“We will expand orders in emerging overseas markets such as China and India to increase the proportion of global automaker clients to 40% by 2033.”

Leading automotive parts company Hyundai Mobis recently announced at the '2025 CEO Investor Day' that it plans to increase its current overseas client ratio, which is only about 10%. Hyundai Mobis is not alone. Automotive parts companies that have focused on domestic and U.S. markets are now turning their attention to other overseas markets. With risks emerging from the U.S., which was the largest export market, due to high tariffs and visa policies under the Donald Trump administration, there is now a movement to penetrate 'third countries' outside the U.S.

For automotive parts companies, 'export diversification' has become a survival task. It has become difficult to expand business even in the U.S. market, which they had managed to penetrate, due to the tariff burden. The tariffs themselves are burdensome, and calculating the actual tariffs applied to automotive parts is challenging. For example, while a 25% tariff is imposed on automobiles and parts, frames (structures) used in the vehicle underbody, which have a high steel content, are subject to a 50% steel tariff. Additionally, if the proportion of Chinese raw materials exceeds a certain standard, Chinese tariffs, not Korean tariffs, may be applied. An industry insider stated, “It is difficult for individual companies to accurately gauge due to the wide variation depending on the material, origin, and additional regulations of the parts,” adding, “It is complicated enough to confuse U.S. authorities.”

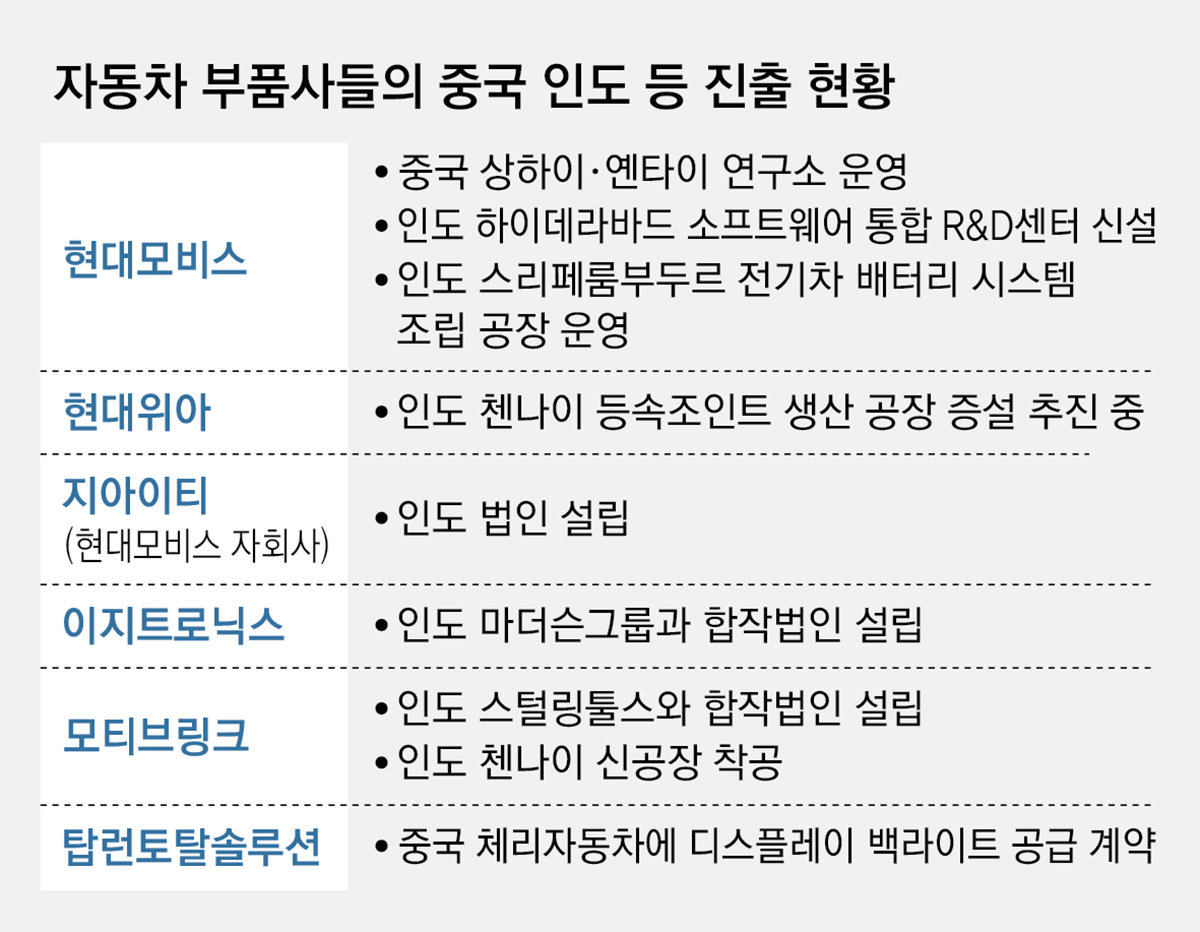

China is a representative market targeted by parts companies. Hyundai Mobis aims to secure $200 million in orders from the Chinese market this year. Companies like Xiaomi, which have recently entered automobile production and have clear parts demand, are the main targets. Toprun Total Solution, a mid-sized company that manufactures vehicle display parts, recently signed a contract to supply display backlights worth KRW 60.6 billion to China's Chery Automobile.

Rapidly growing India is also an attractive market. According to the Society of Indian Automobile Manufacturers, India's new car sales last year were approximately 5.2 million units, ranking third in the world. The popular car models have diversified from previously small cars to include sports utility vehicles (SUVs) and electric vehicles, expanding demand for high-value parts that are considered 'profitable.'

In response, Hyundai Mobis opened a software integrated research and development (R&D) center in Hyderabad, India, in April this year. The aim is to secure orders from Indian automakers through localized R&D. EZtronics, a mid-sized company that manufactures commercial vehicle parts, established a joint venture with India's largest vehicle parts company, Motherson Group, earlier this month to supply in bulk to local electric vehicle companies. Motivelink, which produces power conversion parts for electric vehicles, also secured a contract in June to supply parts to local Indian automakers.

Experts analyze that in the long term, penetrating additional markets beyond China and India is necessary for 'diversified investment' to ensure stable business in a rapidly changing global environment. There is also an opinion that government support is needed as smaller companies find it challenging to pioneer overseas markets. Kim Pil-soo, a professor at Daelim University’s Department of Future Automotive Studies, stated, “The government and local governments should coordinate entry channels by gathering multiple parts companies that wish to expand overseas.”

ⓒ dongA.com. All rights reserved. Reproduction, redistribution, or use for AI training prohibited.

Popular News