Samsung Biologics

Samsung Biologics Weighs Expanding US Plant to 100,000L

Dong-A Ilbo |

Updated 2026.01.15

Lim: “Strong demand for production in the U.S.

China will catch up sooner or later, even if we’re ahead now

Plan to introduce physical AI to build intelligent factories”

China will catch up sooner or later, even if we’re ahead now

Plan to introduce physical AI to build intelligent factories”

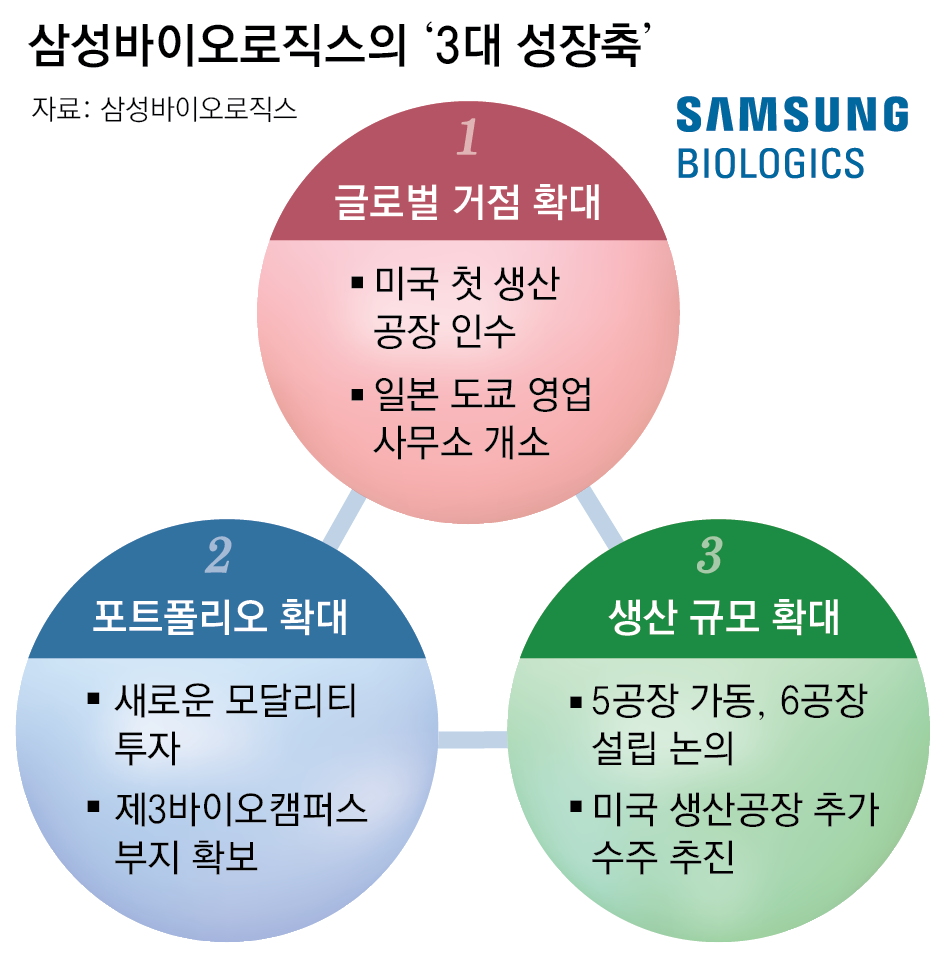

Samsung Biologics is seeking to complete the acquisition of a production plant in Rockville, Maryland, in the United States by March and is reviewing plans to expand its production capacity. In Songdo, Incheon, the company has secured land for its third bio campus and plans to turn the plant into an “intelligent factory” through collaboration with Samsung Electronics.

In December last year, after several years of review, Samsung Biologics announced that it would acquire the Rockville, U.S. plant of GlaxoSmithKline (GSK), one of its clients. Rim told reporters on the 12th, “Since the acquisition announcement, many clients have been requesting production in the United States,” adding, “If we complete the acquisition by March, we will review expanding production facilities on the idle site up to 100,000 L and will seek additional orders.”

In Korea, in December last year the company signed a land deal in Songdo, Incheon, to establish its third bio campus, laying the groundwork for additional plant expansion. Currently in Songdo, the first bio campus consists of Plants 1 to 4, and the second bio campus houses Plant 5. The company plans to finalize the construction of Plant 6 within this year. In his presentation, Rim said, “If we combine Songdo and the United States, our total production capacity will reach 845,000 L, making us the overwhelming global No. 1,” adding, “By building a multi-manufacturing system spanning Korea and the United States, we can respond flexibly to client requests.”

Samsung Biologics is promoting factory automation in cooperation with Samsung Electronics. At present, it is attempting partial automation at Plant 5 by introducing autonomous mobile robots (AMRs). Rim said, “Even if we are ahead now, China could eventually catch up,” and added, “We must rapidly introduce factory automation and physical artificial intelligence (AI) to make our plants intelligent.” In particular, the newly developed third bio campus will be built as an AI-enabled “intelligent factory” with an investment of about KRW 7 trillion by 2034. Rim said, “We will pursue facility automation through cooperation with Rainbow Robotics, acquired by Samsung Electronics, and improve production yield through AI modeling.”

The company plans to use physical AI to respond to rapidly changing demand in the global new drug market. Even in antibody drugs, which are Samsung Biologics’ main products, there is a wide range of possible variations, including multi-specific antibodies, antibody-drug conjugates (ADCs), antibody vaccines, and fusion proteins. Accurate supply and demand forecasting is therefore essential. Rim said, “We are continuing to invest in new modalities, such as ADCs,” adding, “The third bio campus will be a multi-modality campus that can produce multiple modalities simultaneously.”

Next-generation modalities under review by Samsung Biologics include “peptides” such as the GLP-1 obesity treatments “Wegovy” and “Mounjaro.” Rim noted, “Peptides are currently the hottest field and require enormous production capacity,” leaving open the possibility of contract development and manufacturing (CDMO) for peptides.

Meanwhile, Fujifilm of Japan, a competitor of Samsung Biologics, also gave a presentation at the same event and, in reference to Samsung Biologics’ acquisition of a U.S. plant, stated, “Every company is focusing on the U.S. market,” adding, “We would like to emphasize that, rather than purchasing external facilities, we are concentrating on building our own systems in-house,” signaling a competitive stance.

John Rim, CEO of Samsung Biologics, delivers a corporate presentation at the JP Morgan Healthcare Conference held in San Francisco, California, on the 13th (local time). Provided by Samsung Biologics.

At the main stage of the world’s largest pharmaceutical and biotechnology investment event, the “JP Morgan Healthcare Conference (JPMHC),” held at the Westin St. Francis Hotel in San Francisco on the 13th (local time), John Rim, CEO of Samsung Biologics, said, “This year as well, we will actively consider strategic mergers and acquisitions (M&A), such as the Rockville production plant.”In December last year, after several years of review, Samsung Biologics announced that it would acquire the Rockville, U.S. plant of GlaxoSmithKline (GSK), one of its clients. Rim told reporters on the 12th, “Since the acquisition announcement, many clients have been requesting production in the United States,” adding, “If we complete the acquisition by March, we will review expanding production facilities on the idle site up to 100,000 L and will seek additional orders.”

In Korea, in December last year the company signed a land deal in Songdo, Incheon, to establish its third bio campus, laying the groundwork for additional plant expansion. Currently in Songdo, the first bio campus consists of Plants 1 to 4, and the second bio campus houses Plant 5. The company plans to finalize the construction of Plant 6 within this year. In his presentation, Rim said, “If we combine Songdo and the United States, our total production capacity will reach 845,000 L, making us the overwhelming global No. 1,” adding, “By building a multi-manufacturing system spanning Korea and the United States, we can respond flexibly to client requests.”

The company plans to use physical AI to respond to rapidly changing demand in the global new drug market. Even in antibody drugs, which are Samsung Biologics’ main products, there is a wide range of possible variations, including multi-specific antibodies, antibody-drug conjugates (ADCs), antibody vaccines, and fusion proteins. Accurate supply and demand forecasting is therefore essential. Rim said, “We are continuing to invest in new modalities, such as ADCs,” adding, “The third bio campus will be a multi-modality campus that can produce multiple modalities simultaneously.”

Next-generation modalities under review by Samsung Biologics include “peptides” such as the GLP-1 obesity treatments “Wegovy” and “Mounjaro.” Rim noted, “Peptides are currently the hottest field and require enormous production capacity,” leaving open the possibility of contract development and manufacturing (CDMO) for peptides.

Meanwhile, Fujifilm of Japan, a competitor of Samsung Biologics, also gave a presentation at the same event and, in reference to Samsung Biologics’ acquisition of a U.S. plant, stated, “Every company is focusing on the U.S. market,” adding, “We would like to emphasize that, rather than purchasing external facilities, we are concentrating on building our own systems in-house,” signaling a competitive stance.

Choi Ji-won

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News