AI Chip

Korean Chip Boom: Samsung, SK Eye KRW 200T Profit

Dong-A Ilbo |

Updated 2025.12.15

Brokerages keep raising next year’s forecasts

Memory shortage sends prices soaring… full-fledged supercycle boosts earnings outlook

Big Tech races to develop custom AI chips… “Samsung’s HBM shipments likely to triple next year”

Memory shortage sends prices soaring… full-fledged supercycle boosts earnings outlook

Big Tech races to develop custom AI chips… “Samsung’s HBM shipments likely to triple next year”

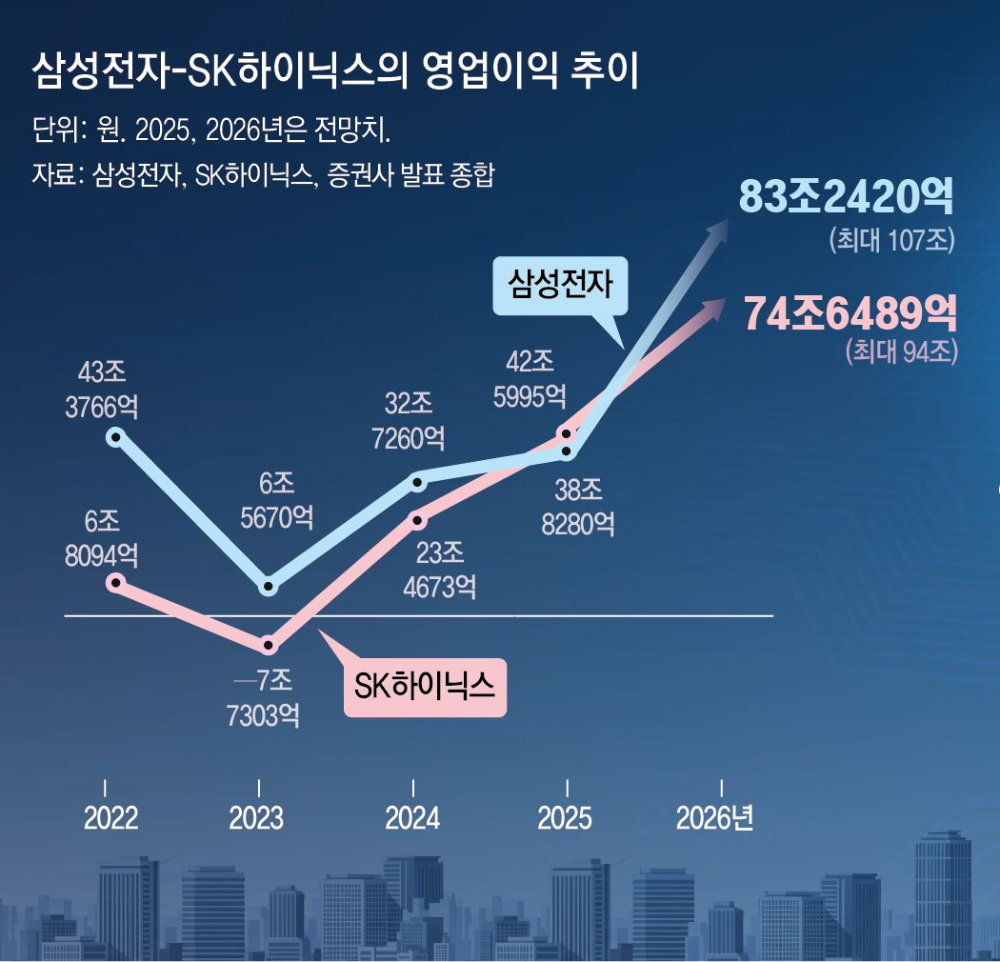

According to the securities industry on the 14th, Kiwoom Securities has raised its 2026 consolidated operating profit forecast for Samsung Electronics to KRW 107.6120 trillion. This is 29.3% higher than the existing market consensus (average of securities firms’ estimates over the past three months) of KRW 83.2420 trillion. iM Securities has raised its consolidated operating profit forecast for SK hynix for the same period to KRW 93.8430 trillion. Based on the most optimistic projections, the combined operating profit of the two companies would exceed KRW 200 trillion.

● Projection of “KRW 200 trillion operating profit”… DRAM as the top contributor

The memory semiconductor market, including commodity DRAM, is experiencing a deepening supply shortage, with supply unable to keep up with demand and prices soaring sharply. A major factor is cloud service providers that are building artificial intelligence (AI) data centers and aggressively securing memory. According to market research firm DRAMeXchange, the average price of standard PC DRAM products (DDR4 8Gb 1GX8) in November was USD 8.1, about six times higher than in January this year (USD 1.35).

Against this backdrop, attention in the securities market is focused on Samsung Electronics. Among the world’s top three memory companies — Samsung Electronics, SK hynix, and US-based Micron — Samsung has the largest production volume, and DRAM accounts for a high proportion of its sales. LS Securities stated, “While competitors will face a shortage of fab (factory) space next year, Samsung Electronics has sufficient space to expand DRAM production,” adding, “There is room for further earnings upgrades depending on memory prices.”

For SK hynix, where further production expansion is difficult, analysts expect profitability improvements to stand out more from price increases per product than from sales growth driven by higher shipment volumes. Hyundai Motor Securities forecast, “With prices of commodity DRAM also surging, SK hynix is highly likely to post the highest profitability among global DRAM vendors.”

● Expectations for diversification of HBM customers

The backdrop to the “record-breaking” earnings outlook for Korean memory semiconductor companies also includes the issue of global big tech firms developing customized AI chips in-house. As the application-specific integrated circuit (ASIC) market expands, driven by efforts to reduce reliance on Nvidia’s graphics processing units (GPUs), demand for high bandwidth memory (HBM) produced by Samsung Electronics and SK hynix is expected to increase significantly.

Google’s tensor processing unit (TPU) is a representative example. The TPU is the AI chip responsible for training and running Google’s AI model “Gemini 3.” OpenAI is also developing its own AI chips. Amazon Web Services (AWS) has developed “Trainium 3,” and Microsoft plans to launch its AI chip “Maia 200” next year.

Park Yoo-ak, senior research fellow at Kiwoom Securities, said, “Samsung Electronics, which has secured ASIC players as key customers, will see its HBM shipments in 2026 more than triple compared with this year,” adding, “In the first quarter of next year (January–March), sales of HBM applied to major ASIC chips will grow sharply, and in the second quarter (April–June), shipments of HBM4 to be mounted on Nvidia’s ‘Rubin’ will begin in earnest.”

Lee Min-a

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News