Autonomous Driving

U.S.-China Self-Driving Race Widens Gap, Korea Reboots

Dong-A Ilbo |

Updated 2025.12.29

Chung Euisun visits FortyTwoDot headquarters in Pangyo… directly test-drives vehicle equipped with ‘E2E technology’ that processes driving data for learning–decision–control

Tesla focuses R&D budget on a few models… Hyundai develops dozens of lineups in parallel

“We need a control tower to draw the overall picture”

Tesla focuses R&D budget on a few models… Hyundai develops dozens of lineups in parallel

“We need a control tower to draw the overall picture”

On the 24th, Hyundai Motor Group Chairman Chung Euisun personally boarded an IONIQ 6-based autonomous driving vehicle in the Pangyo area of Seongnam, Gyeonggi Province, to inspect the level of technology. Provided by Hyundai Motor Company

On the morning of the 24th, Christmas Eve, Hyundai Motor Group Chairman Chung Euisun made an unannounced visit to the headquarters of “42dot,” the core autonomous driving base in Pangyo Techno Valley in Seongnam, Gyeonggi Province. Chairman Chung personally test-drove an IONIQ 6-based autonomous vehicle around the Pangyo area. The test vehicle was equipped with “end-to-end (E2E)” technology developed by 42dot, a method in which AI learns the entire set of driving data and handles decision-making and control in a single process.It is precisely this E2E technology that has enabled Tesla to dominate the autonomous driving market, including the launch in November of its supervised Full Self-Driving (FSD) service in Korea. Videos showing Tesla vehicles driving smoothly even in Busan, a city notorious for rough driving, have drawn comments such as “The technology gap is not small.” With President Song Chang-hyeon, who oversaw the group’s Software-Defined Vehicle (SDV) strategy, stepping down earlier this month, a sense of crisis has intensified. Against this backdrop, Chairman Chung’s on-site inspection is being interpreted as a determination to reorganize the ranks ahead of the full-scale global autonomous driving competition set to begin next year.

● A disadvantageous fight burdened with ‘legacy baggage’

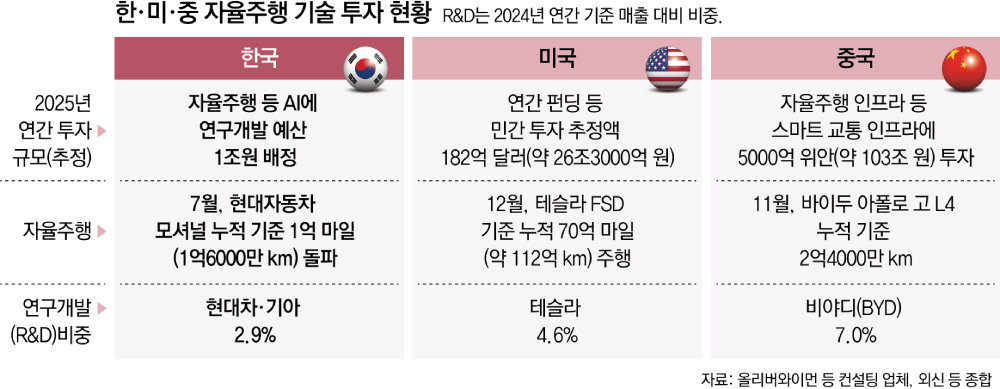

Baidu’s “Apollo Go” in China has also exceeded a cumulative 240 million km of Level 4 autonomous driving. Compared with Motional, the Hyundai Motor–Aptiv joint venture, which as of July had just passed 160 million km, the gap is clear. Given that driving data determines AI performance, this has significance beyond simple numbers.

Experts attribute this to the “legacy company dilemma.” In fact, last year’s R&D spending as a share of revenue was 2.9% for Hyundai Motor and Kia, 4.6% for Tesla, and 7.0% for BYD. While Tesla concentrated that R&D budget on a small number of models to advance AI and robotics, Hyundai Motor simultaneously developed dozens of lineups ranging from internal combustion engine vehicles to hydrogen cars. This structural constraint, which makes resource dispersion unavoidable, is translating into a technology gap. An executive at a domestic mobility company said, “There are few successful cases of legacy automakers transitioning to autonomous driving in the global automobile industry,” adding, “Hyundai Motor and Kia bear the burden of having to pursue existing internal combustion engine development and the transition to electrification and autonomous driving at the same time.”

● In 2025, will it become a pioneer rather than a follower?

In the autonomous vehicle market, a “fast follower” strategy does not work. Once a company secures an early lead and locks in customers, it is difficult to win them back. Tesla CEO Elon Musk’s plan to sell FSD software follows the same logic. The CEO of a domestic autonomous driving company, identified as A, warns, “Autonomous driving has strong OS characteristics like Windows or Android, so once users become accustomed to it, changing is almost impossible.”

The United States and China are already moving to preempt the market in their own ways. China announced an investment of 500 billion yuan (about KRW 103 trillion) in smart transportation infrastructure at the beginning of the year, while the United States is pouring in KRW 26.3 trillion annually through private funding of US$18.2 billion. In contrast, the R&D budget allocated by Korea’s Ministry of Science and ICT for AI, including autonomous driving, is only KRW 1 trillion.

To make matters worse, leadership in standardization is also vacant. The “SDV Standardization Council,” launched on 7 November with the participation of 65 companies including Hyundai Motor and Samsung Electronics and aiming to establish autonomous driving standards by 2026, lost its commander when its inaugural chair, President Song Chang-hyeon, resigned after just one month. At a time when essential standards such as software APIs and architectures must be established, the leadership needed to coordinate them has disappeared.

Jeong Gwang-bok, head of the Autonomous Driving Technology Development Innovation Project Group, which oversees cross-ministerial autonomous driving projects, said, “The Ministry of Trade, Industry and Energy is in charge of SDVs, the Ministry of Science and ICT handles data collection, and the Ministry of Land, Infrastructure and Transport is pursuing demonstration-focused projects,” adding, “Rather than proceeding by ministry as is currently the case, there should be a single control tower drawing the overall blueprint.”

Kim Jae-hyung; Choi Won-young

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News