Business / Commodity Market

Banks’ Gold Products Hit Record; Silver Sales Soar

Dong-A Ilbo |

Updated 2025.12.29

Gold and silver see strongest rally since 1979 this year

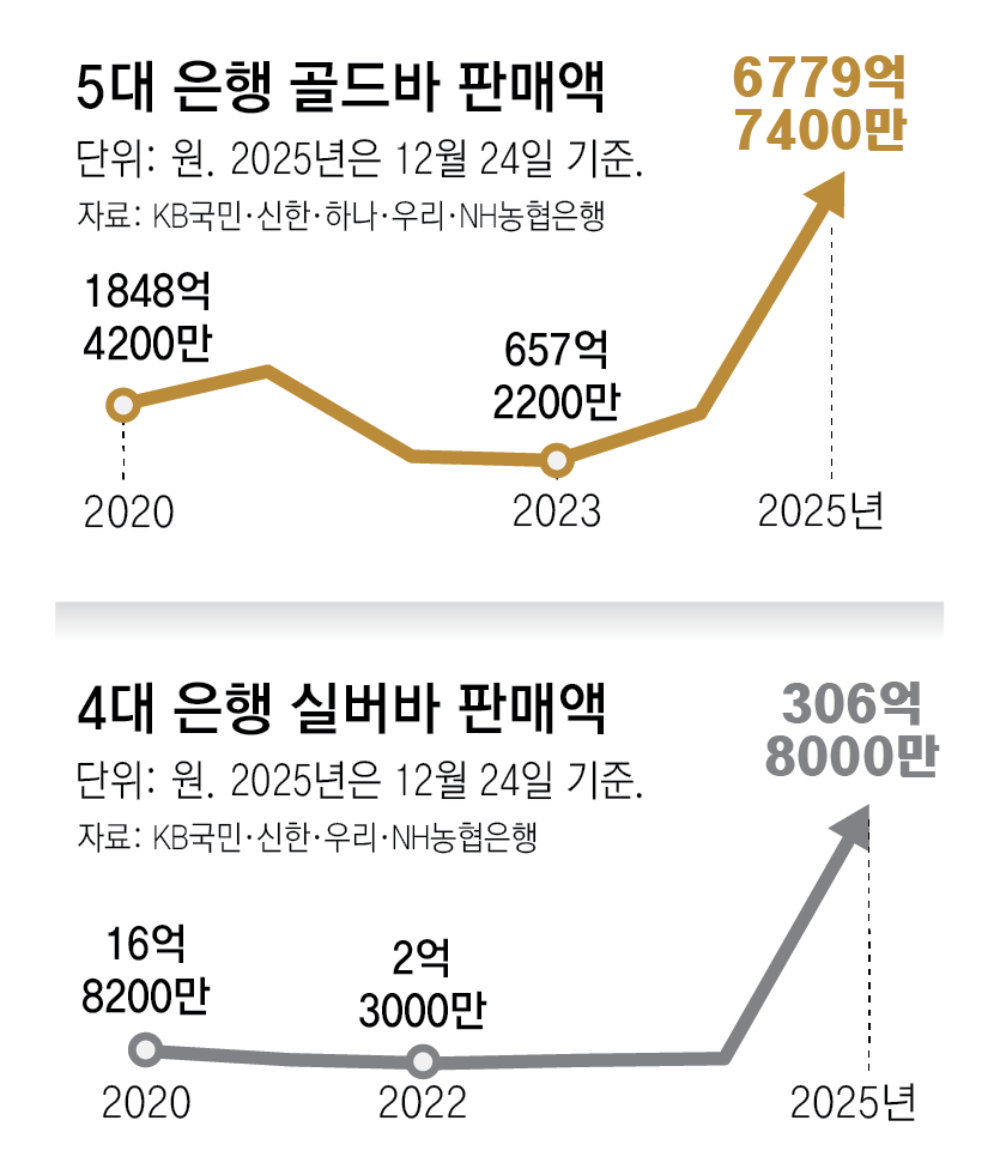

Gold bars worth KRW 677.9 billion sold at the five major banks

Silver bars even face shortages

Experts warn of high volatility in silver prices

Gold bars worth KRW 677.9 billion sold at the five major banks

Silver bars even face shortages

Experts warn of high volatility in silver prices

As prices of precious metals such as gold and silver hit all-time highs, gold bars and silver bars are displayed at a precious metals arcade in Jongno-gu, Seoul, on 25 December. 2025.12.25. Newsis

Office worker Mr. Kim (30), who opened a gold banking (gold passbook) account in September this year and began accumulating gold, now checks his account several times a day. He was anxious when gold prices fell, but as prices have recently broken through the ceiling again, his return has exceeded 5%. Kim said, “I believe it can rise further, so I plan to increase my holdings whenever there is a correction.”The sales value of gold bars and silver bars at major commercial banks and performance of gold banking products have been tallied as the highest since statistics began to be compiled. As economic uncertainty has increased recently and prices of gold and silver—classified as safe assets—have surged by about 70% and 150%, respectively, this year, marking the highest rate of increase in about 50 years, buying interest has also intensified in the domestic market.

● Silver bar sales value 38 times last year’s

Excluding NH NongHyup, which does not disclose weight information, gold bar sales volume at the remaining four banks also more than doubled in a year to 3,745 kilograms.

Silver bars have at times been in short supply. The four banks other than Hana Bank, which does not handle silver bars, recorded silver bar sales of KRW 30.68 billion this year, 38 times last year’s KRW 799 million. The banking sector believes that individual investors account for the majority of gold and silver bar sales volume.

Gold banking (gold passbook) products, which allow customers to save gold as if depositing money, have also set record highs this year. As of the 24th, Shinhan Bank’s “Gold Rich” product held balances of KRW 1.2979 trillion across a total of 187,859 accounts. According to Shinhan Bank, both the number of accounts and the balance are the highest since the product was launched in 2003. Compared with last year, the balance has increased about 2.4 times and the number of accounts is up 14%.

● ‘Santa rally’ in gold and silver prices boosts buying

The unprecedented enthusiasm for gold and silver investment has been driven largely by a surge in buying interest as international gold and silver prices repeatedly set new record highs. Since the start of this year, gold prices have risen about 70% and silver prices more than 150%, both marking the highest annual growth since 1979.

Year-end gold and silver prices continued to hit record highs, extending a Santa rally. According to Bloomberg, on 26 December (local time), the day after Christmas, international spot gold prices climbed as much as 1.2% intraday to exceed USD 4,530 per troy ounce (ounce, 31.1 g), surpassing the previous day’s intraday record high. Spot silver prices, meanwhile, rose for a fifth consecutive trading day and at one point gained as much as 4.6% intraday, surpassing USD 75 per ounce for the first time ever.

Experts are broadly optimistic about gold and silver prices but warn investors to be cautious about volatility. Lee Heung-doo, head of KB Kookmin Bank’s Seoul Forest PB Center, said, “If the U.S. maintains its rate-cutting stance, there is a possibility that prices will rise to higher levels than now,” but added, “In the case of silver, trading volume is relatively small and price volatility is high, so caution is needed when investing.”

Joo Hyun-woo

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News