Global Expansion

Samsung Biologics Buys US Plant for KRW 413.6b

Dong-A Ilbo |

Updated 2025.12.22

Panoramic view of Samsung Biologics headquarters (courtesy of Samsung Biologics)

Samsung Biologics has moved to acquire a production plant in the United States and completely eliminate tariff-related uncertainties. On the 22nd, Samsung Biologics announced that it had signed an agreement with global pharmaceutical company GlaxoSmithKline (GSK) to acquire Human Genome Sciences’ biopharmaceutical manufacturing facility in Rockville, Maryland, in the United States. The acquiring entity is Samsung Biologics America, the U.S. subsidiary of Samsung Biologics, and the acquisition price is USD 280 million (approximately KRW 413.6 billion). The facility is an active pharmaceutical ingredient (API) manufacturing plant with a capacity of about 60,000 liters, and Samsung Biologics stated that, taking into account mid- to long-term demand and capacity utilization, it may also invest further to expand production capacity. The acquisition process is expected to be completed in the first half of next year (January–June), with revenue from the plant projected to be reflected in results from the second half (July–December).

The main reason behind Samsung Biologics’ large-scale investment is ongoing uncertainty surrounding U.S. pharmaceutical tariff policy. On November 13, the U.S. government released a joint factsheet from the Korea–U.S. summit, stating that South Korean pharmaceutical products would receive most-favored-nation (MFN) tariff treatment. As a result, tariffs of up to 15% are expected to apply. While this is lower than the previously mentioned 100% tariff, it could still pose a significant long-term burden for companies with a high export share.

Earlier, Celltrion, for the same reason, acquired Eli Lilly’s manufacturing plant in New Jersey in September this year for approximately KRW 460 billion and announced plans to invest an additional KRW 700 billion in expanding production facilities and related projects.

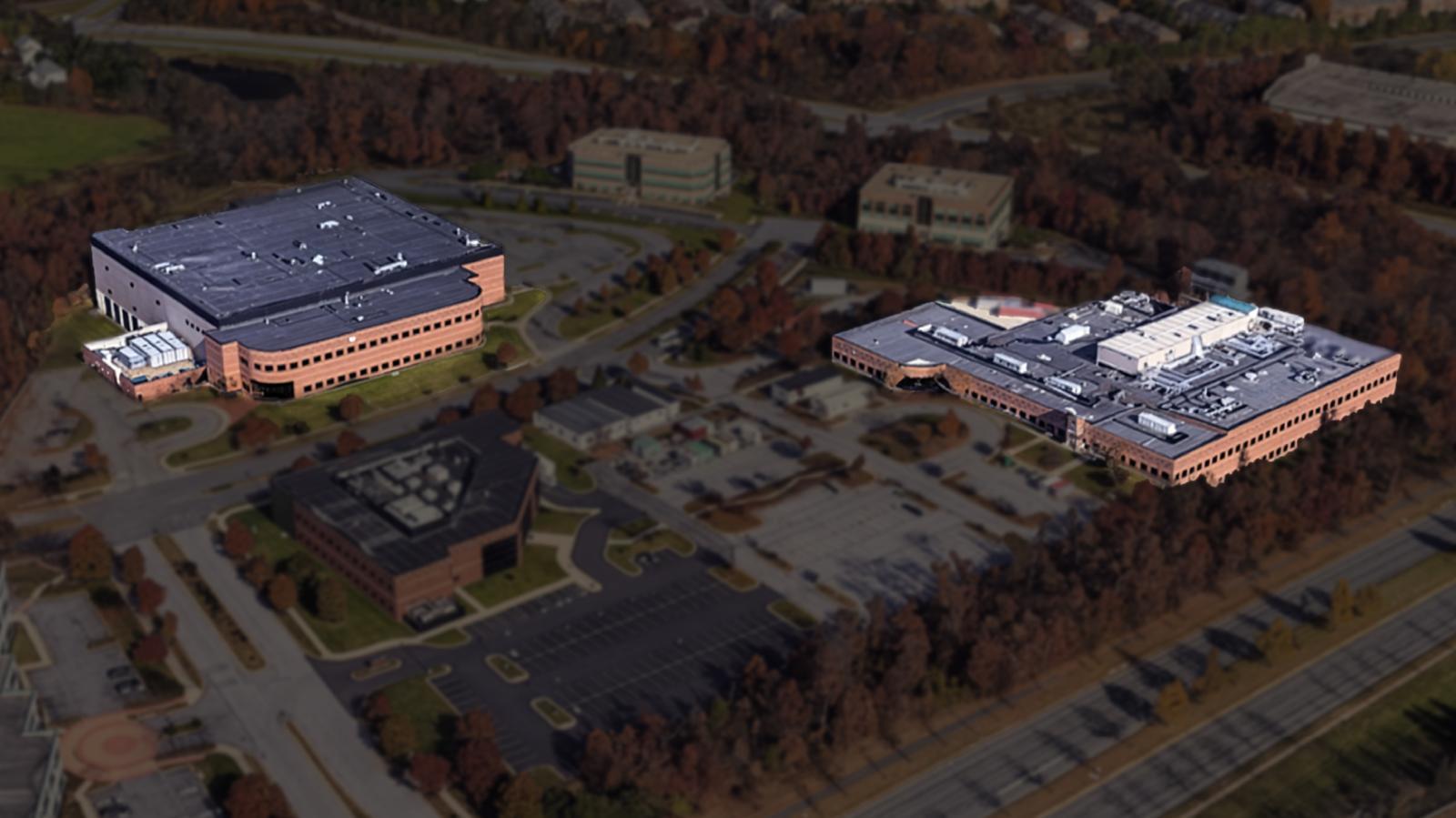

Panoramic view of Human Genome Sciences’ biopharmaceutical manufacturing facility in Rockville, Maryland, U.S. (photo courtesy of Samsung Biologics) 2025.12.22

Meanwhile, the recent passage in the U.S. of a biosecurity law targeting China is expected to generate windfall gains for domestic contract development and manufacturing organization (CDMO) companies, including Samsung Biologics. On the 18th of this month (local time), U.S. President Donald Trump gave final approval to the National Defense Authorization Act, which includes the biosecurity law. The biosecurity law restricts transactions with “countries of concern” biotech companies deemed to pose a threat to U.S. national security, effectively targeting Chinese genetic analysis firms and CDMO companies. Among them, there is a high likelihood that WuXi AppTec, a global CDMO player, will be included, and competition among companies from South Korea, India, Japan, and other countries is expected to intensify to capture China’s displaced production volumes. In this context, domestic CDMO firms such as Samsung Biologics, Celltrion, and Lotte Biologics—which already has a manufacturing plant in the U.S.—are seen as well positioned to demonstrate their competitiveness.

In addition, the recent continued rise in exchange rates is expected to be favorable for CDMO companies, which have a high proportion of API exports and contracts denominated in U.S. dollars. A representative of the domestic biotech industry said, “The biosecurity law could be a boon for domestic companies that have earned credibility in overseas markets,” adding, “However, since the U.S. government has recently been introducing various pharmaceutical-related policies such as drug price reductions, it will be necessary to carefully calculate the impact on profitability.”

Choi Ji-won

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News