Investment / Semiconductor

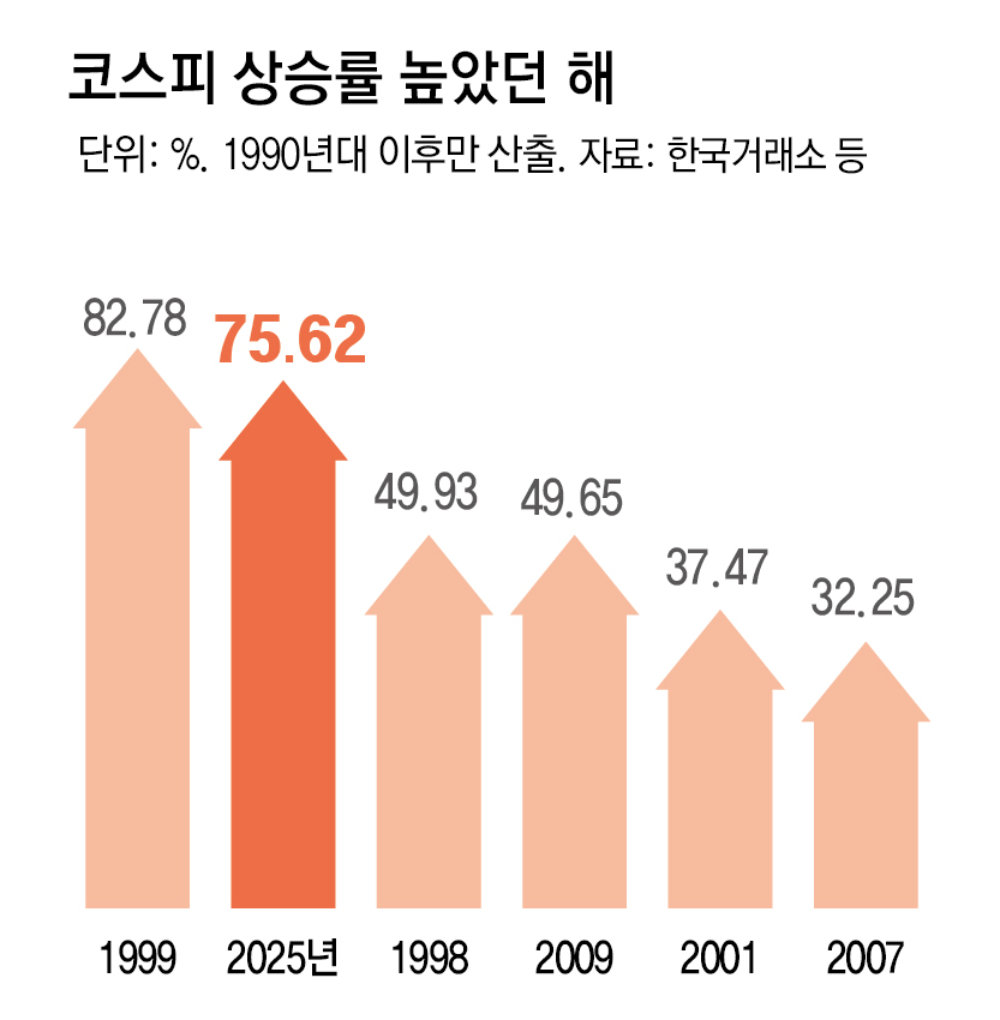

KOSPI Posts Biggest Gain in 26 Years; Semiconductors Seen Leading Next Year

Dong-A Ilbo |

Updated 2025.12.31

Up 75.6% year-to-date, closing at 4,214

First-ever breakthrough of 4,000 points… a record bull run

‘Semiconductor top two’ hit all-time highs

“Driven by robust semiconductors on rising AI demand… KOSPI could reach as high as 5,500 next year”

First-ever breakthrough of 4,000 points… a record bull run

‘Semiconductor top two’ hit all-time highs

“Driven by robust semiconductors on rising AI demand… KOSPI could reach as high as 5,500 next year”

On the 30th, the last trading day of the year for the domestic stock market, the KOSPI closed at 4,214.17, down 6.39 points (0.15%) from the previous trading day (4,220.56), while the closing price is shown on the electronic board in the Hana Bank dealing room in Jung-gu, Seoul. Photo by reporter Lee Han-gyeol always@donga.com

The domestic stock market finished its final trading day of the year after recording the highest annual gain since 1999, when the “Buy Korea” fund-buying boom took off. During intraday trading, Samsung Electronics’ share price exceeded KRW 120,000 and SK Hynix surpassed KRW 650,000. With demand for artificial intelligence (AI) data centers expected to expand and drive semiconductor company growth through 2026, the consensus outlook is that the KOSPI’s upward trend will continue.● KOSPI up 75.62% this year

On the final trading day of the year, the 30th, the KOSPI closed at 4,214.17, down 0.15% from the previous session. Individuals were net buyers of KRW 918.1 billion, while foreigners and institutions were net sellers of KRW 512.6 billion and KRW 429.7 billion, respectively. The securities industry analyzed that foreigners and institutions turned to net selling to actively realize year-end profits.

As a result, the KOSPI’s gain compared with the last trading day of last year (December 30) came to 75.62%. This far outpaced the annual gains of the US benchmark indices as of the 29th (local time), with the S&P 500 up 17.41% and the Nasdaq Composite up 21.56%.

The financial investment industry expects the KOSPI’s upward trend to continue next year as well. Samsung Securities forecast a KOSPI trading range of 4,000–4,900 for next year. Daishin Securities projected that the KOSPI could reach 5,300. Hyundai Motor Securities, which presented the most optimistic outlook, set the upper bound of its KOSPI forecast at 5,500.

● Intraday ‘KRW 120,000 Electronics’, ‘KRW 650,000 Nix’

The financial investment industry expects semiconductor companies to lead next year’s KOSPI rally as well. Demand is simultaneously increasing not only for advanced semiconductors such as high bandwidth memory (HBM), which is essential for AI training and inference, but also for general-purpose semiconductor products such as DRAM and NAND flash, while supply remains tight.

In fact, domestic and overseas securities firms expect next year’s operating profit of Samsung Electronics and SK Hynix to each reach KRW 100 trillion. NH Investment & Securities projected the major domestic semiconductor companies’ annual operating profit next year at KRW 115 trillion for Samsung Electronics and KRW 105 trillion for SK Hynix. Japan’s Nomura Securities similarly forecast Samsung Electronics’ operating profit at KRW 133.4 trillion and SK Hynix’s at KRW 99 trillion. Nomura Securities in particular stated, “The super-boom in memory semiconductors is highly likely to continue at least until 2027.”

Buoyed by these record-breaking earnings forecasts, Samsung Electronics’ share price climbed intraday to KRW 121,200 on the 4th, hitting an all-time high and surpassing the previous “KRW 110,000 Electronics” phase to become “KRW 120,000 Electronics” in intraday trading. SK Hynix’s share price also soared intraday to KRW 659,000, setting a new record high.

Lim Jung-eun, a researcher at KB Securities, said, “The domestic stock market in 2025 achieved the first-ever ‘4,000 KOSPI’ (Sacheonpi) and can be evaluated as a year that posted record returns,” adding, “Next year as well, it will be necessary to maintain a positive view on the KOSPI and focus on sectors where earnings growth continues, such as semiconductor stocks.”

Ji Min-gu 기자 warum@donga.com

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News