Business / Commodity Market

Silver Tops $60 an Ounce for First Time

Dong-A Ilbo |

Updated 2025.12.11

Lower rate expectations spur precious metal demand

Essential material for AI chips, EVs, and more

“Better stock up now” — investor sentiment heats up

BIS warns of “bubble signs” amid overheating

Essential material for AI chips, EVs, and more

“Better stock up now” — investor sentiment heats up

BIS warns of “bubble signs” amid overheating

An employee displays silver bars at Korea Gold Exchange in Jongno-gu, Seoul. 2025.9.2 News1

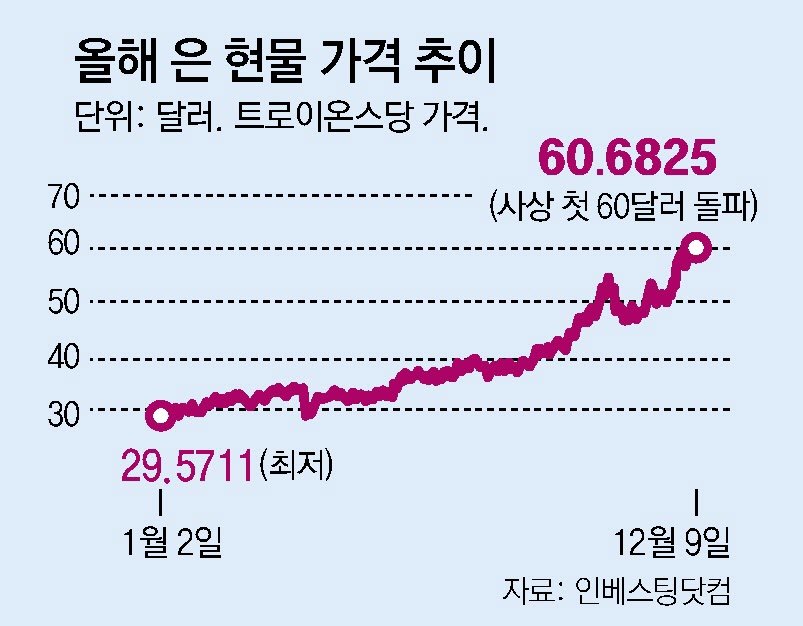

The price of silver has surpassed USD 60 (about KRW 88,000) per troy ounce (approximately 31.1 g) for the first time in history. Expectations of interest rate cuts in the United States combined with a surge in demand have driven silver prices to more than double this year alone, continuing a historic rally.

According to Bloomberg News in the United States on the 9th (local time), spot silver was trading at USD 60.8 per troy ounce, up 4.5% from the previous day. Silver prices have for the first time in history broken through the USD 60 per troy ounce level. Based on data from financial information platform Investing.com, silver, which was at USD 28.9 per troy ounce at the end of last year, has risen 110.2% so far this year.

The sharp rise in silver prices is underpinned by expectations of a benchmark interest rate cut by the US Federal Reserve (Fed). Market expectations that the Federal Open Market Committee (FOMC), which sets interest rates, will lower the benchmark rate by 0.25 percentage point on the 10th (local time) have been priced in. Typically, when interest rates fall, the investment appeal of bonds and bank deposits declines, and demand shifts into precious metals such as gold and silver.

Rising industrial demand has also fueled the increase in silver prices. Silver is a material widely used in advanced industries such as artificial intelligence (AI) semiconductors, electric vehicles, and solar power. In this regard, the Washington Post in the United States noted that “over the past four years, industrial demand for silver has surged by about 18%.”

In addition, India, the world’s second-largest silver investment market, has further stimulated investment demand as its central bank recently officially allowed silver-backed loans. Expectations that the United States government may soon impose tariffs on silver, which it has designated as a critical mineral, have led to increased stockpiling demand.

However, global silver production from mines this year is expected to reach only 813 million troy ounces, slightly below the annual output in 2021.

Some observers forecast that the upward trend in silver prices will be difficult to halt for the time being. Robert Kiyosaki, author of the bestseller “Rich Dad Poor Dad,” stated on his social media on the 23rd of last month that “silver prices will soon reach USD 70 and could rise to USD 200 by 2026,” adding, “Now is the time to buy more gold, silver, Bitcoin, and Ethereum, and among these, silver is the best and the safest.”

However, warnings have also emerged that recent asset price gains are overheating. The Bank for International Settlements (BIS) said in its quarterly report released on the 8th (local time), “This is the first time in 50 years that gold and equities have simultaneously entered bubble territory,” pointing out that “both gold and US stocks are showing signs of a bubble, such as speculative frenzy and surging valuations.” Mike McGlone, chief market strategist at Bloomberg Intelligence, also commented that the rally in silver prices is “somewhat unsettling,” and observed that “given the high volatility, prices could rise to USD 75 per ounce or fall to USD 40.”

Han Jae-hui

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News