Business / K-Beauty Industry

Over KRW 3 Trillion M&A in K-Beauty Boom

Dong-A Ilbo |

Updated 2025.11.26

Expansion in Transaction Areas, Largest in 8 Years

KKR Acquires Samhwa for KRW 733 billion, etc.

Widespread Growth in Beauty Medical Devices and ODM

“Value Chain Rises Alongside K-Beauty's Leap”

KKR Acquires Samhwa for KRW 733 billion, etc.

Widespread Growth in Beauty Medical Devices and ODM

“Value Chain Rises Alongside K-Beauty's Leap”

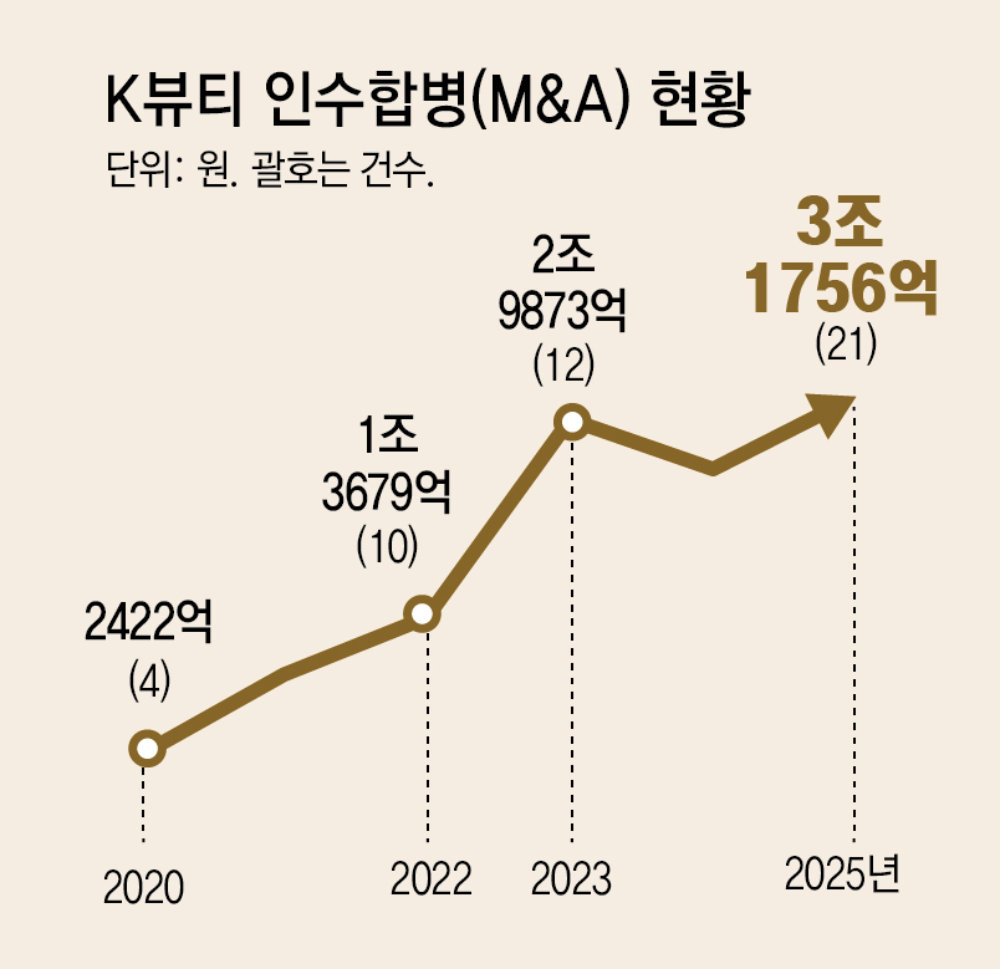

According to MMP, a small and medium-sized enterprise M&A advisory firm, 21 M&A deals were completed in the domestic cosmetics industry from January to October this year, with a total transaction value of KRW 3.1756 trillion. This represents a 26.9% increase compared to last year's KRW 2.5818 trillion (18 deals). It is the first time in eight years that the figure has exceeded KRW 3 trillion since KRW 3.3312 trillion in 2017.

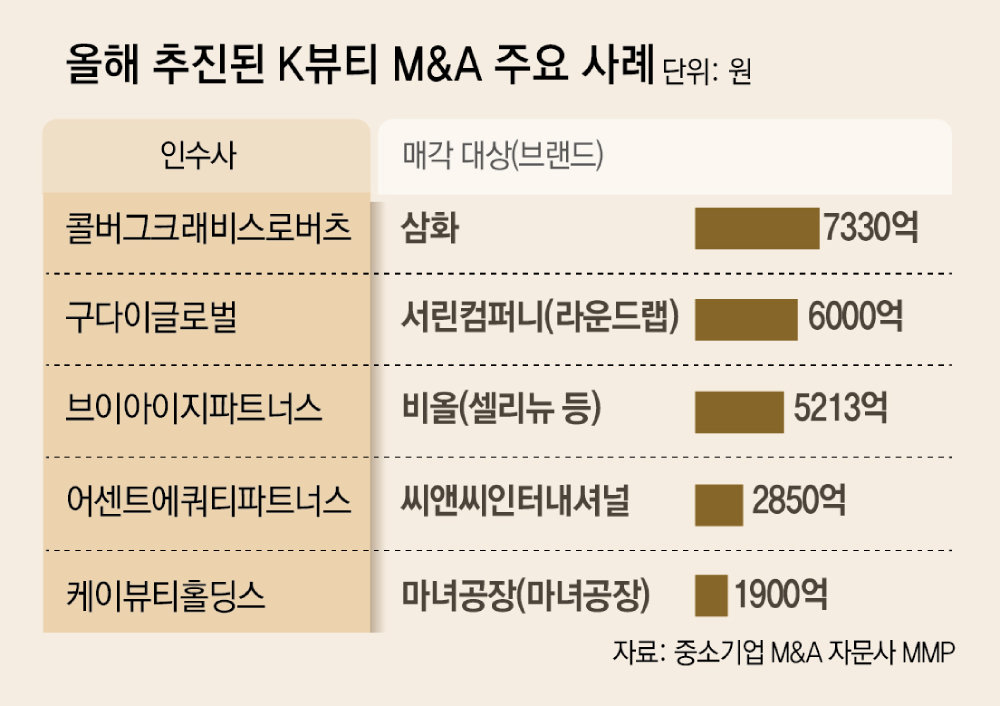

The largest deal this year was the acquisition of Samhwa by global private equity firm Kohlberg Kravis Roberts (KKR) for KRW 733 billion, setting a record high for a single item (packaging). Founded in 1977, Samhwa is the leading domestic packaging company supplying premium packaging to major brands such as Amorepacific and LG Household & Health Care.

Large transactions continued in the beauty medical device sector. VIG Partners acquired Viol, which owns RF-based lifting devices 'Celineu,' 'Scarlet,' and 'Silfirm X,' for KRW 521.3 billion. Viol is recognized for its technological value amid the expansion of beauty medical device exports and is one of the widely used beauty medical device brands in domestic and international clinics.

Color cosmetics ODM company C&C International was sold to Ascent Equity Partners for KRW 285 billion. C&C International has grown as a strong player in the ODM field of 'point makeup' such as lip and eye products, securing global clients like L'Oréal and Estée Lauder Group.

Last year, domestic cosmetics exports reached USD 10.2 billion (approximately KRW 15 trillion), a 20.6% increase from the previous year, marking a record high. In the first half of this year (January to June), exports were USD 5.51 billion (provisional), a 14.8% increase from the same period last year. The number of export destinations has expanded to 176 countries. As the favorable export trend of K-beauty continues, global investors' participation in M&A is increasing.

Park Jong-dae, a researcher at Meritz Securities, analyzed, "The global momentum of K-beauty is just beginning, with exports increasing to Europe and the Middle East following Japan and the United States," adding, "The value chain, including ODM, packaging, and distribution, is rising together."

Nam Hye-jeong

AI-translated with ChatGPT. Provided as is; original Korean text prevails.

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News