns from deposits and bonds decline, potentially shifting investment demand toward other assets such as gold and silver.

Experts forecast that gold and silver prices will continue to rise for the time being. Hwang Byeon-jin, a researcher at NH Investment & Securities, said, “Against a backdrop of expanding monetary liquidity and a weaker US dollar, precious metals such as gold and silver are expected to lead price increases in the global asset market for the time being.”

Choe Mi-song; Ji Min-gu

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News