Investment / Hanwha

Hanwha Corp Splits Tech-Life Unit, Third-Gen Succession Emerges

Dong-A Ilbo |

Updated 2026.01.15

Spin-off completed in July… 4.45 million shares to be canceled

Defense, shipbuilding, energy, finance and other units to remain… Eldest son Kim Dong-kwan to tighten grip on group

Robotics and hotel businesses assigned to new entity… Third son Kim Dong-sun may pursue separate group

Defense, shipbuilding, energy, finance and other units to remain… Eldest son Kim Dong-kwan to tighten grip on group

Robotics and hotel businesses assigned to new entity… Third son Kim Dong-sun may pursue separate group

Hanwha Group’s Janggyo-dong building in Jung-gu, Seoul. Courtesy of Hanwha Group

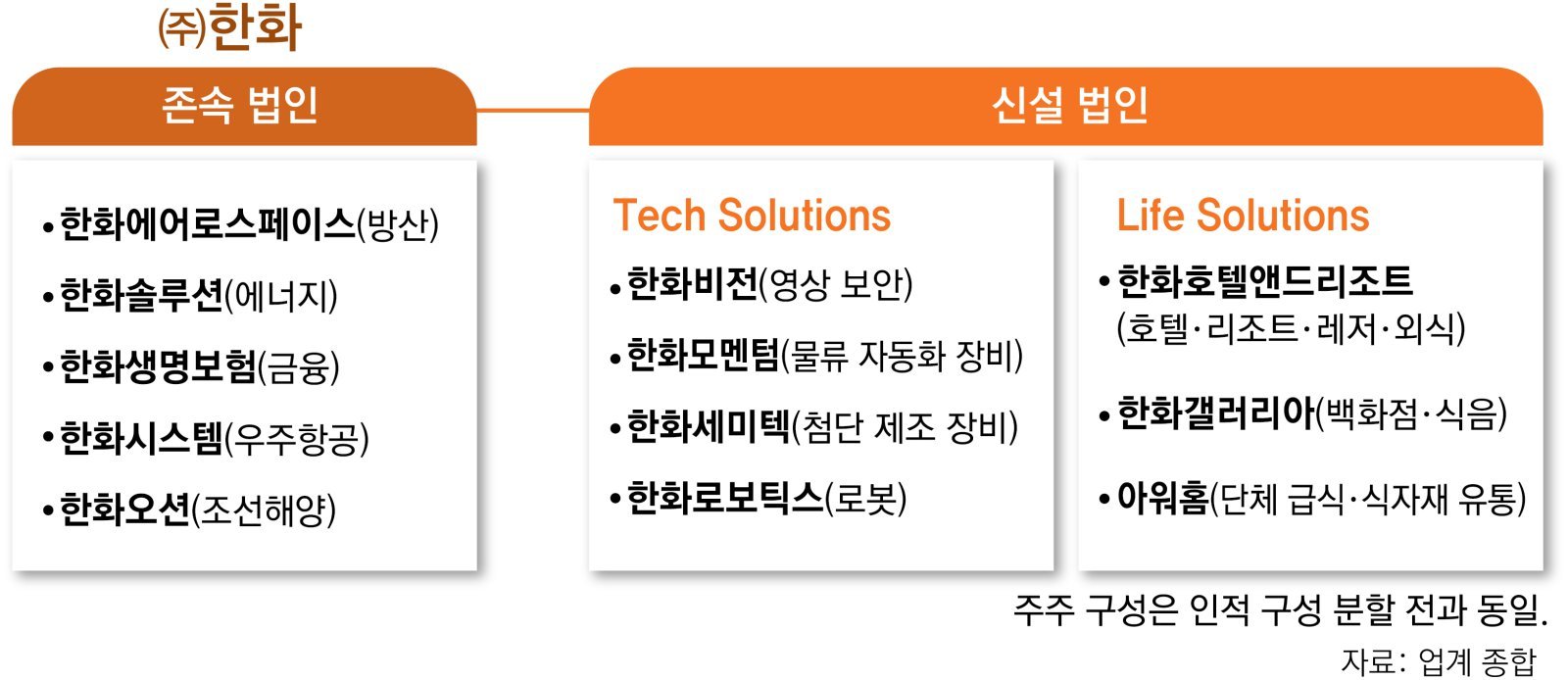

Hanwha Group has spun off its holding company Hanwha Corporation through a physical (in-kind) division. The defense, shipbuilding and marine, energy, and financial businesses will remain under the surviving entity, while the tech and life segments have been carved out into a newly established company, “Hanwha Machinery & Service Holdings.” Analysts say that Kim Dong-seon, Executive Vice President of Hanwha Hotels & Resorts and the third son in the Hanwha founding family, will head the new entity, strengthening his independent management base. According to business circles and the investment banking (IB) industry on the 14th, Hanwha Corporation held a board meeting that day and resolved to proceed with the physical division. Based on the book value of net assets, the split ratio will be 76.3% for the surviving company and 23.7% for the new company. Existing shareholders will receive shares in both entities in proportion to this ratio. Hanwha Corporation plans to complete the division process in July after an extraordinary general meeting of shareholders in June.

The new company will oversee tech affiliates such as Hanwha Vision (video security), Hanwha Momentum (logistics automation equipment), Hanwha Semitek (advanced manufacturing equipment), and Hanwha Robotics (robots), as well as life segment affiliates including Hanwha Hotels & Resorts (hotels, resorts, leisure, dining), Hanwha Galleria (department store, food and beverage), and Ourhome (contract catering, food distribution).

A Hanwha Corporation official stated, “We separated the defense, shipbuilding and marine, energy, and financial business group, where long-term growth strategies and large-scale investments are crucial, from the machinery and services business group, which requires flexible and agile responses to the market,” adding, “Each company will be able to establish its own management strategy, secure swift decision-making and execution capabilities, and thereby enhance its business competitiveness.”

The IB community interprets this physical division as further clarifying the succession structure of Hanwha Group centered on Vice Chairman Kim Dong-kwan, the eldest son of Hanwha Group Chairman Kim Seung-youn. The prevailing view is that the surviving company will be led by Vice Chairman Kim, while the new entity will be overseen by Executive Vice President Kim, the third son. This has led to speculation about a potential future split of the group into separate corporate factions. However, Hanwha has stated that “there are no plans for a group split.”

Earlier, in December last year, Hanwha Energy, which is 100% owned by Hanwha Corporation’s controlling shareholder and founding family members, conducted a pre-IPO fundraising. In this process, Executive Vice President Kim is reported to have sold a 15% stake, securing more than KRW 800 billion in funding. The market is speculating that these funds could be used to acquire shares in the new holding company.

Meanwhile, Hanwha Corporation also resolved on the same day to enhance shareholder returns through the cancellation of treasury shares and an increase in dividends. It will cancel 4.45 million common shares (5.9%) after completing the relevant procedures and will raise the dividend payout by more than 25%. The company also plans to acquire and cancel all 199,033 remaining old preferred shares through off-market purchases. This is seen as a measure to fulfill the small shareholder protection commitments made at the time of last year’s delisting of preferred shares and to strengthen shareholder trust.

Lee Dong-hun 기자 dhlee@donga.com;Park Hyun-ik 기자 beepark@donga.com

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News