Global Expansion

Samsung Biologics Secures US Base, Easing Tariff Risk

Dong-A Ilbo |

Updated 2025.12.23

Acquired GSK bioplant for KRW 413.6 billion

Preemptive move amid potential tariffs of up to 15%

U.S. biosafety law targeting China passed

Raising expectations for contract manufacturing windfall

Preemptive move amid potential tariffs of up to 15%

U.S. biosafety law targeting China passed

Raising expectations for contract manufacturing windfall

● Complete elimination of U.S. pharmaceutical tariff risk

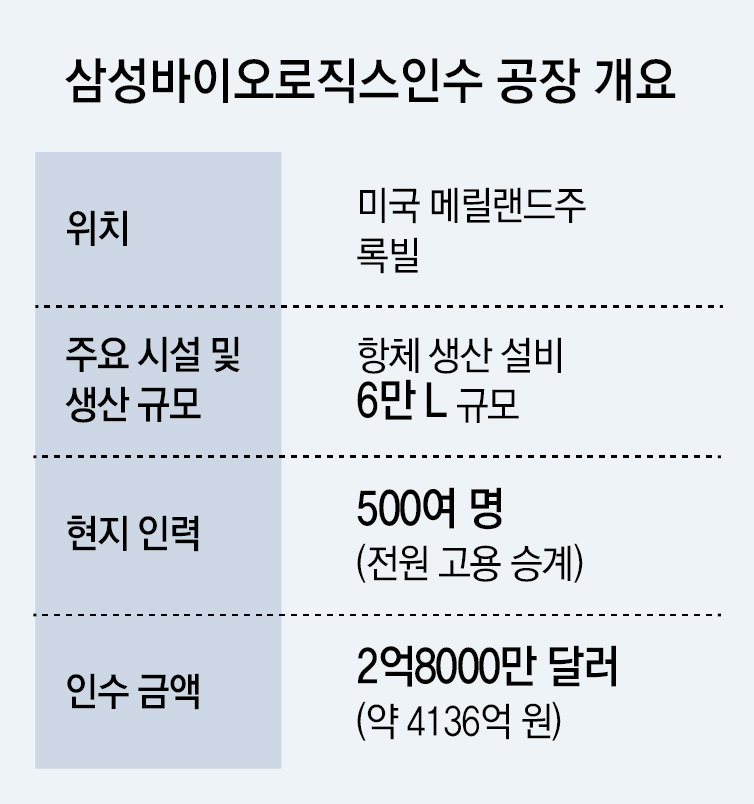

On the 22nd, Samsung Biologics announced that it had signed an agreement with global pharmaceutical company GlaxoSmithKline (GSK) to acquire Human Genome Sciences’ biopharmaceutical manufacturing facility in Rockville, Maryland, United States. The acquiring entity is Samsung Biologics America, the U.S. subsidiary of Samsung Biologics, and the acquisition price is USD 280 million (approximately KRW 413.6 billion). The facility is a drug substance manufacturing plant with a capacity of about 60,000 liters, and Samsung Biologics stated that it may invest in further capacity expansion, taking into account mid- to long-term demand and utilization levels. The acquisition process is expected to be completed in the first half of next year (January–June), with revenue from the plant likely to be reflected in results from the second half (July–December).

Previously, for the same reason, Celltrion also acquired Eli Lilly’s manufacturing plant in New Jersey in September this year for approximately KRW 460 billion and announced plans to invest an additional KRW 700 billion in expanding production facilities and related initiatives.

● Riding the tailwind of the Biosecurity Act to accelerate overseas expansion

The recent passage in the United States of the “Biosecurity Act” targeting China is also cited as a key factor behind Samsung Biologics’ decision to secure a production base in the U.S. On the 18th of this month (local time), U.S. President Donald Trump gave final approval to the National Defense Authorization Act, which includes the Biosecurity Act. The Biosecurity Act restricts transactions with biotech companies deemed to pose a threat to U.S. national security, effectively targeting Chinese gene analysis companies and contract development and manufacturing organizations (CDMOs) such as WuXi AppTec. The measure stems from concerns that outsourcing biopharmaceutical production to CDMOs could lead to the leakage of sensitive data and information.

With the implementation of the Biosecurity Act and the resulting exclusion of Chinese CDMO companies, competition is expected to intensify among companies in countries such as Korea, India, and Japan to capture the displaced volumes. In this environment, companies such as Samsung Biologics and Celltrion, which already operate manufacturing plants in the United States, are viewed as having a significant competitive advantage.

An official from the domestic bio industry said, “The Biosecurity Act could be a positive development for domestic companies that have established credibility in overseas markets,” adding, “However, since the U.S. government has recently been introducing various policies related to pharmaceuticals, including drug price cuts, it will be necessary to carefully calculate the overall cost-benefit balance.”

Choi Ji-won

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News