Global Expansion

Korea, Germany Duel Over KRW 60 Trillion Sub Deal

Dong-A Ilbo |

Updated 2025.12.15

Launching ceremony for the Jangbogo-III Batch-II first submarine, the “Jang Young-sil,” held at Hanwha Ocean’s Geoje Shipyard in Geoje, South Gyeongsang Province. Geoje=Park Hyeong-gi, Reporter onehsot@donga.com

After consecutive setbacks in naval and defense projects in Poland and Australia, South Korea is seeking to restore its pride as it prepares to bid for Canada’s submarine procurement program (CPSP), which is valued at up to KRW 60 trillion. The dominant view in the industry is that, given the difficulty of securing the outcome based on technological competitiveness alone, comprehensive government-level support must be added to secure a realistic chance of winning the contract.

In the case of Poland’s new submarine program, South Korea presented various proposals, including the free transfer of Jangbogo-class submarines, but ultimately failed. The cooperative framework within the European Union and Sweden’s “G2G package” are analyzed to have had a decisive impact. A similar result occurred last year in Australia’s next-generation frigate program. This is why there is growing criticism that technological strength and price competitiveness alone have clear limits in major defense procurement tenders.

The Jangbogo-III Batch-II submarine built by Hanwha Ocean. Hanwha Ocean

● South Korea and Germany shortlisted… Proposals due by 2 March next year

In November this year, the Canadian government selected South Korea and Germany as the final candidates for its submarine program and requested submission of proposals by 2 March next year. The planned procurement is estimated at a total of 8–12 submarines. Including long-term maintenance and operation costs, it is an ultra-large project worth about USD 60 billion (KRW 60 trillion). This is close to 10% of the South Korean government’s annual budget. As the preparation period is not long, a sophisticated response strategy is required for factors beyond technology and price.

The platform proposed by South Korea is the diesel-electric KSS-III Batch-II submarine. Its design features extended submerged endurance through the application of lithium-ion batteries. Industry assessments suggest it can operate for around three weeks (21 days) on extended missions. This implies that it may be able to meet Canada’s requirements for long-duration Arctic operations and emergency surfacing (ice breakthrough) capability.

Schedule competitiveness is also cited as a strength. Hanwha Ocean has presented a plan to deliver the lead submarine within six years of contract signing. Assuming a contract in 2026, it is known to have proposed a roadmap under which the first submarine would be delivered in 2032 and four submarines could be supplied by 2035, aligned with the retirement timeline of the four Victoria-class submarines. Thereafter, one submarine per year would be delivered up to the 12th unit, completing deliveries by 2043. This is evaluated as a competitive advantage in that it can minimize the capability gap that concerns the Royal Canadian Navy.

By contrast, Germany’s TKMS has proposed the Type 212CD, putting forward a 40–50 year long-term package that includes design, maintenance, and future development based on its joint program with Norway. The German government has already implemented a defense offset purchase of Canadian-made CMS-330 valued at about USD 1 billion, and is pursuing a strategy of expanding the industrial scope by combining this with proposals for cooperation on critical minerals and energy, as well as local production facilities. Canada’s NATO membership and the fact that Germany is Canada’s largest trading partner in Europe are also expected to work in Germany’s favor.

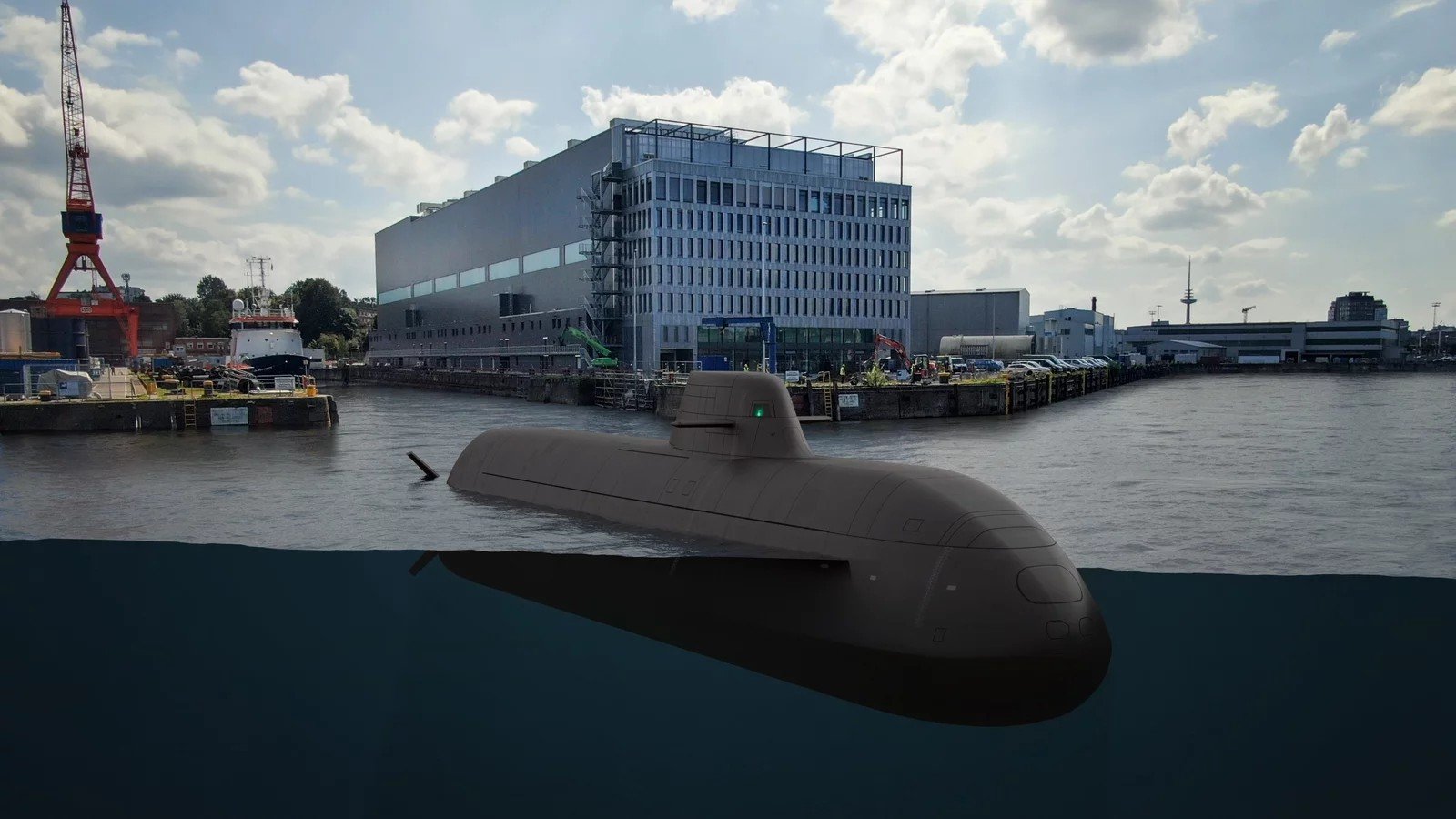

Image of a submarine by Germany’s Thyssenkrupp Marine Systems

● Evaluation of ‘national capabilities,’ not just technology… Analysis: “Government role will determine success or failure”

Canada views this program not merely as a means of acquiring submarines, but as an opportunity to build an economic, industrial, and security partnership that will last for decades. Innovation, Science and Economic Development Canada is making the scale of industrial and technological benefits (ITB), local investment, strategic industry cooperation, contribution to Arctic operations, and reduction of dependence on the United States key evaluation criteria. In other words, the structure is designed to determine “which country can design the future together with Canada,” going beyond a simple technological competition.

Given this nature of the project, industry opinion is that a whole-of-government response system led by the Office of the President is needed. It is assessed that the National Security Office, Policy Office, and Office of the Senior Secretary for Economic Affairs should form the core, while the Ministry of National Defense, Ministry of Foreign Affairs, Ministry of Trade, Industry and Energy, and Ministry of Economy and Finance move in concert to integrate financial support, fulfillment of offset requirements, industrial and technological cooperation, and consideration of local investment into a coherent strategy. Canada is also known to have recently continued to express interest in potential local investments by South Korean automobile and battery companies and in cooperation on Arctic operations.

An official in the defense industry said, “The fact that Hanwha Ocean has stably executed large-scale overseas projects helps build trust in its technology, but this program is difficult to secure based on technological and corporate capabilities alone,” adding, “How thoroughly a national strategic package is prepared will determine the actual likelihood of winning the contract.” The implication is that this is a program that compares and evaluates national capabilities rather than a simple technology contest.

After proposal submission, the Canadian government plans to conduct a comprehensive evaluation of technical suitability, industrial contribution, and diplomatic and security partnership, and to select a Preferred Bidder in late 2025 or early 2026. The goal is to conclude a final contract in 2026 following detailed design and financial negotiations.

The industry views this program as a turning point that will determine the level of trust in South Korea’s naval and defense industries. The project is considered highly symbolic as it represents an opportunity for a rebound after consecutive setbacks in Poland and Australia. Conversely, some warn that if South Korea loses out again, a perception may take hold that, despite strong technology, it lacks the capability to put together a comprehensive national package. This is why all-out, whole-of-government support is deemed crucial.

Hwang So-young

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News