IT / Semiconductor

Samsung-SK See Semiconductor Demand Surge Beyond HBM

Dong-A Ilbo |

Updated 2025.12.08

PC companies raise prices and secure inventory

Smartphone industry reflects rising component costs

Shortage of general-purpose memory for PCs and smartphones

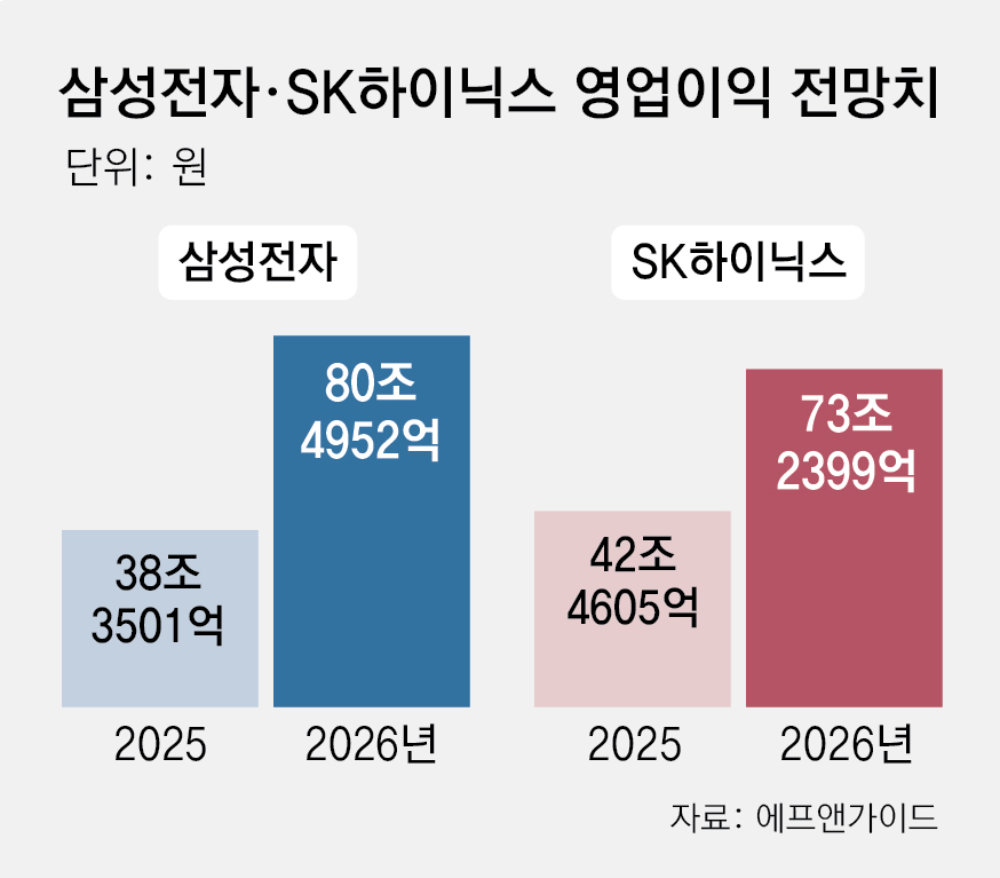

Samsung and SK projected to reach peak operating profits next year

Smartphone industry reflects rising component costs

Shortage of general-purpose memory for PCs and smartphones

Samsung and SK projected to reach peak operating profits next year

Samsung Electronics' general-purpose DRAM product, Double Data Rate (DDR)5. Provided by Samsung Electronics

The memory semiconductor shortage triggered by the artificial intelligence (AI) industry is extending to electronic products such as PCs and smartphones, leading to expectations that Samsung Electronics and SK Hynix will enjoy a 'special boom' next year. This is due to the intensified supply shortage not only of advanced memory like High Bandwidth Memory (HBM) but also of general-purpose products widely used in the information technology (IT) sector. There are also forecasts that both companies will achieve record-high performances next year.● Price Increases for PCs and Smartphones

Enrique Lores, CEO of HP, stated in an interview with Bloomberg at the end of last month, "The second half of next year (July-December) is expected to be particularly difficult in terms of semiconductor supply," and "if necessary, product prices will be increased." It is reported that memory semiconductors account for about 15% of PC costs.

The smartphone industry, which also has high demand for memory semiconductors, is facing increased pressure due to rising component costs. China's Xiaomi priced its flagship smartphone 'Redmi K90 Pro Max' about 8% higher than its predecessor when it was launched in October. Xiaomi CEO Lei Jun said at the time, "The cost pressure is severe, and it inevitably had to be reflected in the new product prices." Smartphone companies like Samsung Electronics and Apple are deeply considering how much of the component cost increase to reflect in next year's new products. An industry insider stated, "There is a significant price burden on components overall, including memory, application processors (AP), and cameras."

● Samsung and SK Expected to Achieve Record Profits Next Year

Until now, memory semiconductors have seen a surge in demand centered around HBM sought by AI big tech companies. However, as AI development spreads across the IT industry, demand from not only big tech but also general companies has increased. This is for memory semiconductors for general server replacement or upgrades.

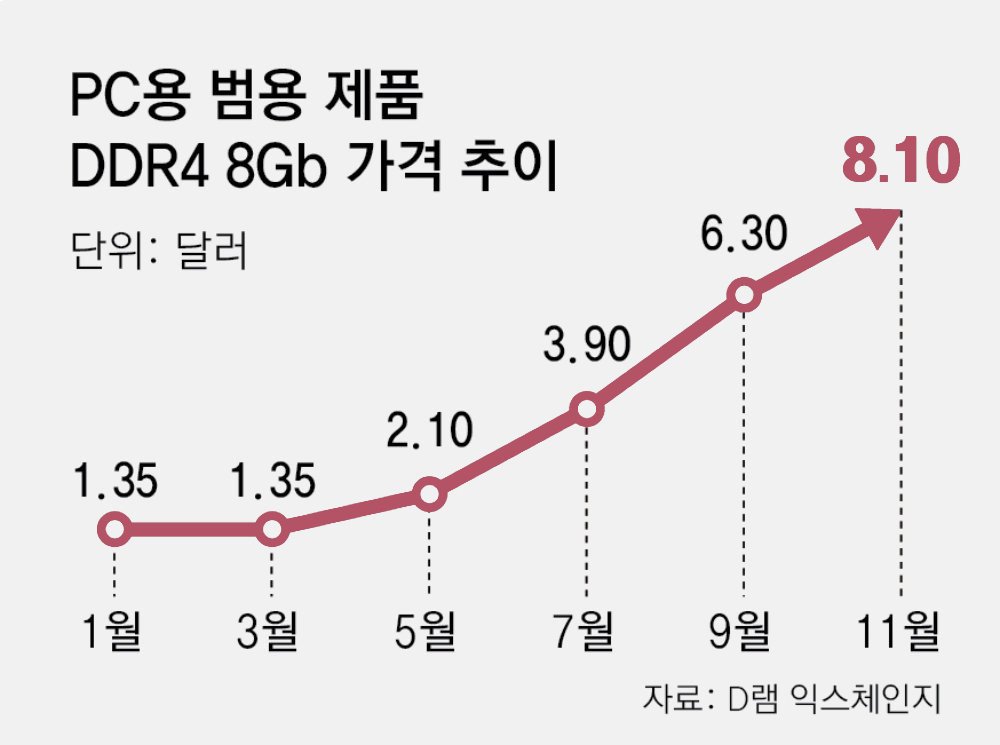

General-purpose memory like Double Data Rate (DDR)5 is mainly used in general servers. Unlike custom-made HBM, general-purpose memory like DDR5 is mass-produced by suppliers and traded as needed by consumers. As Samsung Electronics and SK Hynix expanded production lines focused on HBM, the supply of existing general-purpose products has decreased. For example, the price of a PC product (8Gb) of the previous generation DDR4 was USD 8.10 as of the end of November, a sixfold increase from early this year (USD 1.35).

Noh Geun-chang, a researcher at Hyundai Motor Securities, predicted, "Allocating limited DRAM production infrastructure to HBM and server lines is leading to a supply shortage for PC and mobile products," and "such severe (memory) supply shortages will continue until the first half of next year (January-June)."

Park Hyun-ik

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News