Biotech

Cytiva’s First Korean APAC Head on Korea’s Biotech Rise

Dong-A Ilbo |

Updated 2025.12.29

Cytiva, the world’s No. 1 bio materials and equipment company

President Joonho Choi, from head of Korea to head of Asia-Pacific

Launch coincides with establishment of “Cytiva Korea”

Opening of domestic manufacturing and training facility “Innovation Hub”

“Korea is a ‘full value chain hub’ spanning research, clinical, manufacturing and digital”

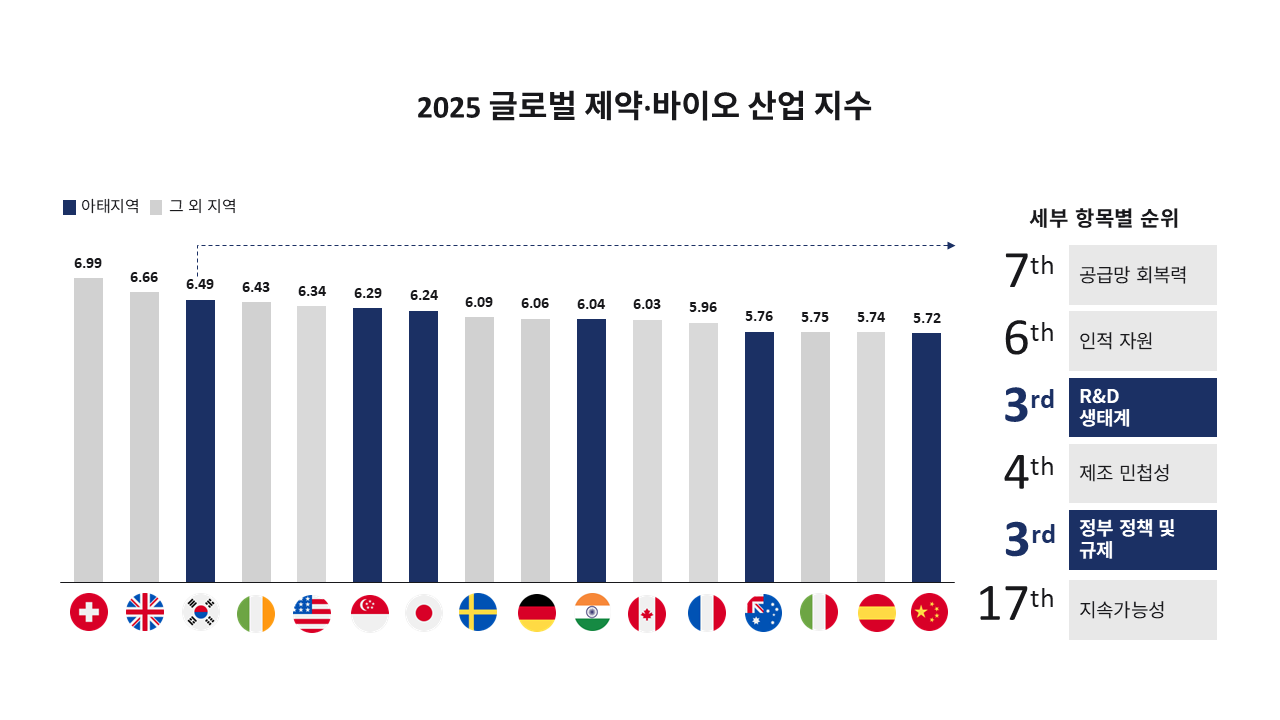

Korea’s pharma-bio index up 9 levels… No. 1 in Asia

President Joonho Choi, from head of Korea to head of Asia-Pacific

Launch coincides with establishment of “Cytiva Korea”

Opening of domestic manufacturing and training facility “Innovation Hub”

“Korea is a ‘full value chain hub’ spanning research, clinical, manufacturing and digital”

Korea’s pharma-bio index up 9 levels… No. 1 in Asia

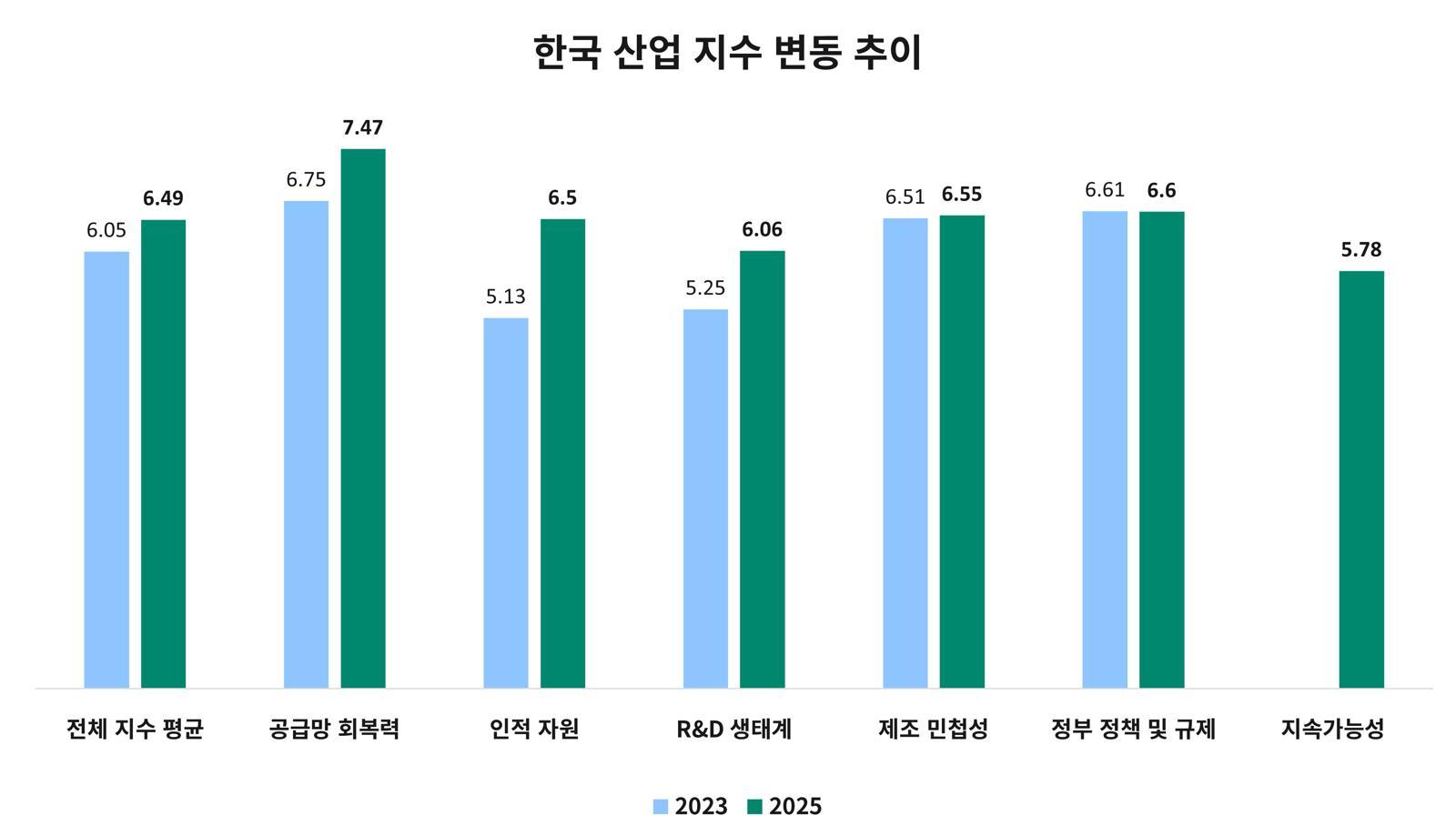

Choi Joon-ho, President of Cytiva Asia-Pacific

Cytiva, a global company that produces raw materials and components for biopharmaceuticals such as vaccines, is focusing on the Korean market. Following the opening of its domestic manufacturing facility, the ‘Innovation Hub,’ established through an investment of more than KRW 60 billion last year, the company recently appointed Choi Joon-ho, head of Cytiva Korea, as President for the Asia-Pacific (APAC) region. This effectively establishes Korea as a core base for Cytiva in Asia-Pacific. The strengthened status of the Korean market is also evident in the results of a survey that Cytiva publishes every two years. According to Cytiva, Korea’s global pharmaceutical and biotechnology industry index ranking rose nine places from 12th in 2023 to 3rd this year. The assessment is that Korea has moved beyond its past position as a fast follower to establish itself as a global market leader.

Cytiva is a specialized technology company that supports biopharmaceutical producers such as Samsung Biologics and Celltrion. It provides technologies and solutions including research equipment, consumables, process technologies, and software to enable efficient production of complex biopharmaceuticals. It is also the global No. 1 company in the field of bio materials, parts, and equipment.

Major products of Cytiva

The company name is a compound of CYTO, the Greek word for ‘cell,’ and the Latin suffix Iva, meaning ‘capable of.’ Its core corporate mission is to discover and accelerate therapies that are beneficial to humanity.Although Cytiva is a relatively young company launched in April 2020 when Danaher Corporation, headquartered in Washington, D.C., acquired the life sciences division of GE Healthcare, its roots trace back to Whatman Plc, which began in 1933 in the United Kingdom as a paper manufacturer. The company grew into a specialist brand in laboratory filtration products and separation technologies and then evolved into a global life sciences company. It possesses unrivaled technologies in filtration and purification that remove impurities from pharmaceutical ingredients and supplies systems and solutions for the manufacture of cell and gene therapies. Its long-standing spirit of innovative research is reflected in Cytiva’s technological and product capabilities. It is known that the majority (around 75%) of biopharmaceuticals approved by the U.S. Food and Drug Administration (FDA) have been developed based on Cytiva technologies. Numerous global products that are synonymous with protein purification, such as ÄKTA, as well as Amersham, Biacore, HyClone, Whatman, Xcellerex, and Xuri, are brands owned by Cytiva. The company operates in 40 countries worldwide and employs more than 16,000 people. It is also known that more than nine Nobel laureates have used Cytiva equipment. It holds a total of 5,192 technology patents (including applications).

Opening ceremony of Cytiva Korea Innovation Hub. Incheon Free Economic Zone Authority

Cytiva Korea was established around the same time as Cytiva’s launch. About 170 employees currently work there. Cytiva regards Korea as one of its three major global markets. It has also built a manufacturing facility in Songdo, Incheon, as a strategic base to respond to demand in Asia. This is Korea’s first integrated bio complex equipped with both a manufacturing facility and an education center, and full-scale product production is scheduled to begin in 2027. A Fast Trak center for nurturing bio talent is also in operation in Songdo, Incheon. The first Korean to move beyond serving as head of the local subsidiary of a life sciences company with over 100 years of history and to take command of management across the Asia-Pacific region, Choi Joon-ho, President of Cytiva Asia-Pacific, shared his views. The following is a Q&A.―This year your role expanded from Korea Country Manager to President for Asia-Pacific. What is the background and significance of this change?

“It is highly significant in that the performance and leadership accumulated in Korea have been recognized as capable of driving growth strategies at the regional level. I believe that the customer-centric execution demonstrated while leading the Korean organization, the operation of a collaboration-based organization, and experience in partnerships with government, industry, and academia have been acknowledged as a reference that can be commonly applied across various APAC countries. This expansion of my role is not a simple change in title but can be seen as the result of the company restructuring its leadership and decision-making framework to accelerate growth in Asia-Pacific. Based on my experience in Korea, I expect to align customers and organizations across multiple countries in a single direction and to organically connect growth opportunities that had been scattered by market. I also believe this reflects both the importance of the Korean market, which continues to grow and mature, and the intention to expand these growth drivers across the entire Asia-Pacific region.”

Choi Joon-ho, President of Cytiva Asia-Pacific

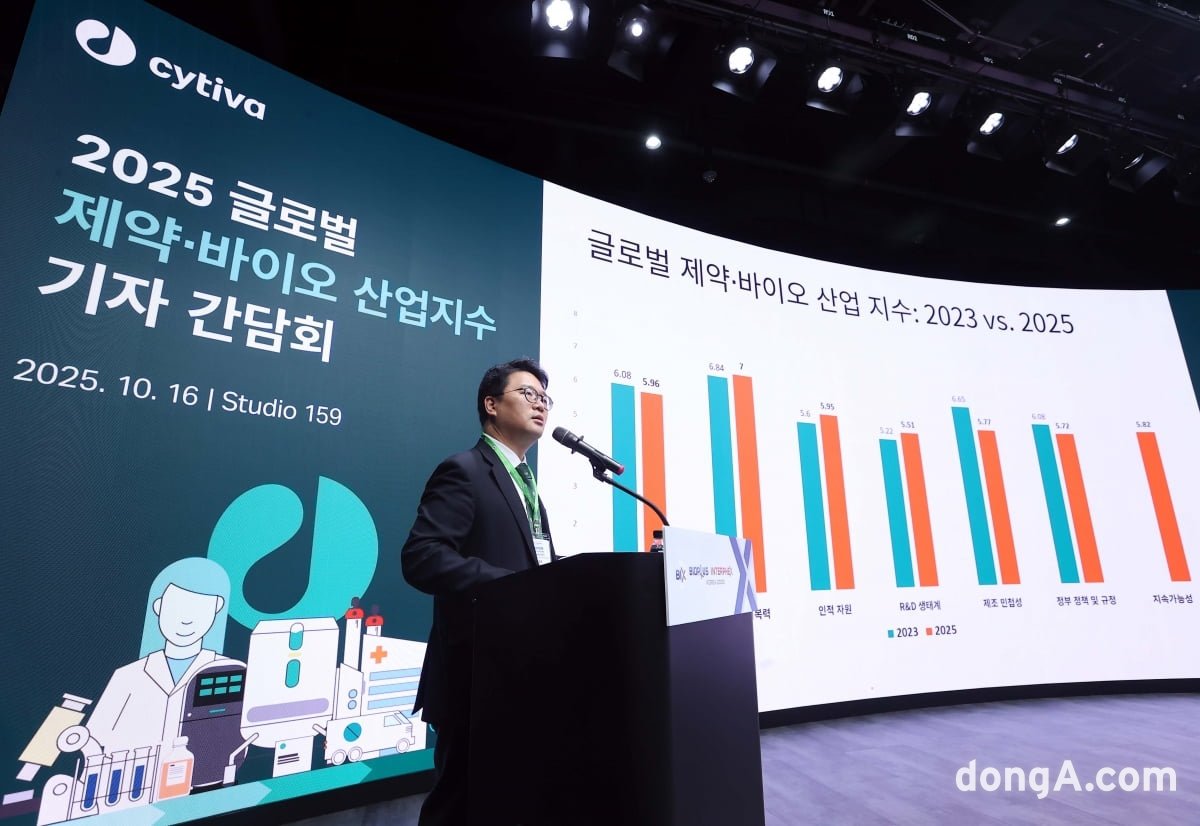

―Cytiva recently published the Cytiva 2025 Global Pharmaceutical and Biotechnology Industry Index. Could you introduce this index?“The ‘Cytiva Global Pharmaceutical and Biotechnology Industry Index (Cytiva Index)’ is an industry report published every two years by Cytiva, a global life sciences company, in collaboration with Longitude, a research firm under the Financial Times in the UK. It was first launched in 2021, and this year’s edition is the third. It is the industry’s only global regular report that derives country- and category-specific indices based on assessments by 1,250 executives and experts from major pharmaceutical and biotechnology companies in 22 countries worldwide. They evaluate six areas: △supply chain resilience △human resources △research and development (R&D) ecosystem △manufacturing agility △government policy and regulation △sustainability.”

―What are the key shifts in global competitive dynamics shown by the Cytiva Index?

“In the 2025 Index, the global average score declined slightly from 6.08 in 2023 to 5.96 this year. This shows that structural challenges remain substantial in areas such as talent, manufacturing agility, and the policy and regulatory environment even after the pandemic. Although supply chain resilience has improved, the gap between leading countries and the rest has widened, and shortages of skilled personnel and regulatory uncertainty have acted as major factors delaying investment and innovation decisions. The Index also shows that, in addition to factors such as market size, production scale, and supply chain stability, ‘qualitative capabilities’—including the use of digital technologies, regulatory innovation, and sustainability investment—are emerging as the core criteria that determine global competitiveness. Countries and companies that have enhanced approval success rates and product launch speed through process automation, data-driven decision-making, and the use of artificial intelligence (AI) are emerging as new leaders. How quickly such capabilities can be internalized will determine the future global landscape.”?

―What is the significance and background of Korea’s rise from 12th to 3rd place in the Cytiva 2025 Index?

“Korea climbed nine places from 12th in 2023 to 3rd in 2025, joining Switzerland and the UK in the top three. It was ranked No. 1 in Asia. The fact that it recorded the largest jump among the 22 countries suggests that Korea is moving beyond being a ‘fast follower’ and establishing itself as a ‘leader’ in the global pharmaceutical and biotechnology industry. The core drivers of this leap can be seen as qualitative improvements in human resources and the R&D ecosystem. Government policies to foster bio talent, close collaboration among academia, research institutes, and industry, increased R&D investment and integration of digital technologies, and stronger cooperation with CROs and CDMOs have combined to significantly enhance Korea’s pool of highly skilled personnel and its capacity to win global clinical trials. As a result, Korea is rapidly evolving into an integrated innovation hub that simultaneously possesses advanced manufacturing infrastructure, regulatory expertise, and digital production capabilities.”

Cytiva 2025 Pharmaceutical and Biotechnology Industry Index

―Within Cytiva’s Asia-Pacific strategy, what roles do major countries such as Korea, Japan, China, and those in Southeast Asia each play? What role do you expect from Korea in particular?“In Asia-Pacific, each country has different strengths and is at a different stage of development, so they play different roles within Cytiva’s APAC strategy. Japan and Singapore are markets with strong regulatory predictability and well-established public–private cooperation, and they play leading roles in high value-added R&D, complex manufacturing, and the co-design of new regulatory and business models. China and India, leveraging their large patient pools and production capabilities, are seen as markets for projects where economies of scale and speed are critical, while key Southeast Asian countries are viewed as markets building growth potential mainly through clinical trials, talent development, and process standardization. In Korea’s case, we expect it to serve as a ‘full value chain hub’ encompassing research, clinical development, manufacturing, and digital. Its leap to 3rd place in the 2025 Cytiva Index and ranking as No. 1 in Asia indicate that investments in digital innovation and strengthening talent and the R&D ecosystem are bearing fruit. Korea’s infrastructure, including Cytiva’s Songdo Innovation Hub, which is scheduled to begin operations in early 2027, can be seen as a pilot and reference market where new processes and technologies are first applied and then disseminated to major APAC countries. On this basis, we expect Korea to become the central axis that reinforces a connected ecosystem.”

Announcement of Cytiva 2025 Pharmaceutical and Biotechnology Industry Index

―Cytiva Korea has newly invested in the ‘Innovation Hub’ production facility in Songdo. What new roles and value will it provide to customers in Korea and across Asia?“The Cytiva Korea Innovation Hub aims to establish itself as an integrated hub designed so that state-of-the-art biopharmaceutical production and research, solution demonstrations, and training are all carried out in one space, with a manufacturing center that actually produces products at its core. Located in Songdo, Incheon, the facility covers approximately 6,100 square meters. Cytiva’s first domestic production base, the manufacturing center, is scheduled to begin operations in early 2027 and will produce products essential for biopharmaceutical development, such as filtration. Through this, we expect to establish a foundation for supplying products more quickly and flexibly to customers not only in Korea but also in the Asian bio market. Above all, we aim to reduce dependence on the global supply chain and provide the major advantage of shortening lead times. In addition, through a customer experience space, the facility will be operated as a venue where customers can directly experience the latest technologies through process demonstrations and product demos.”

―How is Cytiva responding to the rise of next-generation modalities such as cell and gene therapies and mRNA? Please include your views on collaboration with Korean customers.

“In areas such as cell and gene therapies and mRNA vaccines, where process standards have not yet been fully established, the most important role is to provide scalable platforms and reference processes from process development through to commercial production. Cytiva already has a portfolio that covers the entire value chain, including cell culture systems and single-use bags, purification resins, and process analytical solutions. Recently, we have introduced next-generation cell therapy manufacturing systems and continuous processing solutions to the Korean market. With Korean customers, we plan to jointly design next-generation process models and operating standards based on process demonstrations and technical support that will be implemented at the Innovation Hub. In particular, we are focusing on securing competitiveness that can extend from early development to commercial production and entry into overseas markets by incorporating process designs and quality and regulatory requirements that meet global standards from the earliest stages of development.”

Cytiva 2025 Pharmaceutical and Biotechnology Industry Index (Trend in Korea’s Index)

―What are Cytiva’s key priorities for next year and over the medium to long term?“Next year, we will focus on firmly establishing the investments already underway in Korea and the Asia-Pacific region and expanding joint development and process optimization projects with customers centered on the Songdo Innovation Hub. In particular, we plan to expand our support scope so that customers can work with a single partner from early development to commercial production by combining digital solutions, automation, and sustainable production models. Over the medium to long term, we intend to continue investing in talent development, regional partnerships, and regulatory and quality expertise, playing a role in fostering innovation ecosystems across APAC, including Korea.”

―You also serve as head of Danaher Korea Group, to which Cytiva belongs. What are the main focus areas and plans at the Danaher Korea Group level?

“Danaher will strengthen collaboration among its affiliates and develop employee capabilities based on active investment and engagement in the Korean market, thereby expanding its contribution to the Korean bio industry. Due to uncertainty in pharmaceutical tariff policies, reorganization of global supply chains, and intensifying competition to rapidly commercialize new technologies, Korean pharmaceutical and biotechnology companies are facing an environment that requires more complex and strategic responses than ever. Amid these changes, Danaher aims to be the most trusted partner, helping Korean companies achieve both technological innovation and market expansion so that they can leap forward as a bio hub in Asia.”

Kim Min-beom

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News