Startup

Dongguk Campus Town 2025: Kira & Company’s Moneycare Solution

Dong-A Ilbo |

Updated 2025.08.21

[Dongguk University Campus Town X IT Donga] Dongguk University has been participating in the Seoul Campus Town project since 2022, creating a startup ecosystem in the northwestern urban area. By supporting deep-tech and cultural content startups, it was selected as an excellent case of startup nurturing for two consecutive years and received an A+ grade in the 2024 Seoul Campus Town performance evaluation. IT Donga introduces promising startups developing alongside Dongguk University Campus Town.

The financial and investment environment is changing daily, offering diverse opportunities for asset formation through investments. The problem is that financial education on various investment environments is not being properly conducted. The Ministry of National Defense plans to mandate economic education for military personnel starting in 2025, and the Ministry of Education will introduce a finance and economic life course for 11th graders in 2026. This contrasts with countries like the UK and Japan, where financial education is integrated into the curriculum, and the US, where 27 states mandate financial education as a high school graduation requirement.

Most people who enter society without proper financial education rely on luck for investments. They are also reluctant to purchase insurance products to protect themselves from risks, due to the perception that it's wasted money if nothing happens. Edu fintech startup Kira & Company is accelerating the development of services to innovate the limited domestic financial education.

Kira & Company envisions a 'Moneycare Solution' encompassing financial education and management. The goal is to help financial novices, who lack financial knowledge, make their own decisions and take action. Unlike fintech companies focusing on connecting various financial services and facilitating easy financial transactions, Kira & Company chose a different path. Why did they develop a service for financial novices? To find out, CEO Park Hyuk of Kira & Company was interviewed.

Socially disadvantaged cannot break the 'cycle of poverty' with education alone

"My great-grandmother, the late Yoon Hak-ja, was known as the mother of Korean orphans, laying the foundation for the Gongsaeng Welfare Foundation by caring for orphans during the Japanese occupation. My mother (Jung Ae-ri, President of the International Korean Adoptee Association) works for overseas adoptees. Naturally, I became interested in social welfare. I participated in the Language Bound project my mother promoted. Through this, I realized that education alone cannot break the cycle of poverty. Financial education is essential to understand the flow of money to break the cycle of poverty. I decided to start a business to address the difficulties of low-income groups and financial novices."

CEO Park Hyuk believes that while basic education is important, financial education is more crucial for achieving economic freedom, leading to the founding of Kira & Company. The motivation for starting the company came from participating in the Language Bound project as a student to assist with interpretation and translation.

The Language Bound project connects overseas adoptees, who returned to their homeland but struggled to find jobs due to language barriers, with low-income children lacking English education opportunities. Overseas adoptees become native-speaking teachers for the children. However, it was deemed structurally impossible for all low-income children to break the cycle of poverty within South Korea's education system.

"When asked why they want to become doctors, most answer it's because they can earn a lot of money, yet they dismiss financial education as materialistic. Money is at the core of all decision-making, but no one teaches how to earn and manage it properly. I think society is clinging to standardized entrance exams to solve the essence of economic stability."

CEO Park Hyuk judged that developing the ability to read the 'flow of money' is the key to overcoming the cycle of poverty. Understanding supply and demand and developing a sense of the flow of money through financial education is seen as the most essential capability for proactively designing one's life.

All-in on providing correct economic concepts to financial novices

CEO Park Hyuk earned a master's degree in finance from the London Business School and gained practical experience in the financial field while working as an accountant at PwC (PricewaterhouseCoopers) in the UK. He later solidified the business direction through volunteer financial education activities at local child centers in South Korea. While younger children showed interest in financial education, it was far from bringing about immediate change. Instead, it was noted that social workers and university student assistants who helped the children showed changes in their perception of finance.

"Social workers and university student assistants who listened to my financial classes over the shoulder said they gained confidence and started investing in stocks or digital assets. I thought that the most urgent and immediate target for financial education might actually be adults."

CEO Park Hyuk states that financial novices cannot be defined by age. There are elementary students who invest better than experts, while a 70-year-old who has lived all their life might suffer significant losses due to the Hong Kong ELS (Equity-Linked Securities) incident. He determined that the lack of financial autonomy limits economic stability and focused on building the 'KIRA' financial education platform for a wide age range.

KIRA plans to build a service that allows financial novices to gradually grow and develop financial autonomy through ▲diagnosis and learning ▲analysis and optimization ▲personal financial agent.

First, KIRA delivers financial knowledge through quizzes and surveys. Through the process of experiencing quizzes and surveys, users are led to realize what they know and don't know about finance. A mock investment feature is provided to encourage confidence before participating in the actual market. Kira & Company accumulates quantitative and qualitative data on users' financial understanding, investment tendencies, risk tolerance, and financial goals. CEO Park Hyuk describes this process as "a process of self-discovery through mock exams."

Once sufficient data is accumulated, Kira & Company plans to expand services to include user financial product diagnosis and AI financial agents (automation). In addition to analyzing whether users' financial products (insurance, pensions, etc.) are optimal for them, it will provide financial management and investment advisory services. CEO Park Hyuk stated, "KIRA's goal is to democratize private banking. We want to provide services enjoyed by the top 5% of asset holders to the remaining 95% of the public, resolving the rich-get-richer, poor-get-poorer phenomenon caused by information asymmetry."

The distinguishing feature of the KIRA service is its focus on 'Edu-Fintech' itself, unlike other services. While most financial services prioritize functions like financial product sales or remittances, KIRA prioritizes education.

"The members of Kira & Company are more sincere about financial education than any other team. When you launch the KIRA app, a quiz appears on the first screen. Would a fintech service really try to understand customer tendencies? Is the goal to guide users to become proper financial agents? Kira & Company wants to understand customers and enable them to enjoy economic freedom through proper education and guidance. We believe our purpose is fundamentally different from other services."

Aiming to be a Moneycare Solution growing with financial novices

Despite being a startup established in May 2025, Kira & Company is accelerating its growth. It surpassed 5,000 subscribers within a month of launching the Apple iOS app, a notable achievement even without an app for the Android operating system, which accounts for over 70% of the domestic market. An unexpected result was that 25% of subscribers were over 40, despite expectations that the service would attract mostly those in their 20s and 30s. This reflects CEO Park Hyuk's belief that financial education is needed across various age groups. Being selected for Kyobo Life's open innovation within three months of its founding is also considered an achievement. The Kyobo Life open innovation program is expected to be a turning point for Kira & Company as it demonstrates personalized financial product analysis and recommendation functions, advancing towards its long-term goals.

While Kira & Company is growing step by step, it also faces challenges for sustainable growth. Despite advocating for the necessity of financial education across the domestic financial market, the related market remains small. CEO Park Hyuk plans to overcome this limitation by collaborating with institutions that need financial education through a B2B2C (Business-to-Business-to-Consumer) model, in addition to securing service subscribers.

The Ministry of National Defense and the Ministry of Education, which are considering or planning to expand financial education, are recent targets. The Ministry of National Defense is pushing to mandate financial education for soldiers starting in 2025. However, it is difficult to reach military bases with low accessibility, such as those on the front lines or in remote areas. Kira & Company emphasized that it could provide digital-based financial education content, leveraging the fact that soldiers use smartphones. The same applies to financial education included in the high school curriculum in 2026. By providing digital pension education programs to companies, it plans to help employees prepare for retirement and secure a stable user base. CEO Park Hyuk expressed his ambition for KIRA to become part of South Korea's financial education infrastructure, beyond just a financial education service.

Kira & Company was recognized for the potential and achievements of its financial education service and was selected as a resident company of Dongguk University Campus Town in 2025. Dongguk University provided various mentoring programs for stable growth and supported open innovation in the financial sector. It also supported market development through introductions by the Platform Association's mentors. It even created investment opportunities by inviting representatives from venture capital firm Primer. CEO Park Hyuk stated, "We received help in all aspects of business operations, including administration and management, through Dongguk University Campus Town. The advice we received greatly helped in setting the direction for Kira & Company."

"Just as my great-grandmother was interested in the growth of orphans and my mother in the lives of adoptees, Kira & Company is interested in the growth of its customers. Kira & Company hopes that financial novices will enjoy economic freedom and prosperity. If individuals grow through the KIRA service, the company will naturally grow as well. We will strive to make our dream a reality, not just as a financial education platform but as a Moneycare Solution."

CEO Park Hyuk plans to focus on developing a Moneycare Solution that helps financial novices make their own judgments and actions. The goal is to enhance the platform's completeness by verifying the potential for user financial product diagnosis and financial agent development through the Kyobo Life open innovation program. KIRA service will also be made available on various devices to expand the number of subscribers.

IT Donga Reporter Kang Hyung-seok (redbk@itdonga.com)

The financial and investment environment is changing daily, offering diverse opportunities for asset formation through investments. The problem is that financial education on various investment environments is not being properly conducted. The Ministry of National Defense plans to mandate economic education for military personnel starting in 2025, and the Ministry of Education will introduce a finance and economic life course for 11th graders in 2026. This contrasts with countries like the UK and Japan, where financial education is integrated into the curriculum, and the US, where 27 states mandate financial education as a high school graduation requirement.

Most people who enter society without proper financial education rely on luck for investments. They are also reluctant to purchase insurance products to protect themselves from risks, due to the perception that it's wasted money if nothing happens. Edu fintech startup Kira & Company is accelerating the development of services to innovate the limited domestic financial education.

Park Hyuk, CEO of Kira & Company / Source=IT Donga

Kira & Company envisions a 'Moneycare Solution' encompassing financial education and management. The goal is to help financial novices, who lack financial knowledge, make their own decisions and take action. Unlike fintech companies focusing on connecting various financial services and facilitating easy financial transactions, Kira & Company chose a different path. Why did they develop a service for financial novices? To find out, CEO Park Hyuk of Kira & Company was interviewed.

Socially disadvantaged cannot break the 'cycle of poverty' with education alone

"My great-grandmother, the late Yoon Hak-ja, was known as the mother of Korean orphans, laying the foundation for the Gongsaeng Welfare Foundation by caring for orphans during the Japanese occupation. My mother (Jung Ae-ri, President of the International Korean Adoptee Association) works for overseas adoptees. Naturally, I became interested in social welfare. I participated in the Language Bound project my mother promoted. Through this, I realized that education alone cannot break the cycle of poverty. Financial education is essential to understand the flow of money to break the cycle of poverty. I decided to start a business to address the difficulties of low-income groups and financial novices."

CEO Park Hyuk believes that while basic education is important, financial education is more crucial for achieving economic freedom, leading to the founding of Kira & Company. The motivation for starting the company came from participating in the Language Bound project as a student to assist with interpretation and translation.

CEO Park Hyuk dreamed of founding Kira & Company while participating in the Language Bound project / Source=Kira & Company

The Language Bound project connects overseas adoptees, who returned to their homeland but struggled to find jobs due to language barriers, with low-income children lacking English education opportunities. Overseas adoptees become native-speaking teachers for the children. However, it was deemed structurally impossible for all low-income children to break the cycle of poverty within South Korea's education system.

"When asked why they want to become doctors, most answer it's because they can earn a lot of money, yet they dismiss financial education as materialistic. Money is at the core of all decision-making, but no one teaches how to earn and manage it properly. I think society is clinging to standardized entrance exams to solve the essence of economic stability."

CEO Park Hyuk judged that developing the ability to read the 'flow of money' is the key to overcoming the cycle of poverty. Understanding supply and demand and developing a sense of the flow of money through financial education is seen as the most essential capability for proactively designing one's life.

All-in on providing correct economic concepts to financial novices

CEO Park Hyuk earned a master's degree in finance from the London Business School and gained practical experience in the financial field while working as an accountant at PwC (PricewaterhouseCoopers) in the UK. He later solidified the business direction through volunteer financial education activities at local child centers in South Korea. While younger children showed interest in financial education, it was far from bringing about immediate change. Instead, it was noted that social workers and university student assistants who helped the children showed changes in their perception of finance.

"Social workers and university student assistants who listened to my financial classes over the shoulder said they gained confidence and started investing in stocks or digital assets. I thought that the most urgent and immediate target for financial education might actually be adults."

CEO Park Hyuk during a volunteer financial education class at a local child center / Source=Kira & Company

CEO Park Hyuk states that financial novices cannot be defined by age. There are elementary students who invest better than experts, while a 70-year-old who has lived all their life might suffer significant losses due to the Hong Kong ELS (Equity-Linked Securities) incident. He determined that the lack of financial autonomy limits economic stability and focused on building the 'KIRA' financial education platform for a wide age range.

KIRA plans to build a service that allows financial novices to gradually grow and develop financial autonomy through ▲diagnosis and learning ▲analysis and optimization ▲personal financial agent.

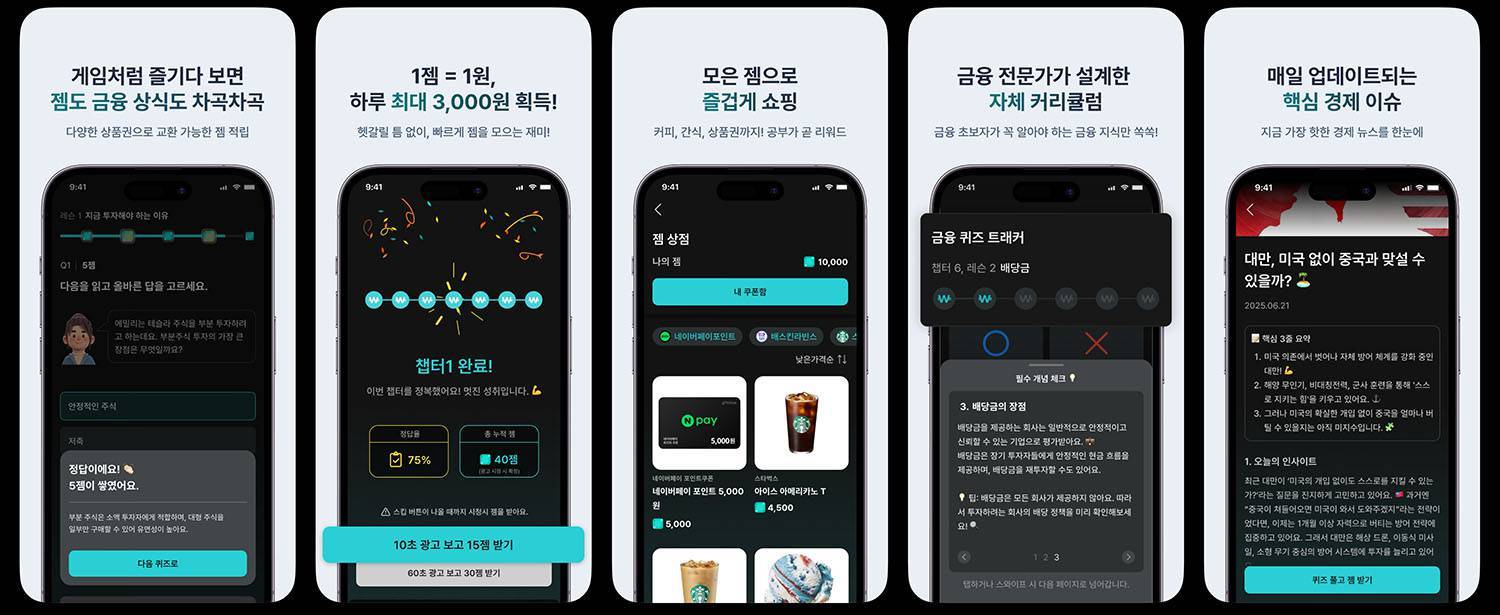

KIRA delivers financial knowledge through quizzes and surveys. It plans to expand services to user financial product diagnosis and financial agents / Source=IT Donga

First, KIRA delivers financial knowledge through quizzes and surveys. Through the process of experiencing quizzes and surveys, users are led to realize what they know and don't know about finance. A mock investment feature is provided to encourage confidence before participating in the actual market. Kira & Company accumulates quantitative and qualitative data on users' financial understanding, investment tendencies, risk tolerance, and financial goals. CEO Park Hyuk describes this process as "a process of self-discovery through mock exams."

Once sufficient data is accumulated, Kira & Company plans to expand services to include user financial product diagnosis and AI financial agents (automation). In addition to analyzing whether users' financial products (insurance, pensions, etc.) are optimal for them, it will provide financial management and investment advisory services. CEO Park Hyuk stated, "KIRA's goal is to democratize private banking. We want to provide services enjoyed by the top 5% of asset holders to the remaining 95% of the public, resolving the rich-get-richer, poor-get-poorer phenomenon caused by information asymmetry."

The distinguishing feature of the KIRA service is its focus on 'Edu-Fintech' itself, unlike other services. While most financial services prioritize functions like financial product sales or remittances, KIRA prioritizes education.

"The members of Kira & Company are more sincere about financial education than any other team. When you launch the KIRA app, a quiz appears on the first screen. Would a fintech service really try to understand customer tendencies? Is the goal to guide users to become proper financial agents? Kira & Company wants to understand customers and enable them to enjoy economic freedom through proper education and guidance. We believe our purpose is fundamentally different from other services."

Aiming to be a Moneycare Solution growing with financial novices

Despite being a startup established in May 2025, Kira & Company is accelerating its growth. It surpassed 5,000 subscribers within a month of launching the Apple iOS app, a notable achievement even without an app for the Android operating system, which accounts for over 70% of the domestic market. An unexpected result was that 25% of subscribers were over 40, despite expectations that the service would attract mostly those in their 20s and 30s. This reflects CEO Park Hyuk's belief that financial education is needed across various age groups. Being selected for Kyobo Life's open innovation within three months of its founding is also considered an achievement. The Kyobo Life open innovation program is expected to be a turning point for Kira & Company as it demonstrates personalized financial product analysis and recommendation functions, advancing towards its long-term goals.

While Kira & Company is growing step by step, it also faces challenges for sustainable growth. Despite advocating for the necessity of financial education across the domestic financial market, the related market remains small. CEO Park Hyuk plans to overcome this limitation by collaborating with institutions that need financial education through a B2B2C (Business-to-Business-to-Consumer) model, in addition to securing service subscribers.

The Ministry of National Defense and the Ministry of Education, which are considering or planning to expand financial education, are recent targets. The Ministry of National Defense is pushing to mandate financial education for soldiers starting in 2025. However, it is difficult to reach military bases with low accessibility, such as those on the front lines or in remote areas. Kira & Company emphasized that it could provide digital-based financial education content, leveraging the fact that soldiers use smartphones. The same applies to financial education included in the high school curriculum in 2026. By providing digital pension education programs to companies, it plans to help employees prepare for retirement and secure a stable user base. CEO Park Hyuk expressed his ambition for KIRA to become part of South Korea's financial education infrastructure, beyond just a financial education service.

Kira & Company was recognized for the potential and achievements of its financial education service and was selected as a resident company of Dongguk University Campus Town in 2025. Dongguk University provided various mentoring programs for stable growth and supported open innovation in the financial sector. It also supported market development through introductions by the Platform Association's mentors. It even created investment opportunities by inviting representatives from venture capital firm Primer. CEO Park Hyuk stated, "We received help in all aspects of business operations, including administration and management, through Dongguk University Campus Town. The advice we received greatly helped in setting the direction for Kira & Company."

Park Hyuk, CEO of Kira & Company / Source=IT Donga

"Just as my great-grandmother was interested in the growth of orphans and my mother in the lives of adoptees, Kira & Company is interested in the growth of its customers. Kira & Company hopes that financial novices will enjoy economic freedom and prosperity. If individuals grow through the KIRA service, the company will naturally grow as well. We will strive to make our dream a reality, not just as a financial education platform but as a Moneycare Solution."

CEO Park Hyuk plans to focus on developing a Moneycare Solution that helps financial novices make their own judgments and actions. The goal is to enhance the platform's completeness by verifying the potential for user financial product diagnosis and financial agent development through the Kyobo Life open innovation program. KIRA service will also be made available on various devices to expand the number of subscribers.

IT Donga Reporter Kang Hyung-seok (redbk@itdonga.com)

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News