K-Trend

Exports Hit $709.7 Billion; Semiconductors Up, Shipbuilding Down

Dong-A Ilbo |

Updated 2026.01.02

2026 Outlook for Korea’s Exports

Record-high exports last year create a “base effect”… limiting growth in semiconductor and shipbuilding exports

Concerns over worsening export conditions due to U.S. tariffs… need to focus on strengthening competitiveness in “core items”

Record-high exports last year create a “base effect”… limiting growth in semiconductor and shipbuilding exports

Concerns over worsening export conditions due to U.S. tariffs… need to focus on strengthening competitiveness in “core items”

Cars awaiting export are parked at the automobile-only pier of Pyeongtaek Port in Gyeonggi Province in December last year. Despite the impact of tariffs imposed by the United States, Korea’s automobile exports last year rose 1.7% year-on-year to a record high of USD 71.98 billion. However, it remains uncertain whether export growth will continue this year due to increased production in the United States aimed at avoiding tariffs. Pyeongtaek = Reporter Lee Han-gyeol always@donga.com

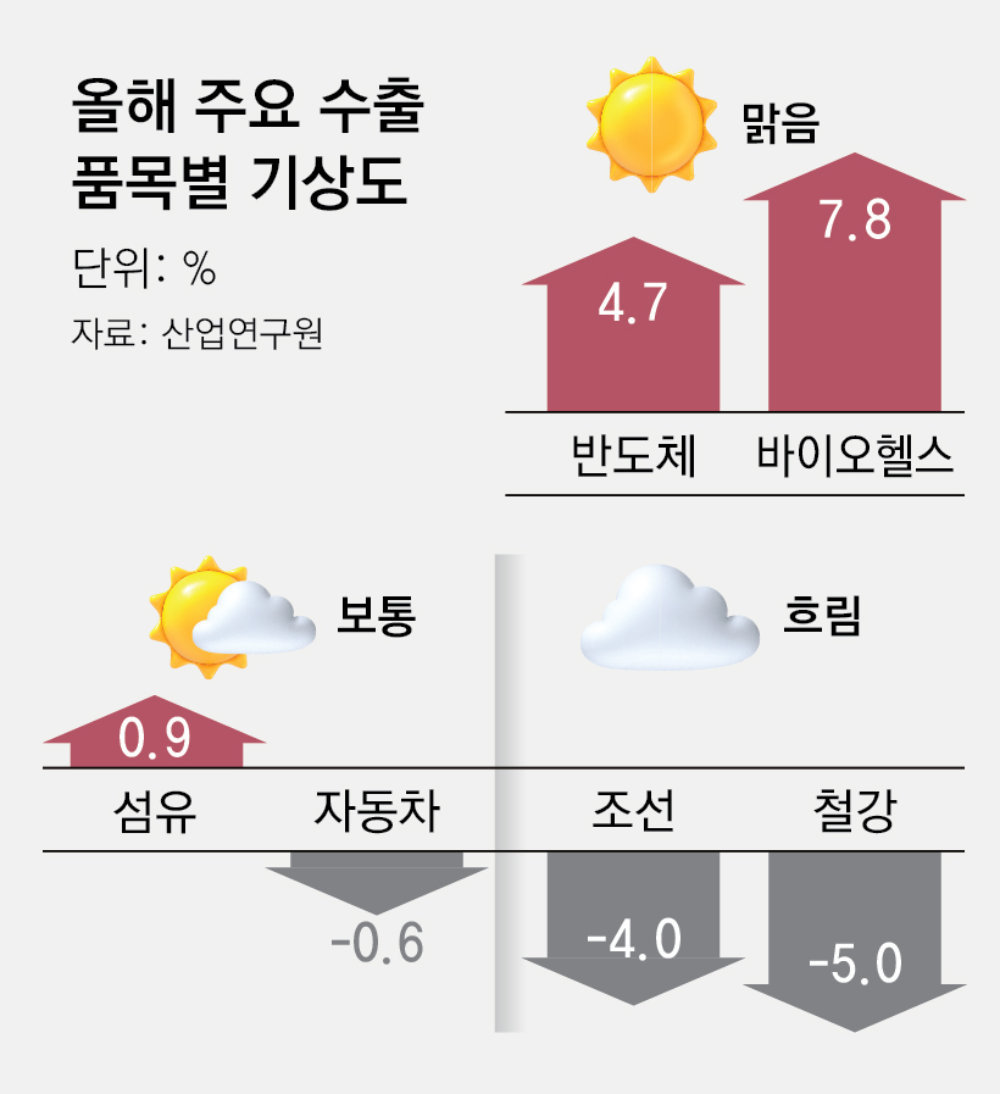

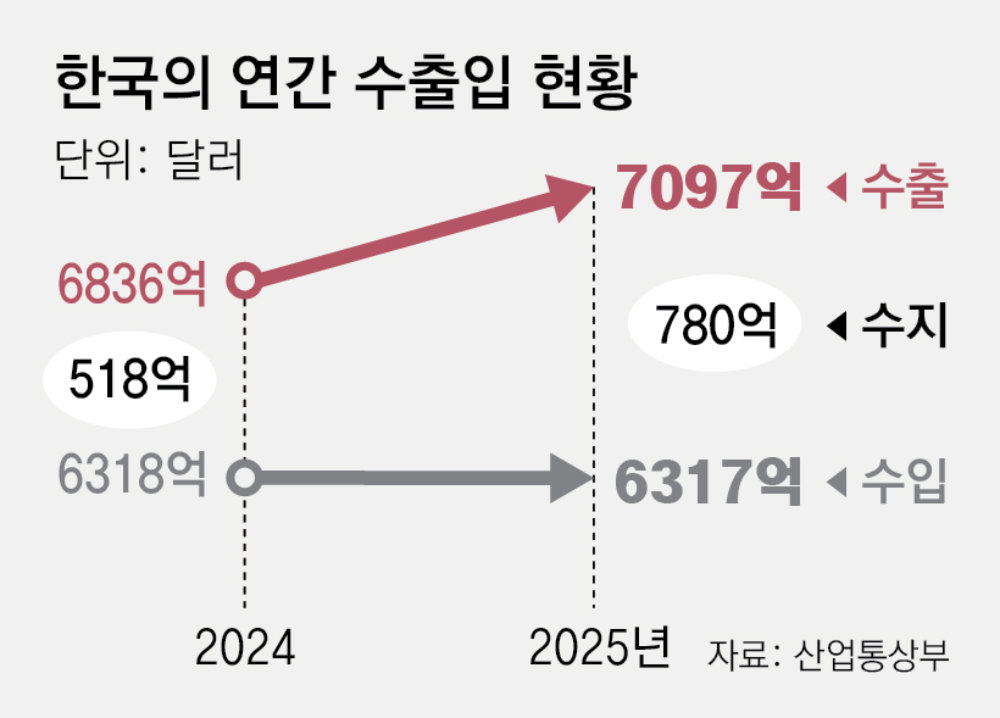

This year, Korea’s exports are projected to retreat despite solid performance in certain key items such as semiconductors and biohealth, due to sluggishness in steel and shipbuilding, according to a forecast from a government-affiliated research institute. Front-loaded export shipments in the global market ahead of U.S. tariff measures are highly likely to lead to a decline in trade volume this year, and countries other than the United States are also tightening trade regulations. There are growing calls for urgent policy support to diversify export markets and enhance the competitiveness of core items such as semiconductors, automobiles and ships.● Semiconductors and bio: “bright”; steel and shipbuilding: “cloudy”

Exports of semiconductors, the country’s largest export item, are expected to continue growing this year, but the pace of increase is forecast to slow sharply. KIET stated, “Exports of high value-added products will continue to rise on the back of sustained investment in artificial intelligence (AI), but due to the base effect from last year’s record performance and demand stabilization, the growth rate will slow to 4.7%.” Semiconductor exports last year surged 22.2% year-on-year to USD 173.4 billion. Biohealth exports are also projected to increase 7.8% from the previous year, supported by robust global demand and expanded contract manufacturing of products such as biosimilars.

In contrast, ship exports are estimated to decline 4.0% this year due to a base effect after soaring 24.9% last year. While exports of liquefied natural gas (LNG) carriers and ship equipment are expected to grow, deliveries of large container ships and exports of offshore plants are projected to decrease. Steel exports, which recorded a 9.0% contraction last year, are also forecast to fall a further 5.0% this year amid continued U.S. tariffs and strengthened regulations in major countries.

● “Trade conditions will worsen… need to strengthen competitiveness of key items”

Song Min-gi, senior research fellow at the Korea Institute of Finance (KIF), said, “Due to preemptive moves driven by concerns over U.S. tariff imposition and increased investment related to AI, global trade volume last year posted a higher-than-expected growth rate,” adding, “Because of this base effect, the global trade growth rate this year is likely to slow considerably compared with last year, potentially acting as a negative factor for economies with high export dependence.”

There is also a high possibility that export conditions for Korean companies will deteriorate further. The European Union (EU) began implementing its Carbon Border Adjustment Mechanism (CBAM) on the 1st, effectively imposing so-called “climate tariffs” on major Korean export items such as steel, cement and aluminum. Canada likewise raised the tariff burden on Korean steel products by tightening its steel tariff rate quota (TRQ) system from 26 December last year.

Jang Sang-sik, head of the Institute for International Trade at the Korea International Trade Association, said, “Diversifying export markets and items is important, but it is also essential to focus on strengthening the competitiveness of areas where we already perform well, such as semiconductors, automobiles and ships.”

Sejong=Jeong Soon-gu

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News